End of January 2021 - moving to quarterly portfolio performance reviews

and a little SPAC experimentation

For each month in 2020, I posted a monthly review of my portfolio. I found it an excellent way to maintain perspective with the rollercoaster ride that 2020 proved to be. I mentioned in my end of year review that I would likely be moving to quarterly reviews in 2021 for three key reasons

I don’t add and remove companies very often

I want to remain focused on the long term

I want my habits to support my goals

That said, I want to keep the transparency going and keep myself accountable. I started positions in $HAAC and $AGC during the dip in the last week of January. Both are SPACs.

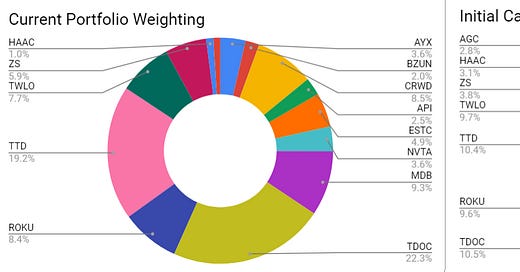

Current Portfolio Allocations via Google Sheets

I accept that might seem surprising, given the scepticism I expressed about them back in Sept 2019.

I’ve been learning a bit more about SPACs these last few months. This 20VC podcast was a good primer

And listening to this episode of Invest like the Best got me thinking…

Patrick: [00:13:54] I want to come back to the next transformation of home buying a bit later in the conversation. But before we leave this concept of transparency, I actually think it's an interesting segue into the first of several topics that we have planned, which is Altimeter Growth Corp and SPACs more generally speaking. This is a topic that I think is fresh. So everyone's kind of scrambling to figure out where they stand on it. And I think there are certainly some negative connotations with SPACs from history. But I want you both to walk me through your logic and thinking around Altimeter Growth Corp, where Brad you're the sponsor. Rich, you're on the board. And talk through how this may be the way that you're doing it an advantaged product I'll call it to offer to later stage founding teams as they think about bringing their companies public.

Brad: [00:14:37] Well, our logic was actually very simple. We wanted to give the world's best founders and companies a better, a less dilutive, and a faster path to the public markets. I mean remember; I started my career as a securities lawyer. And I'm just shocked that while the rest of the world has moved forward, over the last 25 years if anything, the traditional IPO has gotten harder and less efficient. So like any good entrepreneur, we asked the question, what if we took the mechanics of a SPAC IPO, which has some distinct advantages, and married it with the full capital market capabilities of Altimeter? And we think it gives you the best of both worlds. I mean at a minimum, there are clearly now three legitimate paths to an IPO. You can partner with a bank like Goldman. You can partner with a sponsor like Altimeter. Or you can do a direct list. And we think that banks do a pretty good job, but they operate in a pretty Byzantine system.

…while the rest of the world has moved forward, over the last 25 years if anything, the traditional IPO has gotten harder and less efficient.

I mean, think about this. It's a year-long process where you don't know the price for your shares or even who your shareholders are going to be until the end of the line. And you assume all the market risk during this time. And then of course the bank is very involved in the pricing and allocation of your shares, which Bill Gurley and others have argued leads to chronic underpricing.

But I mean, even if you don't think this mispricing is as big a deal, when you combine it with the bank's fees of 6 to 7%, this becomes very costly to the company. And on top of that of course, you can only give historical financials, which leaves most investors in the dark about a high growth company's future prospects.

Now juxtapose that against partnering with Altimeter, where our principal goal is long-term ownership in your company and to do whatever we can to enable your success. We don't act like agents. We act like owners. We're totally aligned with you. So I mean, we can get you public in a fraction of the time, reducing market risk. You set the price. You tell the story with forward-looking forecasts. We serve up a world-class group of mutual funds and hedge funds as your shareholders. You ring the bell, it's your IPO. And while the day of the IPO and the day after the IPO are nearly identical as if a bank took you public, we don't charge your company a fee. None. Zero. All the costs are borne by the shareholders of the SPAC who gave us part of their shares when we set up the SPAC as a finder's fee for helping them invest in a world-class company. I mean, it's very similar to our VC funds, where we get paid for helping our investors invest in companies like Snowflake.

$AGC

If you don’t know much about Brad Gerstner, this Youtube clip from March 2020 is a good place to start - I like to understand how people operate when under stress.

