How I lost £25,000 in 3 months

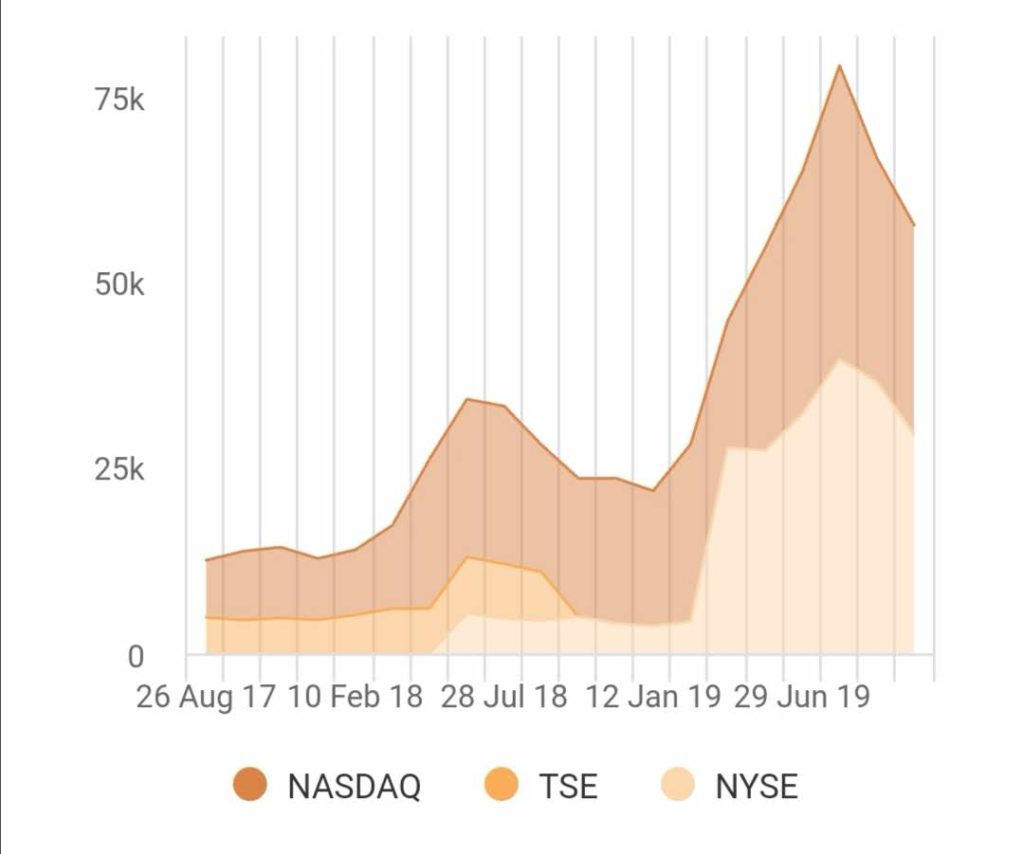

Towards the end of July 2019, I logged in to my ISA account to check-in. The portfolio value in there had me feeling pretty good about myself, my process, what I'd learned over the 2 years I've been investing, and contemplating how much higher it could go before it might be prudent to pay off some of the loans I had outstanding.

3 months later at the end of Oct 2019, my account is still positive, but the portfolio value is £25,000 less than it was during its intraday peak of July. I've noticed that I discuss the portfolio less frequently with my wife than I did over summer.

£25,000 feels like a lot of money, and it is. It represents about 80% of the loan that I still have outstanding or about 38% of our annual household income, so if I had been able to time this perfectly, theoretically I could have sold up, paid off the bulk of my loan, and still had a similarly sized portfolio to what I have today.

That is a huge IF, as I feel with that with resources I currently have, market timing is not a useful way to try and spend my time as it can be woefully ineffective. It seems far more logical to try to identify amazing businesses trading at reasonable valuations for their growth metrics than to do that and also try to time the market top. I learned my lesson in this with Shopify this year. I bought more Shopify at $123 in Oct 2018 and sold it in Jan 2019 at $160 after a very choppy few months and general market misery. I was feeling pretty good with myself, deciding $160 was a fair valuation and solid return for 3 months.

