Portfolio Value and Links to Previous Monthly Reviews

August 31, 2020 value - £145.4K

Nov 30, 2020 value £180.6K

YTD ~ 174% (from +138% last month)

Overview

Another weird month. Election drama and stock ticker action all over the place.

In yet another example of why it usually makes a lot of sense to ignore short term noise, my portfolio went from being pounded by the Hulk…

To juicing up on ‘roids by the end of November and acting the Hulk.

Stock prices movements in my companies feel unsustainable in the last week, so I am cautious about the short term. I’m planning to stick to my strategy of being long term focused, but it makes sense to acknowledge the risk to future returns posed by high valuations.

Factors attempting to explain valuation expansion revolve around interest rates, the fact we are pretty close to 2021 (so multiples should reset) and perhaps a wider appreciation of the unit economics of strong software businesses. Byron Deeter, a well respected BVP VC has been evangelising the Public Cloud Kings of B2B software with a catchy acronym.

Perhaps the broader market is catching up with what software investors have understood for some time.

Or perhaps I’m just trying to justify unsustainable algo-driven momentum. After all, $CRM has been listed for 16 years…

There are definitely areas of the market where things look insane. Take $APPN for example: this is not normal.

This is clearly nuts. I don’t own shares in $APPN but the mental exercise of trying to figure out what I would do if I did is a worthy one

I try to optimise for what is under my control. I anticipate and not be surprised by yet another pullback, but I can’t time it, so what are you gonna do?

Portfolio Changes since end October 2020

Sells

Sold another 25 shares of $AYX between ~ $109 and 120

Buys

$ROKU - added 5 at ~ $225

$CRWD - added 10 at ~ $129

$TWLO - added 10 at ~ $275

$API - added 15 at ~ $39

Conversion

My 400 shares of $LVGO converted to 236 $TDOC shares and the cash payout was used to top up the buys listed.

Current Portfolio Allocations via Google Sheets

Company Reviews

$TTD

The Trade Desk has reclaimed the top spot in my portfolio after its post ER moves and the underperformance of $TDOC.

Q3 ER Highlights

Revenue growth of 32% YoY - notable after a negative Q2 due to COVID-19

Continued Omnichannel Spend Growth: Omnichannel solutions remain a strategic focus for The Trade Desk as the industry continues shifting toward transparency and programmatic buying. Channel highlights from Q3 include:

Connected TV grew over 100% from Q3 2019 to Q3 2020

Mobile Video spend grew about 70% from Q3 2019 to Q3 2020

Audio spend grew about 70% from Q3 2019 to Q3 2020

Strong Customer Retention: Customer retention remained over 95% during the quarter, as it has for the previous 5 years.

Building Industry-Wide Collaboration and Support for Unified ID 2.0: The Trade Desk is building support for Unified ID 2.0, a new industry-wide approach to identity that preserves the value of relevant advertising, while putting user control and privacy at the forefront. The ID is an upgrade and alternative to third-party cookies. Recent partnerships include:

Nielsen Holdings, a global measurement and data analytics company

Criteo S.A., a global technology company that powers world marketers

LiveRamp Holdings, the leading data connectivity platform

I don’t have much to add. $TTD seems outrageously overvalued by growth metrics, but it is in the rare positon of being profitable while maitaining good growth combined with leadership in an important emerging market. Some feel that ROKU is a better investment for CTV, which is a valid call, but I’m a fan of the neutral non-media-owning argument. Jeff Green is a visionary passionate leader and analysts seem to like what he’s telling them.

So, today, I'd like to break this discussion down in three ways. First, how we have seen advertisers become more deliberate in 2020 and what that's meant for us. Second, how the tipping point in TV has proven a major factor to our growth in 2020. And three, how all of this adds up to a few things that I'm most excited about for our future, especially starting in 2021.

$TDOC

It seems ridiculous to be sentimental about a stock (and it is) but I miss $LVGO. My shares have converted to $TDOC, and the long term thesis about the company over the next decade seems pretty strong to me. There is concern that COVID vaccines will harm the business in the near term. Over the longer term, I think telehealth has solid tailwinds and the whole person / chronic disease expansion will be a strong differentiator against potential commoditisation. Given that $LVGO was acquired for $18B, the current valuation $TDOC around $28B seems not unreasonable, even if you think Livongo was overvalued at acquisition.

