May 2020 Portfolio Review

An a-May-zing return. I am no genius. The market just likes my companies right now.

Portfolio Value and Links to Previous Monthly Reviews

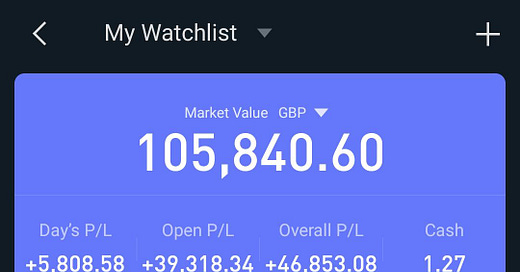

Feb 29, 2020 value- £75.3K

Mar 31, 2020 value - £62.7K

Apr 30, 2020 value - £79.4K

May 29, 2020 value - £105.8K - up 31.8% from last month

YTD ~ 67%

Financial contributions to the portfolio this month: total ~ £860

Portfolio Graph

Overview

May has delivered a year’s worth of returns in one month and I am up over 100% from March 2020 lows. I’m not exactly sure how I feel about that.

The market doesn’t care about my feelings.

On one hand, the best digital businesses are riding powerful tailwinds, building important platforms, have a strong ROI on sales, are constantly improving their offerings, have recurring revenue, high gross margins, high growth rates, positive net retention rates, and are moving towards profitability.

They are worthy of a premium valuation, but enterprise values are so high in some cases that operational metrics will have to surpass already high expectations for a significant period to demonstrate that they are warranted.

On the flip side, valuations may be re-rated like they were in Q3/Q4 of 2019, where my portfolio significantly underperformed. The chart of long term performance of my portfolio since inception vs the S&P500 shows that peaks have historically been followed by aggressive troughs.

I don’t know what will happen in the short term, which I why I choose to focus on the 3-7 years ahead. Over the long term, I have high confidence that companies I own will continue to outperform.

Portfolio Changes since end-April

Sells

6.5.2020 Closed my $LSPD.CA position completely at a loss of ~ £505 (-23%).

I sold Lightspeed POS prior to ER because it was a lower confidence holding for me. After noting the read through on POS data from the $SHOP and $SQ data which I felt might have damaged the thesis for the company and represented headwinds to their hospitality and retail focus.

SHOP

SQ

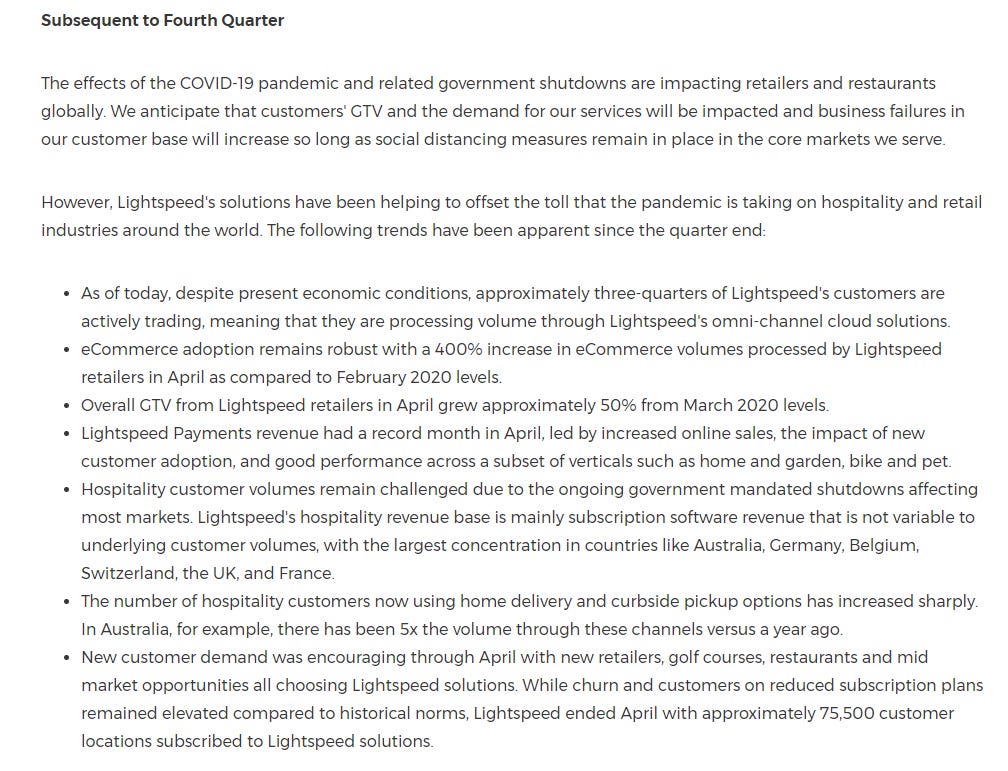

This is what Lightspeed had to say about the impact of COVID-19:

