December 2020, Q4, and Annual Review

2020 is over. +176% for the year. It was a transformative year in many ways, but it's not repeatable

Portfolio Value and Links to Previous Monthly Reviews

August 31, 2020 value - £145.4K

December 31, 2020 value £181.6K

YTD after withdrawal ~ +176% (from +174% last month)

(+183% without the withdrawal)

Overview

What a bizarre year.

Is this dot-com mania 2.0?

Are software investors going to get a well-deserved beating in 2021?

Was this a fair reflection of real digital transformation trends that will continue in the 2020s?

Was the broader market recognising what software investors had already realised?

Is the real answer somewhere between all the above options?

I don’t know. There are lots of thoughts out there - whatever your opinion, it doesn’t mean much unless you put your money behind it.

This year was my strongest confirmation of Terry Smith’s advice:

Buy good companies

Don’t overpay

Do nothing

Anyone with insight would acknowledge that 2020 was definitely a freak year that I happened to well positioned for. I think I was well-positioned because I believed that asset-light companies with high gross margins, recurring revenue models led by outstanding management and riding secular tailwinds creating valuable, easy to distribute products for business and consumers would prosper over the long term.

Luck was a factor, no doubt. Maybe it is just blind luck. Maybe it’s another type of luck?

I don't know what happens next.

A -35% correction wouldn't surprise me.

Predictions are not worth much - but making sure you have a plan that suits your temperment and keeping an open mind is invaluable.

If I can claim anything about my ability as an investor, it’s that I am proud that my investing behaviour in 2020 was consistent with my investor policy statement. I am far more interested in trying to ensure a consistent process than I am about predicting any particular stock price outcome.

But outcomes are important too. I started 2020 with less than £57,000 in my portfolio and having endured a testing underperformance of the S&P500 after overpaying for some of the companies in my portfolio (I’m looking at you $ESTC, $NVTA). I ended 2020 outperforming $ARKW - probably the closest ETF match to the companies I am interested in.

Just before Christmas my YTD crossed the 200% mark and my portfolio value went above £200,000.

Cresting the £200K mark was assisted by a weak pound due to last-minute Brexit trade deal concerns which have since been resolved. The recent strength of the pound is now having a negative impact on the value of my USD holdings - such are the vicissitudes of investing (word of the week via @fire_growth).

I decided to take a little off the table in order to improve our monthly cash flow at home. In addition to the investment loan, we had just under £5,000 outstanding on our main car loan which I paid off using investment gains of about £4,700. I largely believe that you should aim to not interrupt compounding unnecessarily. The risk/reward of stretched valuations led me to make a move with a guaranteed upside. It’s important to remember why you are investing - I want to make life better for my family.