I log my consolidated transactions in the Webull portfolio tracker, which made it a little tricky to figure out how to best handle the share conversion.

To work out the return on my TDOC position, I’ve taken my $LVGO cost basis of 400 shares at ~ $26.72 and calculated the return on a closing price of $139.77 on October 29. I used that value against the reference closing $TDOC price on the same date of $217.89.

I’ve reported my closed $LVGO position as the value of the cash payout as a sale of 400 shares at ~ $38 from my original cost basis, yielding the ~ $4500 in cash that I received in addition to $TDOC shares.

The conversion was 0.592, resulting in 236 shares. My calculated cost price for $TDOC is entered as $41.8. Happy to reconsider a better way to do this - trying to report as clearly as possible.

$MDB

Mongo has snuck into third place in my portfolio after a year of steady climbing.

It’s a market leader with secular tailwinds. It has a great CEO. It’s growing well. It’s overvalued. It’s in my portfolio.

$TWLO

I added to my $TWLO position after realising that the capital I had allocated to it did not match my confidence in the company. I try to think of my position sizes on the basis of capital allocation rather than current size.

Back in November 2019 I sold 1/3 of my $TWLO due to reduced confidence in management. At the time, I specifically felt comments about '70% rev growth at scale' were misleading in terms of $SEND revenues.

Reduced confidence ≠ no confidence

I tend to adjust position sizes on qualitative factors like trust. I had scaled it back to 2/3 of a full position a year ago.

I’m once again impressed again with the execution of Jeff Lawson and team. It felt like a good month to redress the balance after the pullback from ATHs and bring the capital allocation closer to a full position size for me.

$CRWD

Looking forward to the ER. I topped up my position a little for similar reasons to $TWLO. I had originally considered keeping the paired allocation of $ZS and $CRWD capped together at a single position size around $10,000. The more that I have considered Crowdstrike’s execution as a public company, the more it seemed deserving of a full position from a capital allocation perspective.

$ROKU

Total net revenue grew 73% year-over-year (YoY) to $452 million;

Platform revenue increased 78% YoY to $319 million;

Gross profit was up 81% YoY to $215 million;

Roku added 2.9 million incremental active accounts in Q3 2020 to reach 46 million

Streaming hours* increased by 0.2 billion hours over last quarter to 14.8 billion

Average Revenue Per User (ARPU) grew to $27.00 (trailing 12-month basis), up 20% YoY

The Roku Channel reached U.S. households with an estimated 54 million people.

I’m impressed with the business ROKU is building. The ad-business has obvious CTV tailwinds, the ROKU channel is growing, and payment capabilities may gain significant traction. Turning in a profitable quarter was a pleasant surprise.

$ZS

Not much to report before the next ER. They appointed a new Chief Marketing Officer, which makes sense as their marketing sucks.

$ESTC

Some product upgrades and not much else to say. ER on Dec 2.

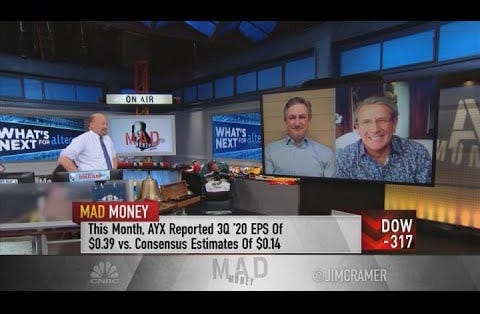

$AYX

In October, I said Alteryx might be my problem child. I was disappointed by the fact that Dean Stoecker wasn’t on the ER call. There are completely benign reasons why this may be, but I have felt my confidence in the company drop due to the way this transition has been handled.

Q3 2020 ER Highlights

Revenue: Revenue for the third quarter of 2020 was $129.7 million, an increase of 25%, compared to revenue of $103.4 million in the third quarter of 2019.

