Going with your best ideas

Warren Buffett said it best

“diversification is protection against ignorance. It makes little sense if you know what you are doing.”

Returns in investing follow a power law distribution https://en.wikipedia.org/wiki/Power_law

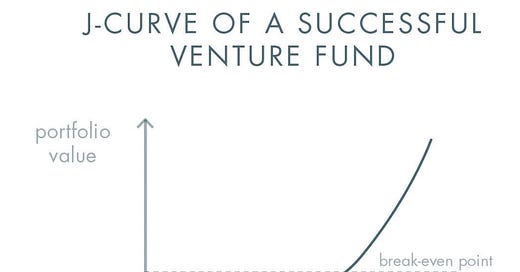

A good model to review is angel or venture capital funds. These typically have a 10 year lifespan to allow for successful exits and for non-linear compounding to take place. Venture capital returns are hugely unevenly distributed, as summed up by Peter Thiel in Zero to One.

Our results at Founders Fund illustrate this skewed pattern: Facebook, the best investment in our 2005 fund, returned more than all the others combined. Palantir, the second-best investment, is set to return more than the sum of every other investment aside from Facebook. This highly uneven pattern is not unusual: we see it in all our other funds as well. The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.

Now I don’t run a venture fund. But there is a lesson here. It stands to reason that if you are looking to outperform an index fund by picking stocks, you must systematically seek to identify and invest in the small group of companies that have a higher likelihood of radical index outperformance, and you should hold on to those companies to allow the long term compounding effect to take place.

Diversification for its own sake hurts returns. Beyond “minimal diversification” – it can quickly become “diworsification”.

In the short term, the potential of long term high compounders may not fully be appreciated by the market focused on short term quarterly results. It should not be expected that returns will follow a linear pattern.

To apply these principles to my own portfolio, I have systemically tried to hone my ideas down to the very best ones that I have, and aim to reduce the amount of “trading” I do. This means making far fewer investments than would be “recommended” – i am not trying to replicate an index fund. This is simple, but not easy to do in practice – so many elements of our day to day life revolve around short termism.

To truly understand the effectiveness of this approach in the public markets, I have tracked my first 6 investments since I started in 2017 in a virtual portfolio, as if I had bought and held them regardless of short term movements. The results are astounding and sobering. The value of my first 6 investments (excluding LVGO which is a recent addition) – made in 2017 and 2018 would have exceeded the value of my entire actual portfolio to date, despite being seeded with £20,000 less than my actual portfolio.

Purchases

…and Current Valuations

My actual performance lags behind my virtual portfolio. This is partly due to:

selling winning positions too early

overtrading based on short termism

Making poor investment purchases that would not have passed my refined rules

I have learnt a lot over these last 27 months and am happy with the current composition of my portfolio, but I keep the virtual portfolio to remind me of the value of slowing down – it’s humbling to monitor the gap.