Portfolio Changes since end November 2020

Sells

10 shares of $AYX at ~ $126

10 shares of ESTC at ~ $153

5 shares of MDB ~ $374

7 shares of ZS ~ $196

Buys

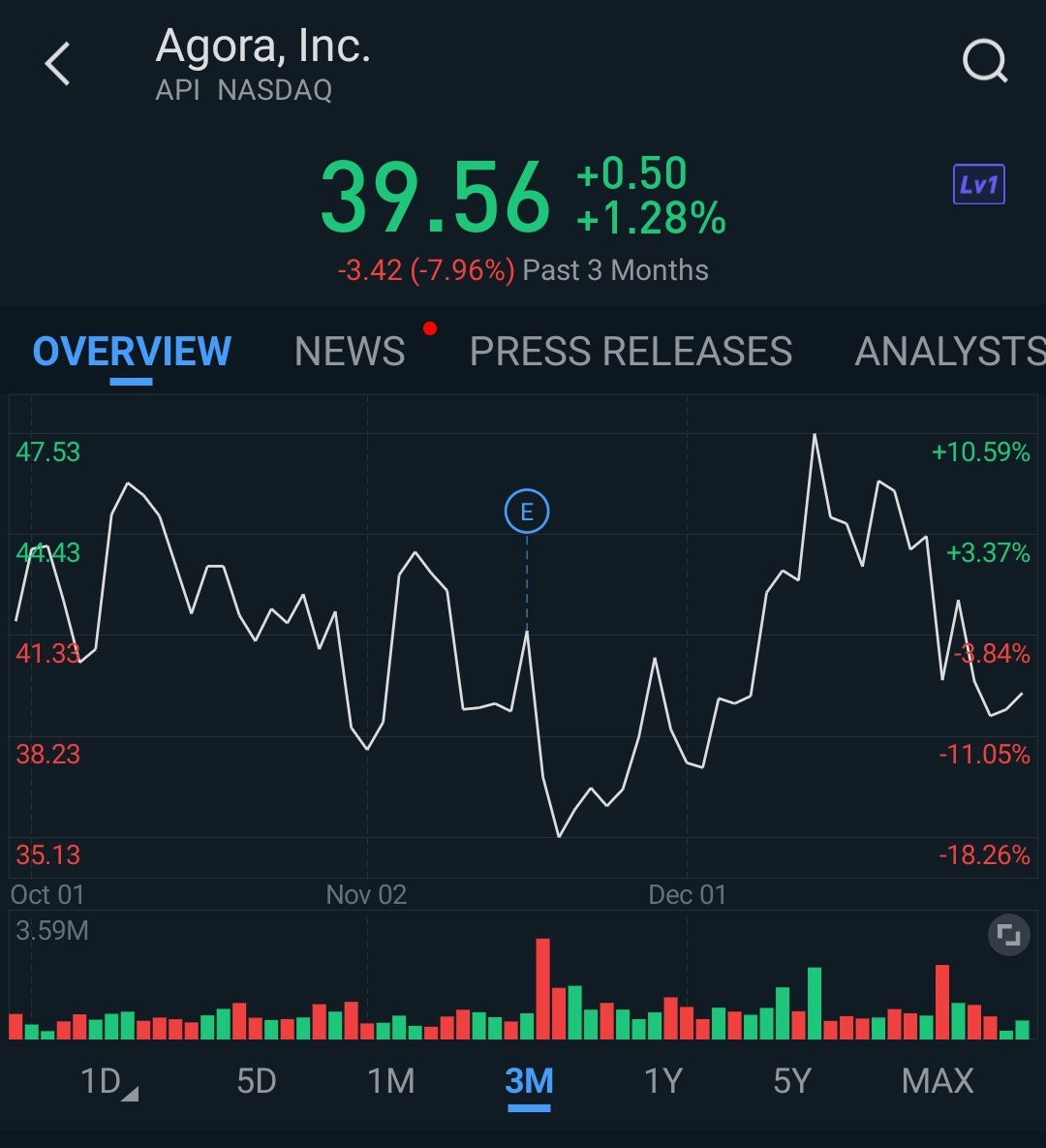

$API - added 10 at ~ $38.5 on lockup expiration

Current Portfolio Allocations via Google Sheets

Company Reviews

$TTD

The Trade Desk rallied hard to $970 and was significantly extended above all moving averages, so the correction near the 50DSMA was swift, brutal and completely justified in my opinion.

The tailwinds are intact, management is confident, and the company has made a good recovery since a poor Q2, but I think that they will either need to show revenue growth acceleration or a prolonged period of impressive growth to justify a $38B valuation - ideally both. That said, they are already profitable.

I consider my capital at the point of allocation. The reason that I didn’t trim $TTD ties back to my historical errors with my holding- if I still had my original 160 shares, I likely would have trimmed at little at the highs to pay off the loan balance. On my current cost basis, I have $9825 allocated to the company, which seems appropriate for my position sizing and confidence in the company.

$TDOC

TDOC stock has not gone anywhere in the last 6 months and is still digesting the merger of Livongo. All the moving averages are lining up nicely as a solid base.

