Portfolio Value

Feb 29, 2020 value - £75.3K

Mar 31, 2020 value- £62.7K (down approx 16.5% from last month)

Cash added this month - £377 (yeah I wish I could add another zero to this)

Overview

My portfolio was absolutely devastated in March, falling from a peak of £80K mid-Feb to approximately £48K mid-March. It has since rebounded slightly from the lows, but this still represents a significant pasting.

My two biggest positions, Alteryx and the Trade Desk are significantly down from their February all-time-highs, and my portfolio has the bruises to prove it.

Portfolio Changes since end Feb

$CRWD Bought another 8 shares at approx $57

No other changes.

I could potentially deploy further capital, but I am not in a rush at current prices, and another leg down would not surprise me. We also have a level of uncertainty regarding childcare options since our nursery is shut, so I am keeping some potential investing money available for other purposes till we get some clarity.

I am planning to add about £1000 - £1500 to the portfolio over the next 2 months

Current Portfolio Allocations (Via Google Sheets)

A review of Q1 performance, stock by stock. The blue E in the charts below represent earnings reports being released.

Stock Reviews

$AYX

17.7% Position

AYX has fallen approximately 31% in the last month. I added 10 more shares back in February at 140. Although the price is very attractive in the 80 and 90s with a long term lens, I feel like I have enough to benefit from when it regains its former majesty.

Stocks that seem to be doing particularly well at the moment at those that may get tailwinds from COVID19. I don’t think that AYX qualifies here, as there is no real remote work angle that they can push, and sales may face some short term headwinds.

Beyond the short term, I don’t see much wrong with the way $AYX is growing its business.

$TTD

17.3 % Position

33% fall in the last month

Ad budgets are plummeting and the Olympics are canceled. What more do you need to say? I do have a lot of confidence in the management at $TTD and they are profitable, it seems likely that advertising may not look back fondly at 2020.

However, the CTV shift from linear TV may happen sooner with the current stay at home trend. Eventually, the advertising will follow, and in the long run, $TTD stands to benefit. I was impressed by the new deal that they have made with Tik-Tok - a platform I can’t stand, but I can appreciate its stellar growth.

$LVGO

14.6% Position

Up 14% this month.

In early March, it looked like $LVGO was ready to move upwards on a positive ER.

It subsequently fell out of its trend channel, as did most stocks, but has clawed its way back in, aided by a favourable reaction to the chairman’s appearance on CNBC. There is also an article by the CFO talking about the company’s efforts to support members during COVID-19

While I think the medium-long term trends are supportive of LVGO’s strategy, I am unsure whether it’s truly a coronavirus play in the shorter term, as sales cycles may be impacted. It’s not in the same class as $WORK or $ZM in that sense. I’m happy with the execution of the company to date, and the impressive growth rate, business progress and deepening of partnerships, with a reasonable valuation favour the long term shareholder.

What I said wanted to see at LVGO ER and what we got

Triple-digit revenue growth for Q4: 137%

Guidance above consensus for 2020: Yes

More medically validated research: I may have missed this, but don’t recall seeing it

$MDB

13.1% Position

8% fall in the last month

Mongo had its ER in mid-March, in the trough of the selloff. Revenue growth is slowing, as per the law of large numbers, and it would be reasonable to be uncomfortable with the rate of the revenue growth deceleration this year, even acknowledging the difficult comps due to the mLAB acquisition: 44.50%, 52.46%, 66.69 the last 3 quarters.

Mongo is not yet showing significant movements towards profitability, so I can understand why investors may sour on them. I have a slightly longer timeframe than most, so I am happy to continue holding for now. They have guided for approx 25% revenue growth in 2020 at the top end, acknowledging the impact of the coronavirus.

MongoDB Fourth Quarter Fiscal 2020 Financial Highlights

Revenue: Total revenue was $123.5 million in the fourth quarter fiscal 2020, an increase of 44% year-over-year. Subscription revenue was $117.8 million, an increase of 46% year-over-year, and services revenue was $5.7 million, an increase of 17% year-over-year.