I still think that Lightspeed is a good company and appreciate that COVID-19 may actually be a net positive for digital transformation in its target market. Revenues are largely subscription-based, so clients that remain in business should continue to pay them. I do think it will take time for the hospitality industry to move beyond survival mode.

The company turned in a solid ER with excellent growth. Growth accelerated to 70% but operating margins remain (-)50% or so. Shares were rewarded with upwards re-rating post ER, but that is not the outcome I am using to determine whether re-allocation of capital was the right move.

I will keep an eye on the company, and if improvement in operating margins is seen and I have increased confidence I will happily reconsider opening another position, even if the price is higher. You have to be willing to pay a premium for a de-risked investment. I moved the capital to $ROKU and $CRWD which are likely to keep winning in today’s COVID-19 climate.

Buys

Put the $LSPD.CA proceeds into 12 shares of CRWD at $72.6 and 9 ROKU at $126.72

Added another 10 LVGO at $48.6 and 4 ROKU at $103.6 during the tech selloff

Bought 1 share of AYX to take my total cost allocation to bring it to my max allocation limit per company of ~$11,000

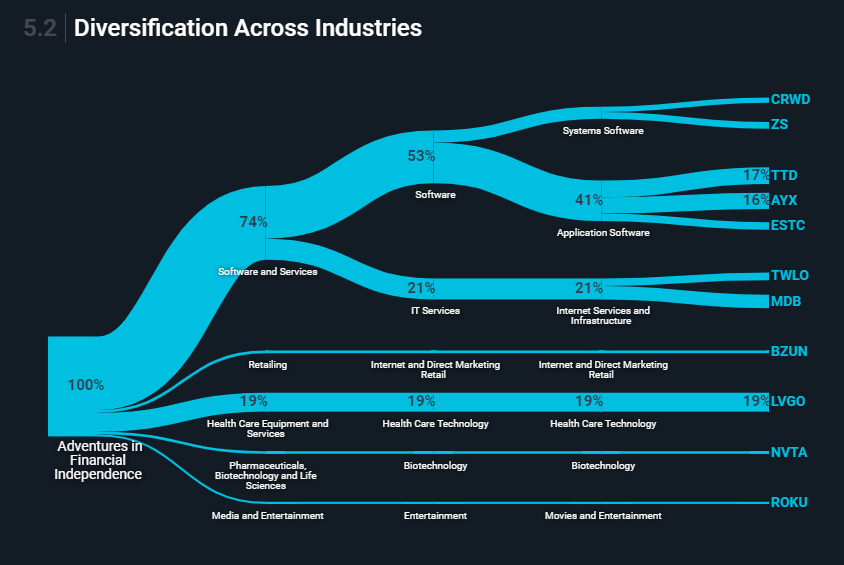

Current Portfolio Allocation

Via Simplywall.st

Last 30 Days Individual Stock Performance Summary

$LVGO

Now my biggest position. Up 43% this month.

Great ER with a beat of the preliminary results.

First Quarter Fiscal 2020 Financial Highlights:

Revenue: Total revenue for the quarter was $68.8 million, up 115% year-over-year, driven by the continued adoption of our Applied Health Signals platform.

Gross Margin: GAAP gross margin of 73.7% and non-GAAP gross margin of 74.4%.

Net Loss and Non-GAAP Net Income: GAAP net loss of $5.6 million, and GAAP net loss per share attributable to common stockholders of ($0.06) on a diluted basis; and non-GAAP net income of $3.9 million, and non-GAAP net income per share attributable to common stockholders of $0.03 on a diluted basis.

Adjusted EBITDA: $3.8 million in the first quarter of 2020.

Livongo for Diabetes Members: Over 328,000 as of March 31, 2020, up approximately 100% year-over-year.

