Overview

There isn’t much to report in terms of portfolio moves. My energy has been focused on getting rid of my remaining loan balance.

I can almost taste the freedom…

The Loan Breakdown

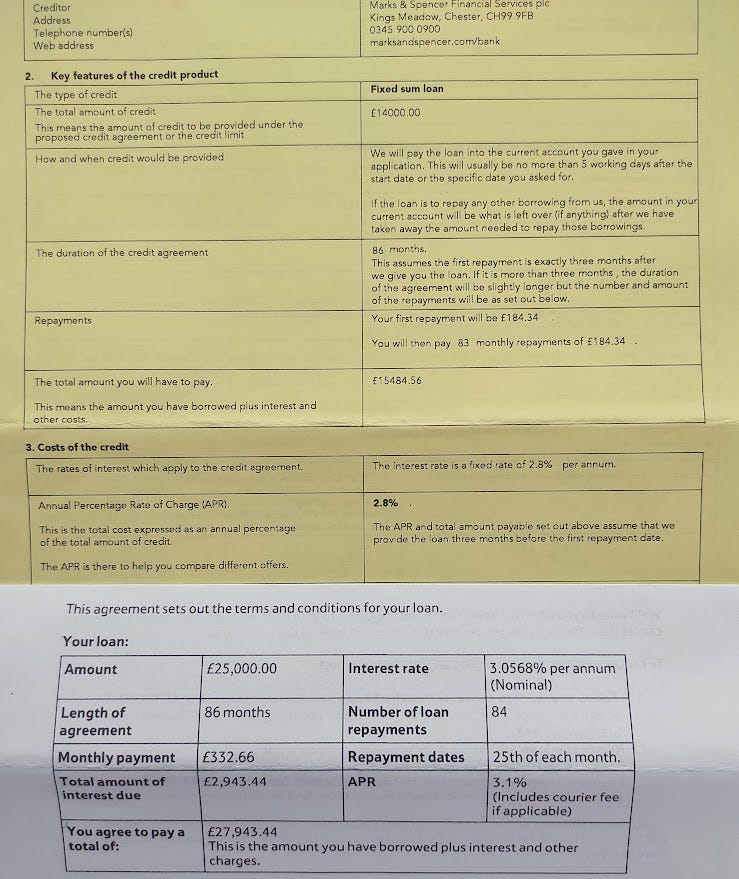

I started my investing with a loan experiment back in the summer of 2017. I took out 2 separate ~3% APR loans back then:

a £14,000 loan with Marks and Spencer Bank

and a £25,000 loan with Tesco Bank

Both loans were set to run over 7 years to finish in Autumn 2024.

M&S payments were ~ £184 a month, Tesco payments ~ £333 a month. Total amount to be repaid for investing was £43,427.44 / USD $60,000 (because interest)

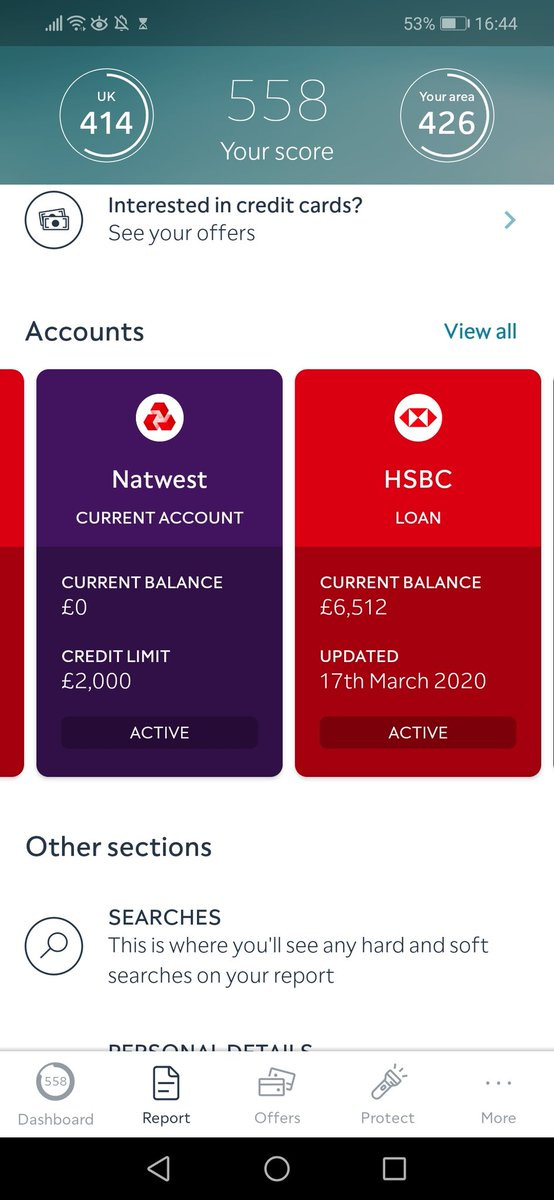

In Jan 2020 - I still had 3/4 of the outstanding investing debt to service.