Gross Profit: GAAP gross profit for the third quarter of 2020 was $119.3 million, or a GAAP gross margin of 92%, compared to GAAP gross profit of $93.8 million, or a GAAP gross margin of 91%, in the third quarter of 2019. Non-GAAP gross profit for the third quarter of 2020 was $120.8 million, or a non-GAAP gross margin of 93%, compared to non-GAAP gross profit of $95.3 million, or a non-GAAP gross margin of 92%, in the third quarter of 2019.

Income from Operations: GAAP income from operations for the third quarter of 2020 was $9.6 million, compared to GAAP income from operations of $11.9 million for the third quarter of 2019. Non-GAAP income from operations for the third quarter of 2020 was $31.2 million, compared to non-GAAP income from operations of $22.0 million for the third quarter of 2019.

Net Income (Loss): GAAP net income attributable to common stockholders for the third quarter of 2020 was $4.4 million, compared to GAAP net loss attributable to common stockholders of $(6.2) million for the third quarter of 2019. GAAP net income per diluted share for the third quarter of 2020 was $0.06, based on 69.8 million GAAP weighted-average diluted shares outstanding, compared to GAAP net loss per diluted share of $(0.10), based on 64.0 million GAAP weighted-average diluted shares outstanding for the third quarter of 2019.

Non-GAAP net income and non-GAAP net income per diluted share for the third quarter of 2020 were $27.1 million and $0.39, respectively, compared to non-GAAP net income of $16.4 million and non-GAAP net income per diluted share of $0.24 for the third quarter of 2019. Non-GAAP net income per diluted share for the third quarter of 2020 was based on 69.8 million non-GAAP weighted-average diluted shares outstanding, compared to 69.5 million non-GAAP weighted-average diluted shares outstanding for the third quarter of 2019.Balance Sheet and Cash Flow: As of September 30, 2020, we had cash, cash equivalents, and short-term and long-term investments of $982.5 million, compared to $974.9 million as of December 31, 2019. Cash provided by operating activities for the first nine months of 2020 was $16.3 million, compared to cash provided by operating activities of $13.5 million for the first nine months of 2019.

Mark Anderson has shared a bit more information about his version of the backstory. I still don’t quite understand the truth about his exit from Anaplan. A a result of these qualitative factors, I’ve reduced my $AYX holding by 1/3 over the last two months. It’s not a decision based on price action, but a reflection of on my reduced trust in the company and confidence in its ability to execute.

$NVTA

Q3 2020 Financial Results

Accessioned approximately 170,000 samples in the third quarter of 2020 compared to 129,000 samples in the third quarter of 2019. Billable volume was approximately 157,000 in the third quarter of 2020

Generated revenue of $68.7 million in the third quarter of 2020 compared to $56.5 million in revenue in the third quarter of 2019

Reported average cost per sample of $274 in the third quarter of 2020 compared to $249 average cost per sample in the third quarter of 2019. Non-GAAP average cost per sample was $247 in the third quarter of 2020

Achieved gross profit of $22.1 million in the third quarter of 2020 compared to $24.4 million of gross profit in the third quarter of 2019. Non-GAAP gross profit was $26.8 million in the third quarter of 2020

Total operating expense, excluding cost of revenue, for the third quarter of 2020 was $102.9 million. Non-GAAP operating expense was $102.6 million in the third quarter of 2020.

Net loss for the third quarter of 2020 was $102.9 million, or $0.78 net loss per share, compared to a net loss of $78.7 million in the third quarter of 2019, or $0.82 net loss per share. Non-GAAP net loss was $81.7 million, or $0.62 non-GAAP net loss per share, in the third quarter of 2020.

At September 30, 2020, cash, cash equivalents, restricted cash and marketable securities totaled $368.0 million. Net decrease in cash, cash equivalents and restricted cash for the quarter was $61.4 million. Cash burn was $64.9 million for the quarter.

Corporate and Scientific Highlights

Completed the transaction to bring ArcherDX, a leading genomics analysis company, into Invitae to create a global leader in comprehensive cancer genetics and precision oncology, bringing germline and somatic testing, liquid biopsy and tissue genomic profiling onto a single platform. With both centralized and distributed capabilities, Invitae is now uniquely positioned to provide flexibility in meeting customers' needs.