Livongo Clients: 1,252 Clients as of March 31, 2020, up approximately 44% quarter-over-quarter.

Estimated Value of Agreements (EVA): $89.0 million, up from $48.1 million in the first quarter of 2019. EVA consists of the estimated value of agreements signed in the quarter with new Clients or expansions entered into with existing Clients.

I still think it is undervalued.

I took the chance to top up my position during the sell-off this week.

Much to look forward to the future with Livongo. It’s a strong team.

I’m not going to buy anymore now for the foreseeable future as I’ve hit my maximum capital allocation of $11,000 per company.

A great company for our times.

$TTD

The Trade Desk is up about 21% this month.

ER in early May was decent, but short term headwinds in advertising made their effects known as the company saw an end March slowdown. They still turned in revenue growth above 30% and remain profitable unlike most of my companies. Tailwinds are not immediate but are there.

First Quarter and Recent Business Highlights :

Continued Omnichannel Spend Growth:

Total Mobile (in-app, video, and web) spend grew 38% from Q1 2019 to Q1 2020

Mobile Video spend grew 74% from Q1 2019 to Q1 2020

Mobile In-App spend grew 55% from Q1 2019 to Q1 2020

Connected TV spend grew 100% from Q1 2019 to Q1 2020

Audio spend grew 60% from Q1 2019 to Q1 2020

Expanding Partnerships in Asia

The Trade Desk and TikTok, the leading destination for short-form mobile video, announced a new advertising partnership covering key Asia Pacific markets.

Financial Guidance has been withdrawn. Not a surprise. I intend to hold. I missed my chance in March - April to get my capital allocation up to my $11,000 max, but would do so when the stock gets beaten down again if I have cash to spare.

$AYX

Alteryx is up 33% this month, despite turning in a ER performance that was solid but not the stellar quality results I’ve gotten used to seeing. It is not an essential work from home tool and there have been notable headwinds from European markets.

Regardless of the short term impact, the long term thesis for Alteryx is firmly intact, and I continue to hold. I’ve maxed my capital allocation it to the $11,000 limit because I’m optimising for the next 5 years, not the short term.

AYX CEO on Cramer

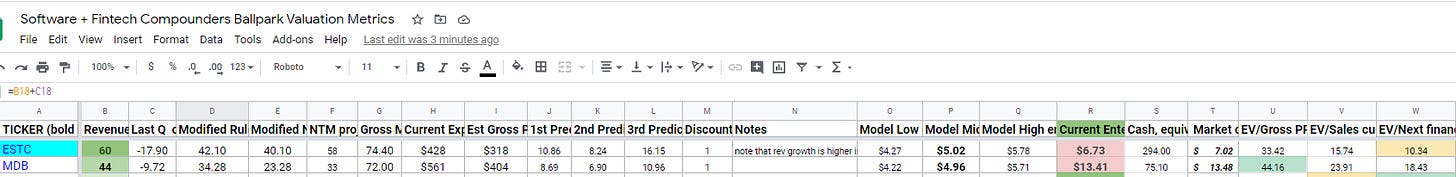

$MDB

Up 50 % in the last month.

Compared to Elastic which has pretty similar operating metrics, this seems a bit frothy. I appreciate the qualitative CAP perceptions differ between the 2 companies. but I don’t fully understand the move this month once you look past the technicals.

$ESTC

The dead man rises. Up 41% in the last month.

Let’s see what ER brings.

An outstanding write up by Richard Chu who you should be following on Twitter has me very interested to see how Elastic performs over the next few years.

$ZS

Up 47% this month and 29% on Friday alone(!) on what I can only presume is a short squeeze.

ER Highlights

Revenue up 40% year-over-year to $110.5 million

Calculated billings grow 55% year-over-year to $131.3 million

Deferred revenue grows 42%year-over-year to $300.8 million

Non-GAAP net income of $9.0 million compared to non-GAAP net income of $7.4 million on a YoY basis

2 new acquisitions, improved sales process, and aggressive sales team building seem to have quietened the doubters in the short term.

ZS CEO on Cramer

$TWLO

Up 89% in May.

First Quarter 2020 Financial Highlights

Total revenue of $364.9 million for the first quarter of 2020, up 57% year-over-year.