I also had a £8,000 car loan from 2018 with HSBC. Payments on that were £148 a month, so in total, at peak debt I had over £45,000 in low-interest personal loans and I was paying £665 a month (roughly 16% of my take-home salary) to service it. Some people might say that was a dumb idea.

The only reason I was ok with doing this was that I was already in a position to invest £500 a month as well as pay the car loan while maintaining a decent quality of life for our family. I had no high-interest loans or meaningful credit card debt, and had done a deep dive into affordability and job stability.

It was a calculated risk that I believed had a decent chance to be compensated in the long run. It would never be advice for anyone else - personal finance is extremely personal and everyone’s situation is unique.

I have friends who think I’m crazy but don’t think twice about dropping £600 a month on car payments. To each their own - trade-offs are everywhere when it comes to financial decisions.

There are many ways to spend £40,000. Some make more sense to me than others - I prefer assets that appreciate over time rather than ones that depreciate.

Our last 2 family cars have been a Honda CRV and Hyundai Santa Fe, bought at 6-7 yrs old. They have been great. I’ll take a solid reliable choice that does what we need over a status signal that rapidly depreciates any day of the week.

My last couple of personal cars for my work commute have been beaters and that has been just fine.

The 2020 C-19 technology stock surge transformed my finances. Many of the secular tailwinds that I believed would take place over the next 5-7 years were compressed into a much shorter timeframe and my portfolio benefited at a time when I had a meaningful amount invested.

I was fortunate to have made the majority of my dumbest investing mistakes during my first 2 years of investing. As a result of reflecting on my screwups, I ended up navigating 2020 pretty well by avoiding fiddling too much. I was glad to have developed far more patience and investing discipline than I did in 2017-2018.

An example of my biggest mistakes: the first 4 stocks I bought in July 2017 were $SHOP, $SQ, $Tencent 700.HKD and $BZUN. My inability to sit still in my early days of investing have cost me a lot in performance. Ironically the only stock I still own from 2017 (for now) is the worst performer out of my class of ‘17.

In 2020 our annual discretionary consumption costs were significantly down compared to normal because everyone was at home. I was suddenly in a position to realistically consider getting rid of some of my debt in a shorter timeframe than I ever would have imagined when I set out on this journey.

I got rid of the M&S loan in September 2020, saving £467 in interest. I then had £184 more per month to pay off other debts.

In December 2020, I cleared the HSBC Car loan after making some minor portfolio trims - this freed up another £148 per month. I was in a position to double my monthly payments on my outstanding Tesco loan.

My tweet on improving your financial situation IRL coincided with the market euphoria of mid-Feb - I could sense markets were free-wheeling but didn’t act fast enough to fully capitalise on my own advice. Timing markets is hard. Elevated software valuations in 2021 despite the pullback made me determined to get rid of all of the loans in 2021.

