Portfolio Value and Links to Previous Monthly Reviews

Feb 29, 2020 value- £75.3K

Mar 31, 2020 value - £62.7K

Apr 30, 2020 value - £79.4K

May 31, 2020 value - £105.8K

June 30, 2020 value - £124.7K (up 17% on last month)

YTD ~ 96%

Financial contributions to the portfolio this month: £650

Overview

It has been an incredible Q2 for software investors after Q1 ended with the thud of March. I wrote in May that I was hoping for a bit of portfolio stability because I was worried that the enthusiasm for software companies needed to be sustainable.

But here we are. There is not much to be gained by trying to predict short term movements. My portfolio return is far beyond what I would have expected at the start of the year, in March, or even last month. It will not always be like this - returns are non linear.

I do not know what the “right” valuation is for many of my companies. It is not possible to know if the current premiums they are currently afforded will look silly or prescient later in the year. Both outcomes are possible. My philosophy means that I am not going to try to use valuation as a sole reason to sell.

This not out of greed, but simply because I think my companies have not finished riding their respective S-curves. I think we are in the relatively early stages of the shift to the cloud.

I believe that in 5 years, every company in my portfolio will be worth more if their management can continue to execute on their opportunities. In the meantime, I expect volatility as we move towards Q3 and Q4. Not all software companies will benefit in the short term, although the long term theses seem intact.

Valuations are high and digital transformation tailwinds are real. But the fruits are unlikely to be distributed evenly, and this article by Beth Kindig (who you should be following) is a very good read. Q3 and Q4 may get ugly for some companies on the chart, but the long term is the only real thing an investor can optimise for.

Portfolio Changes since end May 2020

Sells

$ESTC

I trimmed 15 shares of $ESTC at $87 after the ER, leaving me with 100 shares. I think the Q4 ER results were excellent, but the forward guidance given was confusing.

Buys

$CRWD

Added 15 shares of $CRWD at $92 with the proceeds of $ESTC. It seemed odd to me to have a smaller position in $CRWD than $ESTC when I was more confident about them.

$ROKU

Added 5 shares of $ROKU at $131.

Current Portfolio Allocations (Via Google Sheets)

A review of Q2 performance, stock by stock. The blue E in the charts below represent earnings reports being released.

Stock Reviews

$LVGO

19.9% position

In early March, it looked like $LVGO was ready to move upwards on a positive ER. 4 months later, the stock roughly tripled in value. Improving profitability, insanely high growth rate, raising more money on favourable terms, what’s not to like?