Gross Profit: Gross profit was $88.7 million in the fourth quarter fiscal 2020, representing a 72% gross margin, compared to 70% in the year-ago period. Non-GAAP gross profit was $91.2 million, representing a 74% non-GAAP gross margin.

Loss from Operations: Loss from operations was $40.9 million in the fourth quarter fiscal 2020, compared to $23.8 million in the year-ago period. Non-GAAP loss from operations was $12.0 million, compared to $9.7 million in the year-ago period.

Net Loss: Net loss was $62.6 million, or $1.10 per share, based on 56.9 million weighted-average shares outstanding in the fourth quarter fiscal 2020. This compares to $22.2 million, or $0.41 per share, based on 53.8 million weighted-average shares outstanding, in the year-ago period. Non-GAAP net loss was $14.5 million or $0.25 per share. This compares to $9.1 million or $0.17 per share in the year-ago period.

Cash Flow: As of January 31, 2020, MongoDB had $987.0 million in cash, cash equivalents, short-term investments, and restricted cash. During the three months ended January 31, 2020, MongoDB used $8.6 million of cash from operations, $1.2 million in capital expenditures and $1.1 million in principal repayments of finance leases, leading to negative free cash flow of $10.9 million, compared to negative free cash flow of $12.6 million in the year-ago period.

$ESTC

8.2% Position

Fell approx 24% in March after falling 10% in Feb

Nadir of $39 this month. Elastic remains unloved by the market. Underperformance is frustrating, but I’m holding my position until I find evidence that the thesis is damaged. It’s tough to see -40% to -45% losses, but the company is performing well. Similar to $MDB, profitability remains years away.

$ZS

7% Position

Up 17% this month

Well, well, well.

I was fairly unimpressed with the Feb ER at $ZS and sold 1/3 of my position. I bought some $CRWD shares at a similar price as it didn’t seem to have the sales execution challenges apparent at $ZS and the two companies have a partnership. I have also been increasingly reading up on $NET which has a competitive product to $ZS and seems to be growing at 45-50%.

Interestingly, $ZS has outperformed $CRWD in the last month, as the coronavirus work from home trend has led to analysts to feel this may act as a positive tailwind for Zscaler sales as they need to secure their applications and maintain access and performance for employees connection remotely.

We will see.

$TWLO

5.7% Position

Dropped about 20% in March and was down 8 % in February. Not much to say Twilio is not having a good 2 months, but the long term CPaSS thesis is intact. Brent Bracelin, a respected analyst recently downgraded TWLO on near term revenue contraction due to coronavirus.