Published significant studies underscoring the use of both germline and somatic sequencing in oncology:

Signed 32 biopharma partnership deals in the quarter

22% revenue growth is ok in context. Let’s see how they do with cost control going forwards. Current cash burn will drain the balance sheet in 6 quarters.

Some enthusiastic words from the founder and former CEO of ArcherDX seem to encourage the bullish thesis.

It is abundantly clear to me that if molecular medicine is to become the standard it will need to be delivered in a broad systemic and accessible fashion. With both centralize and distributed capabilities on board Invitae is now uniquely positioned to provide flexibility in meeting customers whatever their specialty and wherever they choose to practice and serve their community.

$BZUN

Q3 2020 Highlights

Total net revenues were RMB1,829.2 million (US$269.4 million), an increase of 21.7% year-over-year. Services revenue was RMB1,025.7 million (US$151.1 million), an increase of 22.0% year-over-year.

Income from operations was RMB84.6 million (US$12.5 million), an increase of 50.9% year-over-year. Operating margin was 4.6%, compared with 3.7% in the same period of last year.

Non-GAAP income from operations was RMB111.7 million (US$16.4 million), an increase of 47.1% year-over-year. Non-GAAP operating margin was 6.1%, compared with 5.1% in the same period of last year.

Net income attributable to ordinary shareholders of Baozun Inc. was RMB64.6 million (US$9.5 million), an increase of 64.2% year-over-year.

Non-GAAP net income attributable to ordinary shareholders of Baozun Inc was RMB91.5 million (US$13.5 million), an increase of 55.1% year-over-year.

Basic and diluted net income attributable to ordinary shareholders of Baozun Inc. per American Depository Share (“ADS”) were RMB1.09 (US$0.16) and RMB1.07 (US$0.16), respectively, compared with RMB0.68 and RMB0.66, respectively, for the same period of 2019.

Basic and diluted non-GAAP net income attributable to ordinary shareholders of Baozun Inc. per ADS5 were RMB1.55 (US$0.23) and RMB1.52 (US$0.22), respectively, compared with RMB1.01 and RMB0.99, respectively, for the same period of 2019.

Improving operating margins, good EPS growth, unexciting revenue growth - now that they have lapped the loss of Huawei, it will be interesting to see how revenue growth trends play out. The thesis is intact, but after seeing how well other ecommerce leaders have grown revenue in 2020, I would consider dropping $BZUN in 6 months if I remain neutral to underwhelmed. Patience is important, but so is opportunity cost.

Double 11 figures and refinements to strategic focus are a source of some encouragement…

Double 11 Shopping Festival is a great example of our progress where our total order value rose by 54.8% during the extended 11-day period to a record high of RMB 16.5 billion.