I’m optimistic about $TDOC’s prospects for 2021 if it can demonstrate strong execution post-merger.

$MDB

Mongo stock had a really strong December. I trimmed 5 of my 75 shares, taking me down to 70 shares, but dropping my capital allocation to be in line with other high conviction companies.

Mongo announced another quarter with revenue growth above consensus and Atlas growth of 61% year-over-year (now 47% of revenue). I’d like to seem them start to make some improvements in operating margins like Elastic, its closest publicly-listed cousin.

Third Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $150.8 million in the third quarter fiscal 2021, an increase of 38% year-over-year. Subscription revenue was $144.1 million, an increase of 39% year-over-year, and services revenue was $6.7 million, an increase of 19% year-over-year.

Gross Profit: Gross profit was $104.7 million in the third quarter fiscal 2021, representing a 69% gross margin, compared to 71% in the year-ago period. Non-GAAP gross profit was $108.6 million, representing a 72% non-GAAP gross margin.

Loss from Operations: Loss from operations was $58.1 million in the third quarter fiscal 2021, compared to $38.7 million in the year-ago period. Non-GAAP loss from operations was $16.0 million, compared to $14.3 million in the year-ago period.

Net Loss: Net loss was $72.7 million, or $1.22 per share, based on 59.4 million weighted-average shares outstanding in the third quarter fiscal 2021. This compares to $42.4 million, or $0.75 per share, based on 56.4 million weighted-average shares outstanding, in the year-ago period. Non-GAAP net loss was $18.2 million or $0.31 per share. This compares to $14.6 million, or $0.26 per share, in the year-ago period.

Cash Flow: As of October 31, 2020, MongoDB had $966.8 million in cash, cash equivalents, short-term investments and restricted cash. During the three months ended October 31, 2020, MongoDB used $8.1 million of cash from operations, $5.6 million in capital expenditures and $1.2 million in principal repayments of finance leases, leading to negative free cash flow of $14.9 million, compared to negative free cash flow of $13.1 million in the year-ago period.

I was already impressed with Dev Ittycheria but really enjoyed learning more about his background in this interview (he gets bonus point from me for having lived in Nigeria and the UK). It’s interesting to hear his commentary about the business uncertainty caused by COVID in the earlier parts of 2020 - it’s clear that the tailwinds have been accelerated if you scan the last ER .

$CRWD

Crowdstrike turned in another set of stunning metrics at their latest ER.

Third Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $232.5 million, an 86% increase, compared to $125.1 million in the third quarter of fiscal 2020. Subscription revenue was $213.5 million, an 87% increase, compared to $114.2 million in the third quarter of fiscal 2020.

Annual Recurring Revenue (ARR) increased 81% year-over-year and grew to $907.4 million as of October 31, 2020, of which $116.8 million was net new ARR added in the quarter, including $6.8 million from the acquisition of Preempt Security.

Subscription Gross Margin: GAAP subscription gross margin was 77%, compared to 74% in the third quarter of fiscal 2020. Non-GAAP subscription gross margin was 78%, compared to 76% in the third quarter of fiscal 2020.

Income/Loss from Operations: GAAP loss from operations was $24.2 million, compared to $38.5 million in the third quarter of fiscal 2020. Non-GAAP income from operations was $18.9 million, compared to a loss of $16.5 million in the third quarter of fiscal 2020.

Net Income/Loss: GAAP net loss was $24.5 million, compared to $35.5 million in the third quarter of fiscal 2020. GAAP net loss per share, basic and diluted, was $0.11, compared to $0.17 in the third quarter of fiscal 2020. Non-GAAP net income was $18.6 million, compared to a loss of $13.4 million in the third quarter of fiscal 2020. Non-GAAP net income per share, diluted, was $0.08, compared to a loss of $0.07 in the third quarter of fiscal 2020.

Cash Flow: Net cash generated from operations was $88.5 million, compared to $38.6 million in the third quarter of fiscal 2020. Free cash flow was $76.1 million, compared to $7.0 million in the third quarter of fiscal 2020.