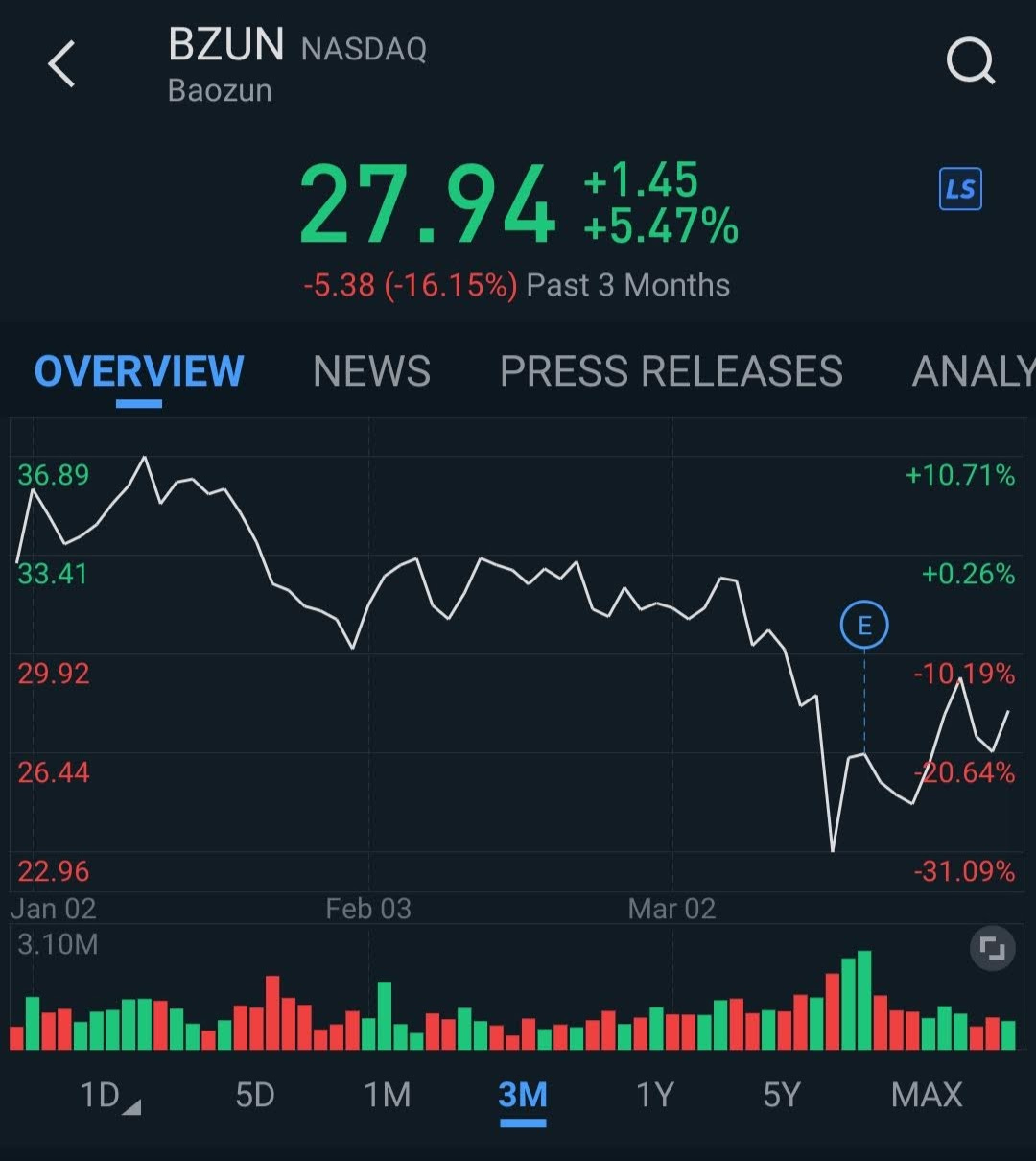

$BZUN

4.8% Position

-13% in the last month. Broke LT support just under $30 and working back up.

ER released, which showed impressive GMV growth, and particularly non-distribution GMV growth, and comparatively unimpressive revenue growth, including the key high margin “services” growth. The long term thesis seems ok, with solid brand partner expansion and GMV growth. It is an open question when this will be seen in revenue growth acceleration. Not adding, but not selling either.

Fourth Quarter 2019 Financial Highlights

Total net revenues were RMB2,784.1 million (US$1399.9 million), an increase of 26.4% year-over-year. Services revenue was RMB1,491.0 million (US$214.2 million), an increase of 21.6% year-over-year.

Income from operations was RMB195.9 million (US$28.1 million), a decrease of 14.7% year-over-year. Operating margin was 7.0%, compared with 10.4% in the same quarter of last year

Non-GAAP income from operations2 was RMB216.6 million (US$31.1 million), a decrease of 12.3% year-over-year. Non-GAAP operating margin was 7.8%, compared with 11.2% in the same quarter of last year.

Net income attributable to ordinary shareholders of Baozun Inc. was RMB140.9 million (US$20.2 million), a decrease of 25.2% year-over-year.

Non-GAAP net income attributable to ordinary shareholders of Baozun Inc.3 was RMB161.3 million (US$23.2 million), a decrease of 21.4% year-over-year.