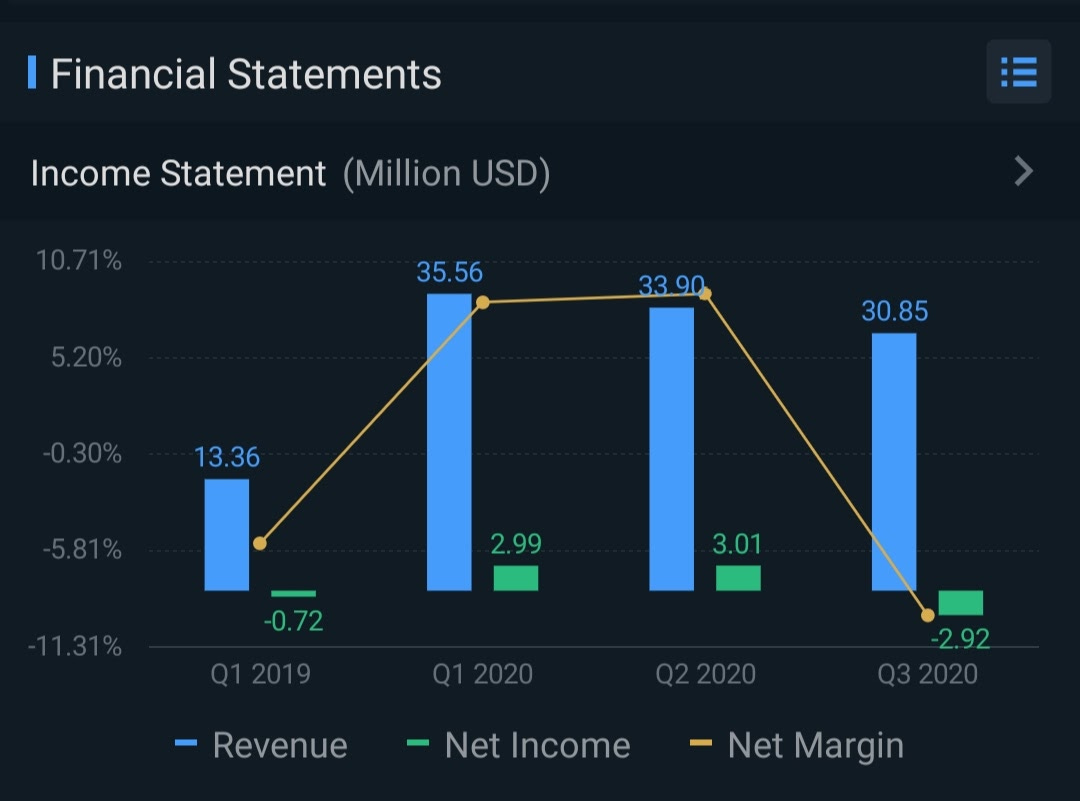

$API

Agora Q3 ER results were fine but nothing to get particularly excited about - it was the second QoQ drop in revenue, guidance was maintained, and it seems reasonable to suggest that there was not a great deal of enthusiasm for the shares post ER as they hit their lowest price since IPO, falling below $34.

Total revenues for the quarter were $30.8 million, an increase of 80.8% from $17.1 million in the third quarter of 2019.

Active Customers as of September 30, 2020 were 1,815, an increase of 95.4% from 929 as of September 30, 2019.

Constant Currency Dollar-Based Net Expansion Rate was 187.9% for the trailing 12-month period ended September 30, 2020.

Net loss for the quarter was $2.9 million, compared to net loss of $1.1 million in the third quarter of 2019. After excluding share-based compensation expense, non-GAAP net loss for the quarter was $0.4 million, compared to the non-GAAP net loss of $0.3 million in the third quarter of 2019. Adjusted EBITDA for the quarter was negative $0.1 million, compared to $0.2 million in the third quarter of 2019.

Total cash, cash equivalents and short-term investments as of September 30, 2020 was $635.4 million.

Net cash used in operating activities for the quarter was $1.9 million, compared to $0.1 million in the third quarter of 2019. Free cash flow for the quarter was negative $5.1 million, compared to negative $1.3 million in the third quarter of 2019.

Agora has been a great example of why patience is needed with new IPOs and waiting for asymmetrical risk/reward is good strategy. $34 would have represented an attractive entry for going long - I like to see a 50% haircut from the post listing peak in new IPOs before building a position, but I let 2020 FOMO persuade me to start a position a bit early. Because I have kept the position small, it has not harmed my overall portfolio, but it reinforces the lesson for me.

The company is getting the word out on new use cases and examples of the technology. I added a small amount in November, but do not expect to add further until after lockup expires (if at all)

Podcast Episodes I’ve Been Listening To

The Loan

Loan balance outstanding: ~ £16K

Loan to portfolio value (LTV) rate: 8.9%, down from 10% last month

Final Thoughts

It has been a ridiculous month and year. I don’t expect to ever see another year of 2020 style returns. There are some excellent businesses in my portfolio riding secular tailwinds, but the pressure is on the companies to live up to the potential afforded by the generous market caps.

In 2017, it wasn’t hard to find attractive B2B Enterprise SAAS companies at a EV/S of 7-12 and market caps below $3B. That world feels a long way away as we draw towards the end of 2020. My key takeaway for the last 3 years is been to find and hold on to hypergrowth excellence and to be prepared to pay up for quality, but the rubber band can surely only stretch so far…

Watchlist: $APPS, $BLFS, $FEAC, $LSPD, $MELI, $NNOX, $PAGS, $STNE, $SHOP, $SE