Cash and Cash Equivalents was $1,060 million as of October 31, 2020.

I don’t have much more to say about $CRWD - it’s an impressive business with products that are needed in 2021. Strong customer growth, increased deployment of multiple modules, strong net expansion rate, improving profitability and a record pipeline. Speed of deployment, a strong endorsement boost following high profile breaches and strong competitive advantage from ML derived network effects. It’s a much bigger company today, but it is executing extremely well.

$TWLO

Chugging along.

$ROKU

A strong end to the year after lagging for much of 2020. Sealing the deal with HBO Max is a demonstration of the platform’s growing power. It remains an open question whether they can replicate their US success internationally, but I think $ROKU is well positioned for 2021.

$ZS

Some new product launches from Zscaler on Cloud Protection, more positive ratings from Gartner, and a rapid response to the Solarwinds hack. $ZS is executing well again like the ZScaler of 2018.

$ESTC

Elastic turned in a strong Q2 ER, with strong growth and marked improvements in operating margins. Management has expressed confidence that they have no near term expectations of capital raise.

Second Quarter Fiscal 2021 Financial Highlights

Total revenue was $144.9 million, an increase of 43% year-over-year, or 40% on a constant currency basis

SaaS revenue was $37.4 million, an increase of 81% year-over-year, or 79% on a constant currency basis

Calculated billings was $177.7 million, an increase of 42% year-over-year, or 39% on a constant currency basis

Deferred revenue was $309.2 million, an increase of 54% year-over-year

GAAP operating loss was $28.4 million; GAAP operating margin was -20%

Non-GAAP operating loss was $1.7 million; non-GAAP operating margin was -1%

GAAP net loss per share was $0.34; non-GAAP net loss per share was $0.03

Operating cash flow was -$17.3 million with free cash flow of -$18.6 million

Cash and cash equivalents were $349.0 million as of October 31, 2020

Elastic delivered excellent results in the second quarter. We are innovating across our three solutions built on a single stack, expanding our relationships with key partners, and empowering our customers to drive outcomes through data, insights, and action.

My 10% trim of my position reflects my impression that it may continue to lag $MDB on valuation metrics due to the complexity of Elastic’s offerings. It’s not a simple company to understand, but I very much feel the investment thesis behind Elastic remains strong. I’ve kept a healthy stake in the company, and I’d be happy to see it grow into a larger position over time.

Developer led growth is powerful.

In the quarter, it was fantastic to see so many of our users come together during our first virtual conference, ElasticON Global, more than 25,000 registrants from more than 80 countries signed up to participate. We had more than 300 sessions that showcased how our solutions help customers drive outcomes with data, insights and action. We were pleased to have our strategic partners Google and Microsoft participate as sponsors and presenters at the event. I was especially excited to have Google Cloud's CEO, Thomas Kurian, speak about our continued partnership during the opening keynote. It's wonderful to have that level of executive engagement.

I was also happy to see so many of our customers speak and share their stories at ElasticON Global, including Cisco, Audi, Rocket Homes and Wells Fargo, all of whom renewed business with us in Q2 as well. Achieving this level of engagement on a global scale doesn't just happen overnight. It all starts with the power of our developer community. We earned their mindshare every day with openness and transparency, as they adopt, shape and champion our technology. Our three solutions Enterprise Search, Observability, and Security built on -- actually built into a single stack make it possible for us to innovate once and apply everywhere.

$AYX

I’ve been slowly reducing my $AYX position due to my previously described frustration with how the leadership transition has been handled. It’s fair to say that I have about 60% of the confidence that I did in Jan 2020, so that’s what I’ve done with the position. I’d be happy to be impressed by Mark Anderson and the new executive changes - but it’s in the prove it category for now.

$NVTA

A sharp pullback to the $40s after peaking at $61.5. The company is sharing new studies on breast cancer and germline testing. The real question I have for Invitae in 2021 is about future revenue growth and operational cost control.