Basic and diluted net income attributable to ordinary shareholders of Baozun Inc. per American Depository Share (“ADS4”) were RMB2.42 (US$0.35) and RMB2.36 (US$0.34), respectively, compared with RMB3.29 and RMB3.17, respectively, for the same period of 2018.

Basic and diluted non-GAAP net income attributable to ordinary shareholders of Baozun Inc. per ADS5 were RMB2.77 (US$0.40) and RMB2.71 (US$0.39), respectively, compared with RMB3.59 and RMB3.46, respectively, for the same period of 2018.

Total Gross Merchandise Volume (“GMV”)6 was RMB17,771.8 million, an increase of 47.6% year-over-year.

Distribution GMV7 was RMB1,448.8 million, an increase of 29.5% year-over-year.

Non-distribution GMV8 was RMB16,323.0 million, an increase of 49.5% year-over-year.

The number of brand partners increased to 231 as of December 31, 2019, from 185 as of December 31, 2018.

The number of GMV brand partners increased to 222 as of December 31, 2019, from 178 as of December 31, 2018.

$CRWD

4.8% Position

Down 6.6% in the last month

I never expected to see $CRWD in the 30s if I’m honest. Had I anticipated the pummeling, I would have scooped up shares in the 30s as the companies turned in an outstanding ER as expected.

The exec team feels confident that they stand to benefit from the work from home driven need for endpoint security. A great ER across all metrics.

$NVTA

3.5% Position

Down 33% in the last month and up over 90% from the lows of $7.42

NVTA feels either go the zero or be a long term multi-bagger - I think I would have benefitted by selling when I was in profit here.

$LSPD.CA

1.8% position.

Down over 40% in the last month, and up 100% from the lows of March

Headwinds from SMB collapse and imminent recession.

$ROKU

1.3% position

-20% in the last month

Low of $55 mid-month. Ad budget falling with the recession, but stay at home cord-cutters may accelerate the trend. I did have to laugh at Fox behaving like a noob retail investor by selling at the nadir $58 to buy another streaming service, only to have seen a 45% appreciation in ROKU stock almost immediately afterward.

Stocks I’ve been watching

$ZM (who isn’t?), $WORK, $NET

The Loan

Loan balance outstanding: £28.6K

Loan to portfolio value (LTV) rate: 45%, up from 38.7%

Summary

I felt psychologically ready for a significant fall in the markets, but on reflection, I did not anticipate the speed and intensity of the selloff, nor did I fully appreciate the global impact of the coronavirus - a foolish mistake in retrospect. Importantly, whilst acknowledging valuation risk and bubbly behaviour in my posts, I did not take any definitive actions to mitigate the risk I recognised.

There are several actions that I could have taken:

Selling off my lower conviction positions when they were nicely in the green. I’m specifically thinking of Invitae ($NVTA) where:

I already knew what the ER would show as results were preannounced in Jan

The stock had a strong run-up to $28 before ER

Burn rate is high and profitability years away

Balance sheet and rate of acquisitions are increase risk of further capital raise

Gross margins are lower than my software investments at ~45% vs 75%

My entry was far from ideal

I had higher conviction ideas

I also could have increased my cash position or hedged with a volatility ETF such as TVIX, VIX or the like. Access to most US ETF is restricted by my UK and European brokers but is technically possible with the service at Stake which recently launched in the UK.

I have opened an account but won’t qualify for US ETF access in the short term as they don’t offer ISA accounts and I otherwise won’t have sufficient funds to do so. A service to keep an eye on….

And there you have it. February was fabulous, March was misery, April may be agony. There are lots of opinions out there, but no one knows and there is value in keeping an open mind.

Investing is simple, but not easy. Over the short term, I would not be surprised by more pain.