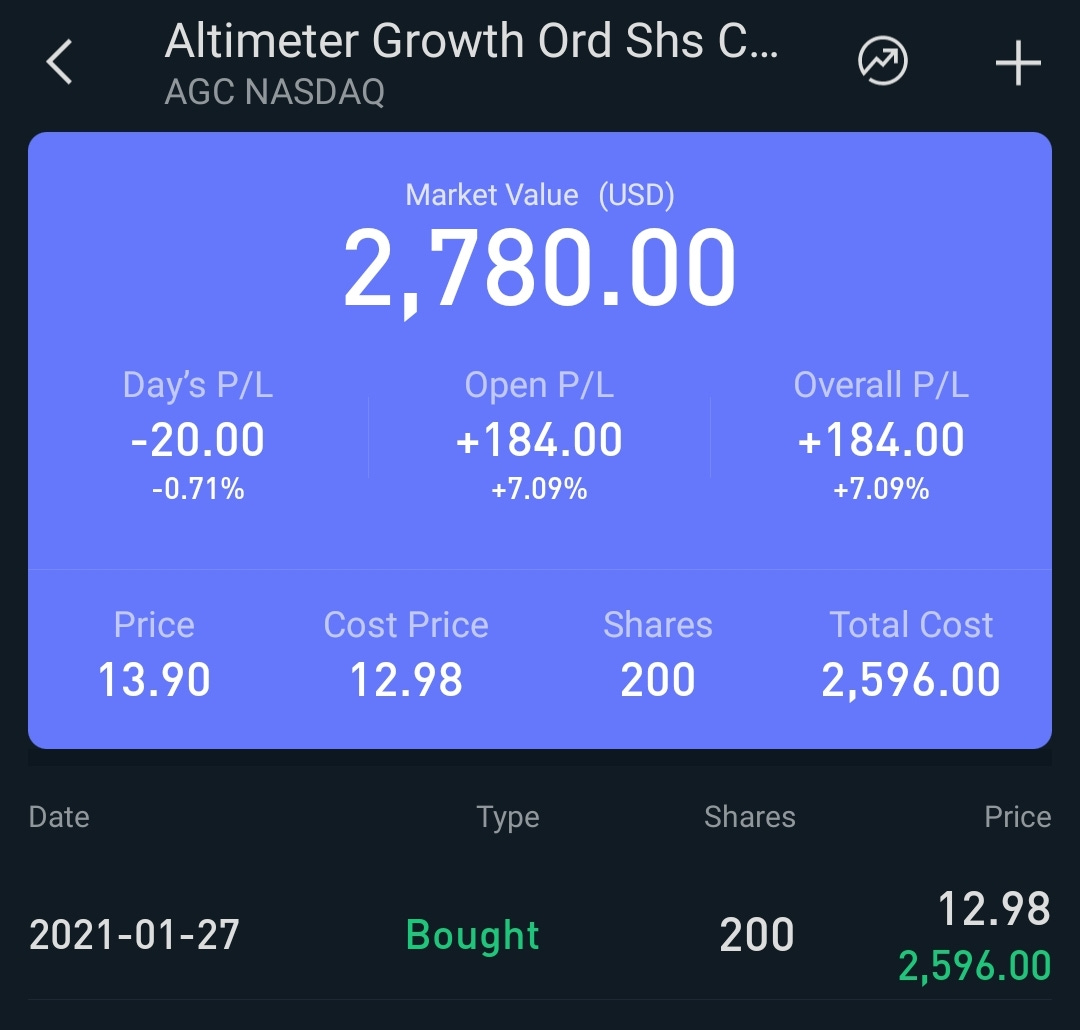

Altimeter has a very impressive track record and I was content to pick up $AGC at ~$12.95. It trades at a premium to the issue price of $10 due to the quality of the sponsor, but downside feels within my risk tolerance. It rose to $16.75 on speculation from this PIPE tweet from Chamath, which turned out to be a red herring.

I wonder whether Plaid might the target after the acquisition by Visa was nixed.

$HAAC

I started a position this week. My interest is due to my confidence in the founders of Livongo, my most successful investment to date. The downside risk is ~ -15%.

There is no target announced, but I enjoyed reading this thoughtful speculation.

A shoutout to @BornInvestor for brought the article to my attention. I am fascinated by the possibilities of the intersection of healthcare and technology.

My thinking with SPACs is similar to what I feel about stocks. Most will turn out to be a waste of time and unworthy of attention or funds. There is limited information to assist in decision making - it’s much more of a qualitative assessment of the sponsors. By definition, they are more speculative than my usual moves.

In both cases here, I feel that they present asymmetrical upside over longer time horizons. I’ve capped the capital allocation at a manageable level, and am looking at the process as a learning experience. I get to indulge my inner VC without any of the hassles that come with the job…

Other SPACs on my watchlist included $AGCB, $RTP, $CMLF, and $DGNR - all sponsors I admire. I don’t haven’t any near term plans at present to add much to any of my SPAC positions until the future is clearer - I see them as a better-than-cash-if-you-have-a-longer-time frame option, but reserve the right to change my mind!

Elsewhere, it’s encouraging to see my 2020 underperformers finally in the green in 2021. $API is buzzing after the Clubhouse Series B VC round.

I added to Agora during the month to take the capital committed closer to Baozun.

Clubhouse’s MENA counterpart Yalla, $YALA another Agora customer which I looked at in October and passed on (up over 200% since I turned it down!) is growing well too.

$BZUN seemed to indirectly benefit from the unwinding of short driven by the WSB catalysed activity in the last week of January. The company announced a positive PR but it wasn’t a good enough reason for the stock to be 30% up in a day. It remains to be seen when it will stay out of the downtrend channel - it’s teetering on the edge and ER/guidance will be telling.

I hope you still feel in the loop with my changes to portfolio reporting and understand the reasoning behind them. This format is different to 2020. My goal is to keep sharing what I own and remain transparent about any new changes, but I’ve wanted to shift focus away from short-termism in a world full of it. Feel free to hit reply and let me know your thoughts and comments on the changes - it’s all a work in progress!

In other news, I had the Pfizer-Biontech vaccine this month and am grateful for that. I think it’ll take longer than any of us would like for the world to get back to normal - but there are reasons to be optimistic. Have a safe February - it’s looking like it might have a volatile start.

Watchlist

$NCNO, $TIGR, $SKLZ, $GRVY