$BZUN

Ho hum.

Beaten down to the trend line. Again. The opportunity cost of holding $BZUN is real. But I think it’s a good company, and I didn’t overpay, so I am doing nothing.

Thesis seemingly intact - when it moves I believe it’ll move quickly, up or down. The wedge breakout / breakdown should resolve by June 2021…

$API

Tough 2020 quarterly comps, $ZM euphoria, pending lockup and the usual ADR issues have kept Agora down. I made a small addition this month after lock up and have no immediate plans to add more. The guidance for 2021 revenue growth is pegged at under 30% and I believe the company will outperform expectations, but time will tell.

Podcast Episodes I’ve Been Listening To

I enjoyed this Bloomberg interview with Cathie Wood, who has her share of detractors. I’m a fan of people who think differently and put skin in the game behind their ideas.

A reminder that this style of investing is not for everyone - we are all wired very differently.

The Loan

Loan balance outstanding: ~ £15.6K

Loan to portfolio value (LTV) rate: 8.6%, down from 8.9% last month

I thought very hard about paying off all outstanding loan balances (car loan and investing loan) by making a 10% trim across all positions when the portfolio hit £200,000. I ultimately held off because I didn’t want to abruptly change strategy - but the idea has merit.

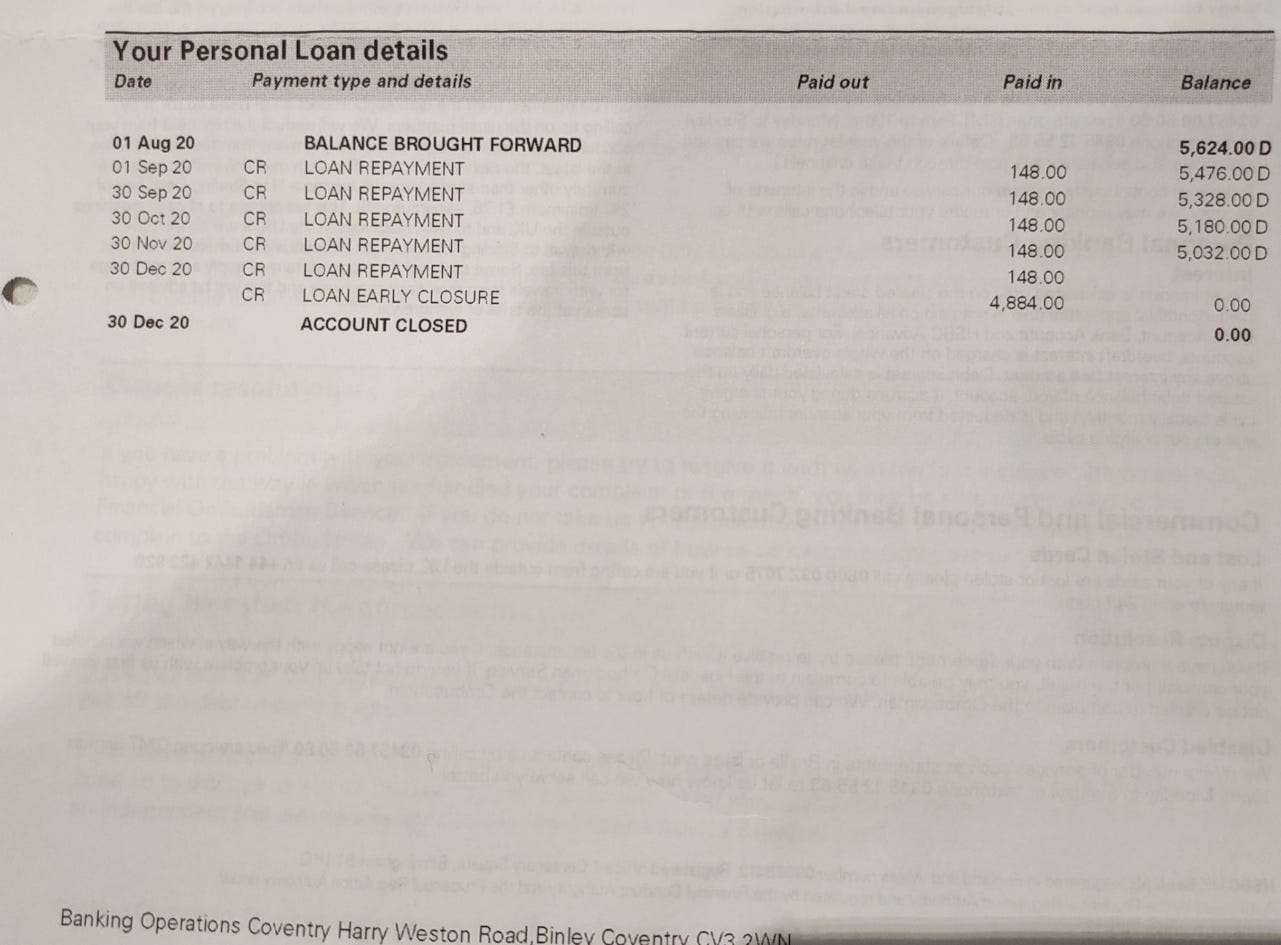

This time last year I was repaying £665 a month in low-cost loans (all under 3%): £185 to M&S bank for one investment loan, £330 to Tesco for another investment loan, and £150 to HSBC for our family car loan.

In the last 6 months, I’ve cleared the M&S Bank loan completely, and now the HSBC loan thanks to my investments. It wasn’t the original plan - I was fine with the idea of paying it off over the fully 7 years on a monthly basis, but this feels like a better plan

Goodbye HSBC Car Loan balance…

Understanding risk/reward, avoiding greed, and being able to delay gratification have been essential to my approach. People often get into trouble with debt because they lack the discipline to manage it appropriately. In certain circumstances, it can be an effective tool, but only with care and eyes wide open.

