On Discipline, Process and Learning from Investing Mistakes

Learn, reflect, iterate, improve

One of the reasons I started this blog was to hold myself accountable. I made some pretty howling investment mistakes in the first few years as a newbie. I had a sense of what I wanted to do, but it took years of learning by trial and error to get clarity on what I thought winning investments looked like.

As a former management consultant, I realised that I needed to apply a more structured approach my investing. Most companies underperform the indices, so a concentrated portfolio really requires honing in on the companies with winning characteristics and the potential to outperform.

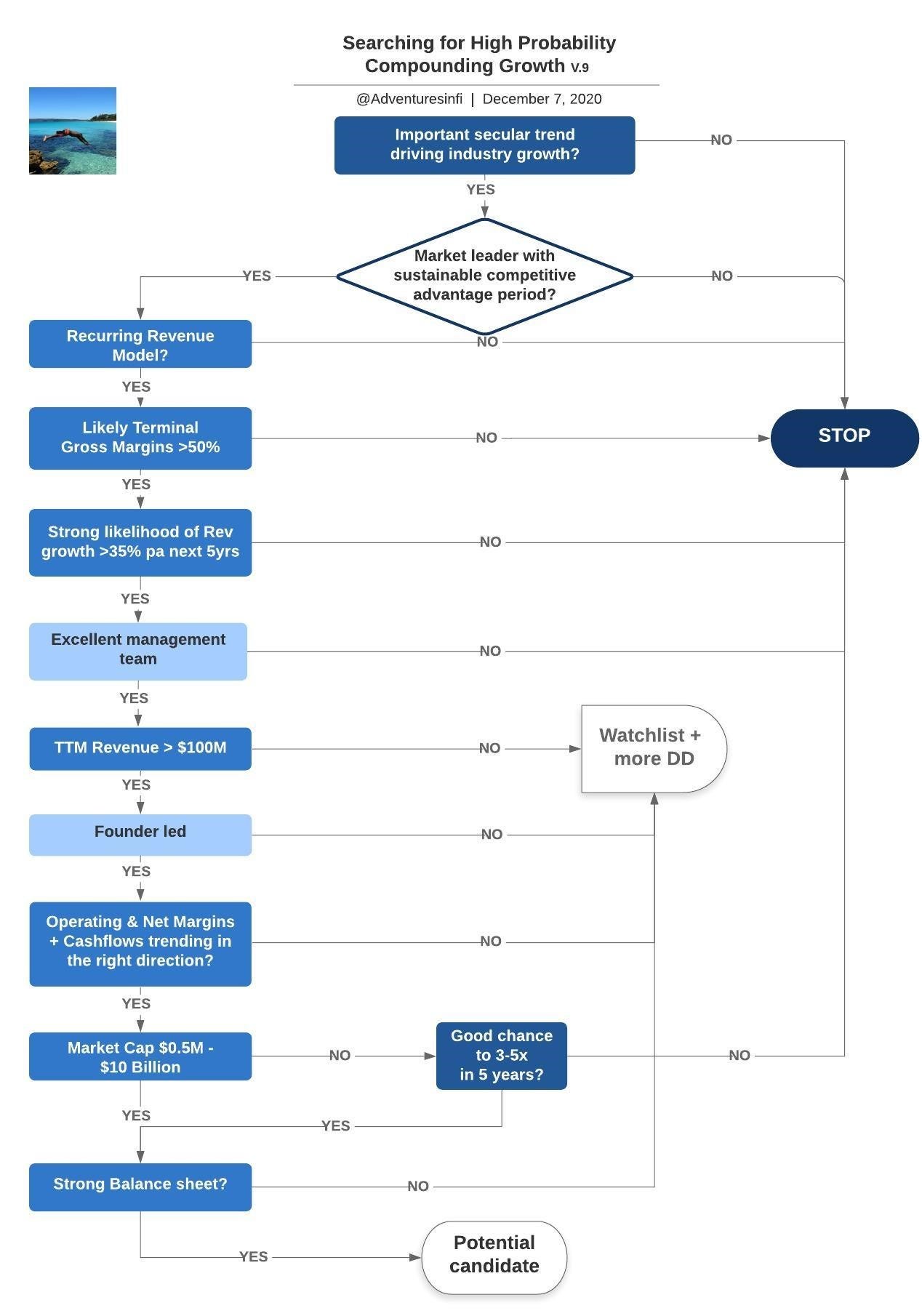

In summer 2019, I tried to really refine my thinking around common traits of investments that I felt had the potential to outperform. Investing is a probabilistic game - there are no guarantees. It makes sense to avoid wasting time on ideas that have a low probability of being a good match for your requirements. Relying on luck won’t cut it.

A consistent framework increases the chance of finding what you are looking for. There is minimal value in stalking squirrels if you are out hunting deer.

This is what potential investments that capture my attention tend to look like.