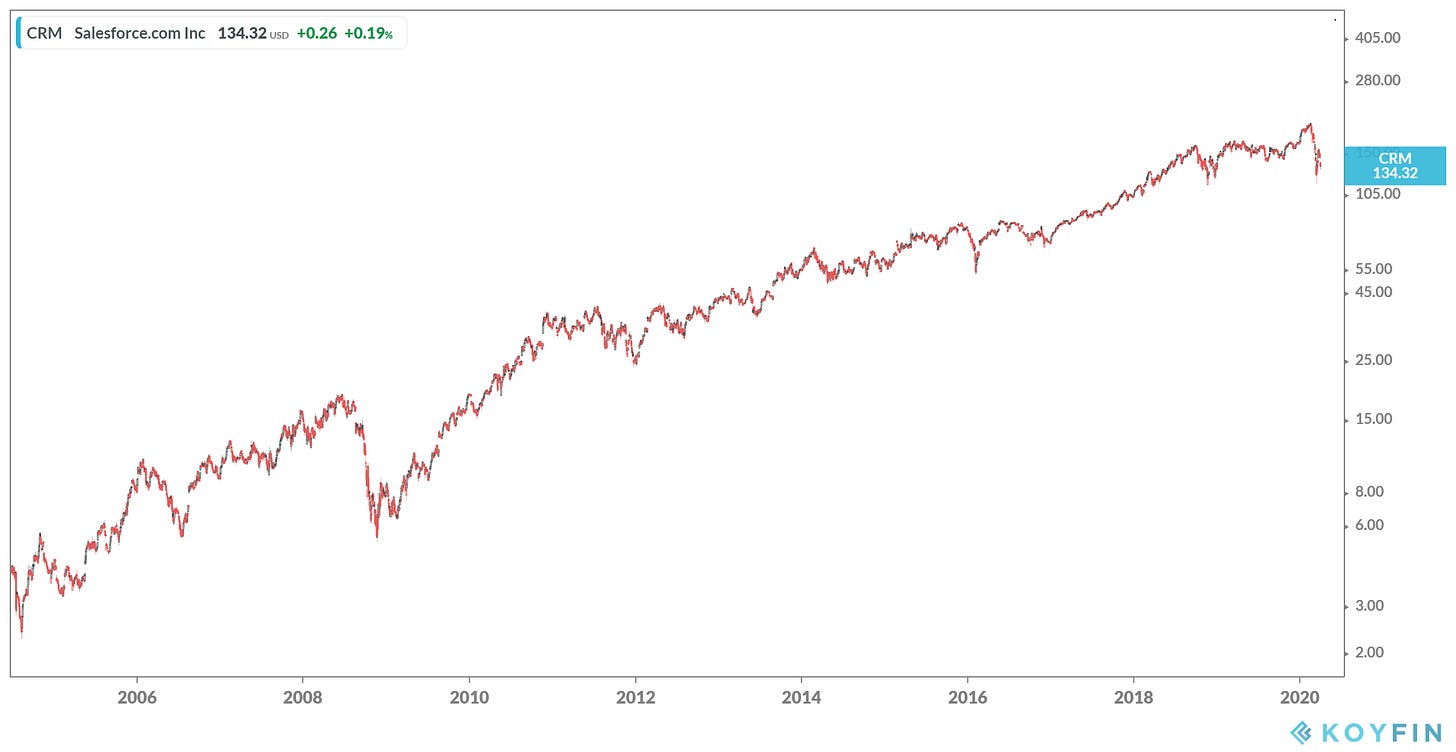

This Salesforce.com $CRM chart going back to 2009 is a strong reminder of what long term growth charts tend to look like. The stock lost 2/3 of its value in the last financial crisis and if you lost sight of the long term, you would have missed out on life-changing appreciation.

”Stocks go down faster than they go, but (the good ones) go up more than they go down”

In the long run, I’m largely happy with the companies that I own and outside of some potential minor tweaks to the portfolio, my sentiment is best described as “dark clouds I can see through” as I review my portfolio.

This episode will eventually pass. I am long innovation, multidisciplinary collaboration, and the triumph of the human spirit. The short term hit to the global economy is necessary to preserve human life. After things get worse, I truly believe that they will get better.

Take care of yourself and stay safe.