The investment loan repayment is currently ~ £330 a month, down from £515 this time last year because I’ve cleared the M&S Bank component.

Clearing the £150 monthly HSBC car loan repayment (2.8% APR) improves the ability to clear the Tesco loan faster than scheduled and gives us a little room for extra childcare that may be needed at home.

I get asked whether I plan to take on any more debt for investing purposes - the answer is no. I want to pay debts off quickly rather than take any more on - even if it is affordable, I’d prefer to be antifragile now that the debt has done the job I “hired” it to do. Having limited extra monthly funds makes it harder to take advantage of the rare opportunities when companies I like are trading at attractive prices.

Missed Opportunities?

Final Thoughts

I’m really grateful to everyone who has been kind enough to join me on my journey so far.

Since I started writing online, I’ve gained over 1300 email subscribers on this blog

over 20,000 followers on Twitter, and learned so much through the amazing community of people I’ve connected to online. Compounding applies to so many important elements of life. The key is to start and iterate and improve as you go - ideas are nothing without execution.

I am grateful to every single one of you and hope that your 2021 is safer, healthier and financially better than your 2020. I’m especially thankful to everyone that supported the launch of my first video course Losing in Order to Win and am very keen to hear feedback on it. Reflecting on mistakes is hard to do, but I honestly believe is the best way to get better and appreciate your own progress.

My portfolio updates will probably shift to quarterly, as I don’t change my portfolio that much and I want to re-focus on being a long term focused investor after the craziness of 2020. I don’t expect stock price movements to be anywhere as dramatic in 2021 - at least not to the upside.

I also have a few day-job-related challenges that are likely to restrict the time available to write for the first 6 months of 2021.

Having said that, I’m open to ideas, questions, or topics so always feel free to reach out via email or Twitter.

Have a great year!

AdventuresinFi

Thanks for the honest reflection and congratulations on your performance this year. Keep safe and focused.