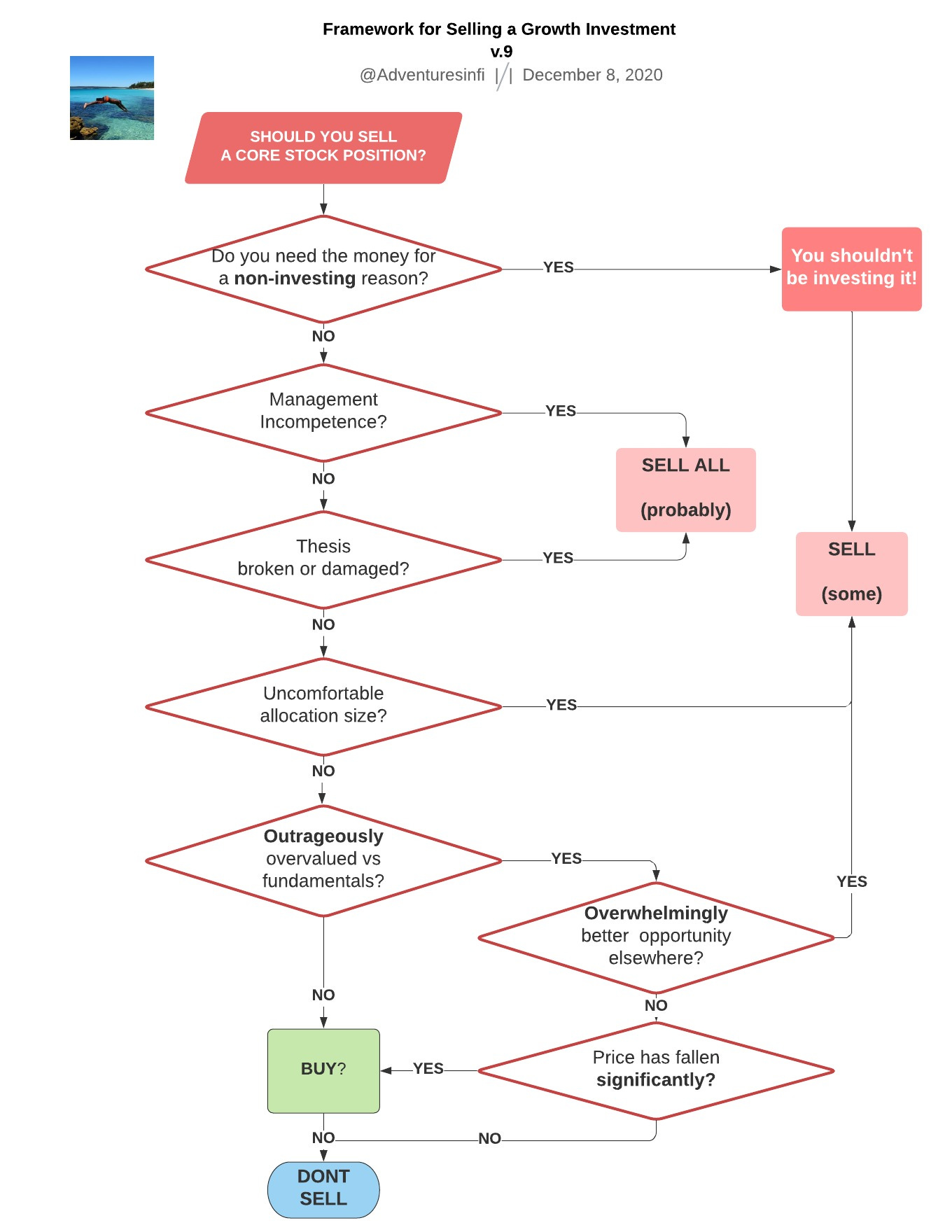

Around the same time, I realised that I had to adjust my behaviour if I was ever going to capture the upside of companies with the potential to provide life-changing returns. Specifically, I needed to stop selling my winners to start letting compounding work for me. After selling 160 shares of $TTD $74 (after it was up +40% in a day) and 60 shares of $SHOP.CA at $CAD210 (+80% in a year) I realised I needed to do a better job on holding on to great companies - there aren't that many of them. The Trade Desk is currently at over $750 USD - more than 10x the price I sold at and Shopify on the TSX is over CAD $1300, at over 6x from when I sold it.

The full details of my mismanagement of my Trade Desk Investment is in the Twitter thread below.

And if you want to read more about I screwed up my investment in Shopify, here it is:

After reflecting on these mistakes, I eventually developed a framework for selling in order to improve my decision making. You can’t guarantee results, but you can develop a consistent process to combat the dopamine, adrenaline, and cortisol swings when you are involved in public markets. Optimise and iterate on a process that works for you over the long term - it’s the best way to improve.

I’d be interested to hear what you think. What does your decision process look like?

How did you come up with the criteria in the buy/sell flowchart? Did you do backtesting before setting the criteria?

Super well-documented process! I especially like your framework for selling. I couldn't see somewhere else this level of detail.