Not bad hey?

This is the Shopify chart since my sale at $160.

Humbling, eh?

I am not in a position to be able to accurately time the market, so arbitrary price targets lead to short term thinking and will impact returns.

What happened - why did my portfolio drop £25,000?

The SAASpocalypse, sector rotation, software correction, whatever you'd like to call it happened, and my portfolio dropped by over 30% in value.

Software stocks have been on a tear in the first 6 months of the year, and although in retrospect it was clear that a reckoning would take place, I didn't fully take on board the warning signs were there on the charts and fundamentals. When over a year of perfect execution is already priced into a stock, it's important to realise that the margin of safety in continuing to hold is evaporating rapidly.

My portfolio companies are now at far more reasonable valuations on an EV/S basis, but a number of stalwarts have taken a beating. This is actually ok by me, and it is easier to make a case that companies are reasonably valued.

With these sort of companies, I feel that you do have to be mindful of the price of entry, and you have to ask yourself how you would feel if the value of a company in your portfolio drops by 10%, 20%, 30%, 40%, or 50% - those are all numbers that I have seen over the last 27 months, and the ability to minimise emotion and think clearly about the appropriate response is the hallmark of a growth investor. It's easy to be a genius in a bull market, but your mettle is tested when the tape is ugly.

So What Did I Do?

After a huge, humbling drop in the value of the portfolio, I decided to

...largely do nothing

The investing process can be simple., but it can be psychologically hard, and anyone who thinks otherwise probably has minimal skin in the game. The urge to "do something" when you have no edge is ultimately likely to work against you. When I started investing, I realised the need to commit and stick with a strategy. Mine is largely to buy and hold great companies for the long term, and to allow my assets to compound over time.

I reviewed the holdings, checked whether the objective evidence underlying my investment thesis was valid, and saw that the underlying business fundamentals were intact. It's tough to watch the drop, but this is the price of entry into the game I have chosen. It's important to remember not to make decisions with long term ramifications based on short term feelings.

The current performance of my portfolio has minimal impact on our ability to meet our monthly and regular financial commitments. Obviously I'd like to pay off the loans faster, but our actual ability to meet established commitments is not an issue.

My thinking is largely geared towards the 3-10 year thesis underlying my companies, but I am also occasionally interested in shorter-term trades. A reasonable hybrid is to have a core LT position that doesn't get touched unless the thesis changes and to consider trading smaller positions around the core.

Assuming that it makes more sense to identify, purchase, and hold onto outstanding businesses for the long term, there is an argument that short term valuation is less important, particularly with companies that have recurring revenue models and compound capital over time. Whilst I understand the reasoning that "entry price doesn't matter", it doesn't sit well with me - returns will always be determined by the original price paid. There is a point at which the risk/reward is not in your favour.

I have been developing some clarity on SAAS valuations, technical analysis and what premium over fair value that I am willing to accept. Datadog DDOG is on my watchlist and seems to be an excellent company, but it is not yet clear to me that it is a better investment than ESTC at the moment. I may be wrong.

The mental process of portfolio management is fascinating. Inner voices and questions on how to maximally optimise a portfolio can ping around your head all the time if you let them.

I have settled on the "do nothing" approach to managing my long term investments, unless I feel actively compelled to do something, such as the thesis for an investment being broken. Every position I hold has been well researched, and I am confident in my portfolio allocation while acknowledging the potential downside risks. It's humbling to see a position valuation cut in half after 9 months of outperformance, but this strategy is acknowledged as one of high growth, high gross margins, and high volatility.

I did take the opportunity to add slightly to some of my favourite companies at more reasonable valuations. I haven't bought Shopify back yet, as it's the premium is higher than what I'm willing to pay when I can pick up LVGO instead.

In any case, I haven’t really lost money unless I close my positions. Selling the dip is a terrible strategy.

Let's see what the next 12 months bring.

Thanks for reading.