Non-GAAP income from operations of $6.1 million for the first quarter of 2020, compared to $3.4 million for the first quarter of 2019.

Dollar-Based Net Expansion Rate, calculated using total revenue, was 143% for the first quarter of 2020

Twilio’s CPaaS platform is seeing increased attention as a result of COVID19.

The number of use cases for CPaaS tech is limited only by developer imagination.

This is a superb breakdown by @Stackinvesting who you should also be following.

$CRWD

Up 25% in May, with sympathy moves in the last week of the month with $ZS earnings. They report June 2 AMC.

$BZUN

Down 16% this month. Up 18% last month.

More worries about the US-China relationship, accounting, VIE and ADR risks, COVID-19, etc.

Thesis intact imho. Holding but not adding.

$NVTA

Invitae had their ER in early May.

First Quarter 2020 Financial Results

Accessioned more than 154,000 samples in the first quarter of 2020, representing a nearly 64% increase over the 94,000 samples in the first quarter of 2019 and more accessioned samples in one quarter than in the full year of 2017. Billable volume exceeded 151,000 in the first quarter of 2020

Generated revenue of $64.2 million in the first quarter of 2020, representing a 58% increase over $40.6 million in revenue in the first quarter of 2019

ER was a mixed bag, which is normal for Invitae. The company is a cash burning machine. The long term thesis is powerful enough that it is worth holding a small position accepting a binary outcome in either direction.

Preliminary net loss for the first quarter of 2020 was $102.2 million, or $1.03 preliminary net loss per share, compared to a net loss of $37.7 million in the first quarter of 2019, or $0.47 net loss per share. Preliminary non-GAAP net loss was $79.8 million in the first quarter of 2020, or $0.80 preliminary non-GAAP net loss per share.

COVID-19 Impact began impacting Invitae during the second half of March. They claim they have taken a number of steps to reduce cash burn and have withdrawn 2020 guidance.

In April, the company completed a public offering of common stock at $9 per share. Not a great look when your average share cost is in the $20s.

Holding, but not adding.

$ROKU

Slowly adding to my position this month with the proceeds of selling LSPD.CA and with a little new money. Platform revenue growth and integration of Dataxu is progressing well while gross margins and profitability took a knock. The market was spooked by the deterioration in profitability. I’m not.

ROKU is a volatile stock, but you have to bear in mind that it 5x’d in 2019, so price stability will take time.

ER Q1 2020 Highlights

• Platform revenue increased 73% YoY to $233 million;

• Gross profit was up 40% YoY to $141 million;

• Roku added 2.9 million incremental active accounts in Q1 2020 to reach 39.8 million;

• Streaming hours increased by 1.6 billion hours over last quarter to a record 13.2 billion;

• Average Revenue Per User (ARPU) of $24.35 (trailing 12-month basis), up 28% YoY

The long term thesis from ROKU’s management:

Over the longer term, not only do we believe that the trends that we expect to define the streaming decade will remain intact, but changes brought on by the COVID-19 pandemic may even accelerate Roku’s path to greater platform scale. In the years ahead, we believe that the vast majority of TVs will use a modern TV streaming OS to connect to the internet; more TV brands will adopt a licensed OS; cord-cutting will continue; ad-supported content will unlock enormous value for consumers.

Average price for me is $114.4, and it remains a smallish position for now.

IP issues over a remote control are worth monitoring but are not something to lose sleep over.

The Loan

Loan balance outstanding: £27.5K

Loan to portfolio value (LTV) rate: 28%, down from 35% last month

Summary

Q2 or Q3 ERs may bring things back to reality. If software companies don’t show evidence of revenue growth on the back of the promise of accelerated tailwinds, valuations may well take a chop.

It would actually feel more sustainable to me if June turns out to be a period of consolidation for software.

Why not sell now and go away?

If you had told me in April to expect $TWLO to jump over 80% in May, I would have suggested you spent less time on the crack pipe.

I’ve seen my portfolio get hammered before. It will happen again.

But I’m playing the long game, not trying to time the market. Volatility is not risk.

Watchlist

$SE, $FSLY, $NET, $SDGR, $PAGS, $STNE, $ZM

ER dates to watch:

June 2 BMO: BZUN

June 2 AMC: CRWD, ZM

June 3 AMC: ESTC, SMAR

June 4 AMC: MDB, WORK