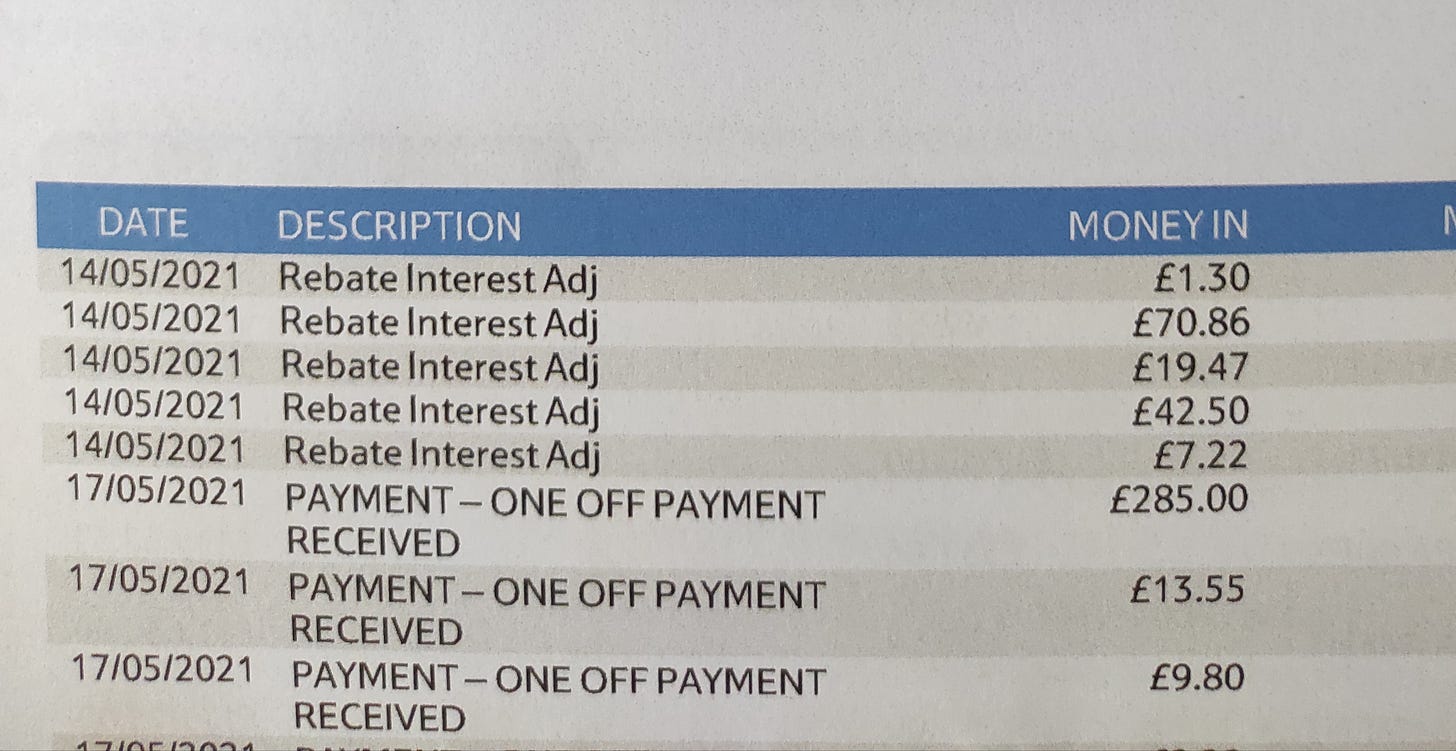

Paying off the residual loan has become an active game for me since March 2021. Every extra top-up payment resulted in a rapid feedback loop. The interest saved appeared as a credit in my Tesco loan account shortly after the payment was made - a seemingly minor, but extremely motivating pattern to try to find money to use to pay it off quicker and quicker.

I found myself funnelling extra pounds into loan payoff whenever I could.

I also took a long look at some of the speculative holdings in my portfolio and realised that I was introducing unnecessary uncompensated risk into my portfolio when I could have a guaranteed return by paying off the loan early.

I had originally been mindful to aim to avoid too many types of concurrent risk in my portfolio (eg investing on margin, options, companies with <$100M revenue) but had gotten slack about SPAC risk control - and bought shares at a premium. I decided to right my wrong and it was goodbye to $AGC and $HAAC, and hello to faster loan payoff. It was the right decision for me.

This is where I am with my remaining Tesco Loan…It’s not hard to see the finish line, and I’ve saved over £600 in interest by early payoff of this particular loan.

The final loan payback amount will likely come in at around £42,250 over ~ 4 years due to early repayments.

Better than the £43,427.44 I had originally planned over 7 years.

August Portfolio Changes

Buys

None

Sells

None

Current Portfolio Allocations via Google Sheets

Menorca

We had a week’s break in Menorca - it was good to be away from markets and and screens, enjoying family time before the kids go back to school in Sept.

One striking observation was the pervasiveness of card payments over cash. It shouldn’t really be a surprise, but this was probably the first family vacation in which I only made a single cash withdrawal - and that was just to rent a pedalo and paddleboard from the lifeguards on the beach - every other transaction was on card - breakdown via Revolut. I should probably take a deeper look at the payments space again.

I also found a ride that matches my portfolio’s performance since Feb 2021…

The underperformers of my portfolio have continued to be the Chinese ADRs $API and $BZUN, which took a real beating in August.

There has been some recovery since, but I think I am reaching the end of my tether with $BZUN after 4 years. Although I can still see a bull case, patience here has not been rewarded. It makes logical sense, but it’s hard to really assess the quality of the company’s management. A concern at the back of my mind is that maybe it might just be a mediocre company - and I'm not that interested in mediocrity. Once I’ve paid off the loan, I’ll reassess, but the opportunity cost here has been pretty high and there are alternative places for capital.

I am no longer able to buy $BZUN in my tax free brokerage account for reasons I don’t fully understand. I’ve learned that tax implications shouldn’t be the primary driver of my decision making - that mentality has already caused me to miss $SE for the last 3 years and stopped me from selling $API (a lower conviction holding) back in February at $10B - a little painful to see it at $2.5B 6 months later…

Final Thoughts

This was much more of a personal finance post than a portfolio review.

In September, I expect to be completely clear of any borrowing bar our mortgage, and I’m excited by that. I am looking forward to setting up a direct debit to my brokerage account for £500 a month and potentially being in a position where I have meaningful capital to allocate at the next significant pullback.

We are also exploring some of our previously discussed ideas on working internationally, maybe as soon as next year…

Have a solid September!

Watchlist

$SEMR, $MTTR, $KSPI.L, $DOCS

Great up. Sounds like you are putting your financial wizardary to good use! I am expecting this current strong bull channel in the indexes to go pop at some point, maybe during the next tightening cycle. However when that happens is anyone’s guess? Could be another year or two, depends on whether the new Covid economy starts firing up. I don’t know what you think about using Cash with a growth stock portfolio. I am leaning to accumulating more for the next pullback rather than DCAing..?

Nice overview of your personal finance. Appreciate the transparency!