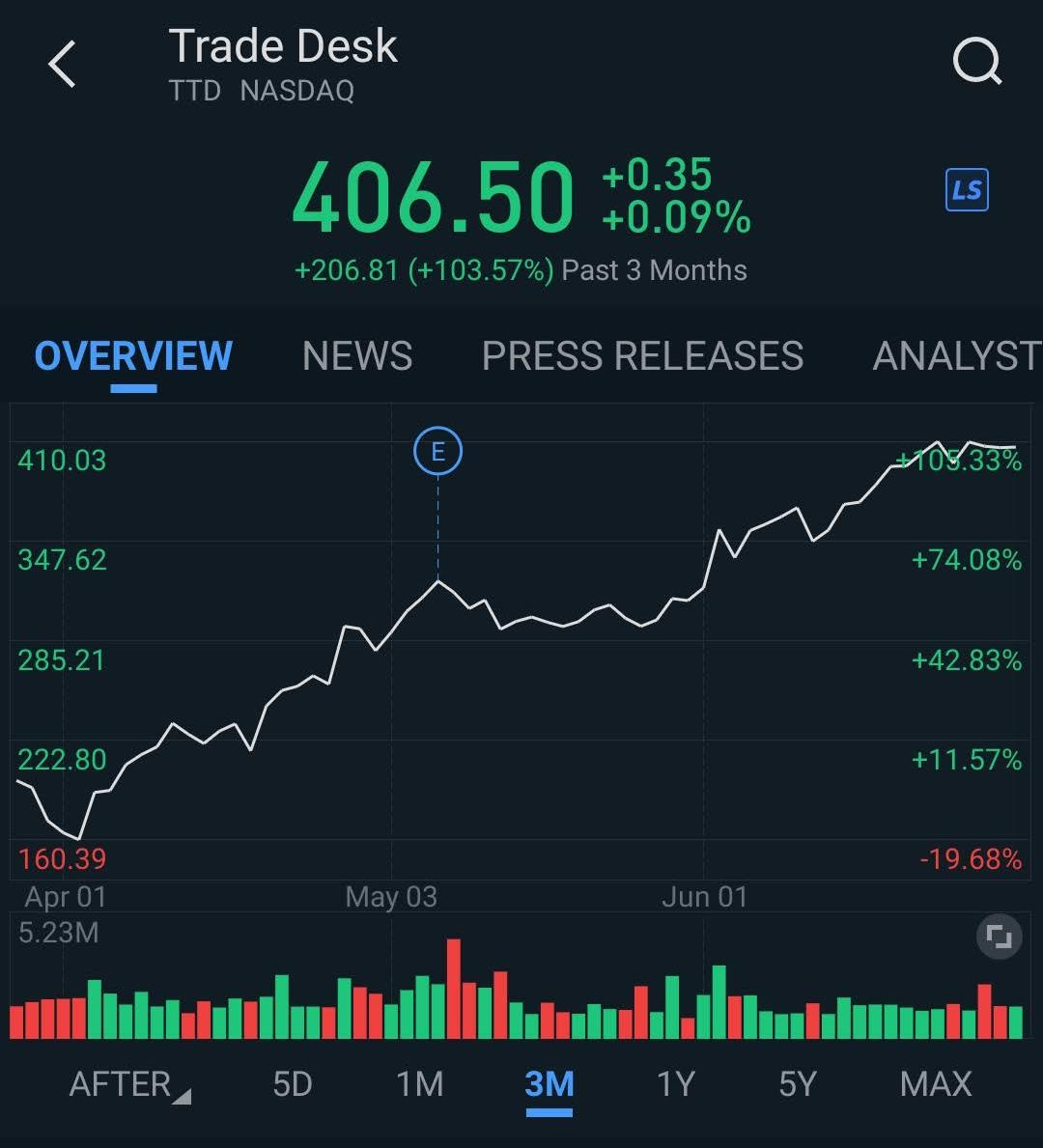

$TTD

18.4 % Position

After March’s 50% haircut, TTD has gone on to new highs. I’m not sure it is justified purely on ER results. However, the Trade Desk’s position as the leading independent DSP and the fact that it does not own media make it an interesting long term company to own as ad budgets move faster towards CTV.

$AYX

15.5% Position

Again, a move that isn’t easy to justify on ER results alone, given the on premise nature of the offering. Interesting announcements of new products and an excellent management team leave me confident about the company in the long term, even if the short term gets messy.

$MDB

11.1% Position

Despite the low guide (as per Elastic), MDB turned in a solid ER.

Mongo DB First Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $130.3 million in the first quarter fiscal 2021, an increase of 46% year-over-year. Subscription revenue was $124.9 million, an increase of 49% year-over-year, and services revenue was $5.5 million, an increase of 1% year-over-year.

Gross Profit: Gross profit was $92.7 million in the first quarter fiscal 2021, representing a 71% gross margin, compared to 68% in the year-ago period. Non-GAAP gross profit was $95.6 million, representing a 73% non-GAAP gross margin.

Loss from Operations: Loss from operations was $42.0 million in the first quarter fiscal 2021, compared to $30.6 million in the year-ago period. Non-GAAP loss from operations was $7.4 million, compared to $12.6 million in the year-ago period.

Net Loss: Net loss was $54.0 million, or $0.94 per share, based on 57.6 million weighted-average shares outstanding in the first quarter fiscal 2021. This compares to $33.2 million, or $0.61 per share, based on 54.7 million weighted-average shares outstanding, in the year-ago period. Non-GAAP net loss was $7.3 million or $0.13 per share. This compares to $12.1 million or $0.22 per share in the year-ago period.

Cash Flow: As of April 30, 2020, MongoDB had $977.5 million in cash, cash equivalents, short-term investments and restricted cash. During the three months ended April 30, 2020, MongoDB used $5.9 million of cash from operations, $1.5 million in capital expenditures and $1.1 million in principal repayments of finance leases, leading to negative free cash flow of $8.5 million, compared to free cash flow of $2.8 million in the year-ago period.

"While the impact from COVID-19 will be longer than we originally expected at the beginning of this fiscal year, we are seeing clear signs that the current environment is reinforcing the long-term trends towards digital transformation and cloud migration. MongoDB is a clear beneficiary of these trends and we will continue making investments to fully capitalize on this market opportunity."

$TWLO

7.1% Position

Twilio is benefiting from COVID tailwinds and expanding into new markets like healthcare. Their Flex product may also be a net beneficiary of the new normal. It will be interesting to see how the Chinese competitor Agora $API does on the market.

$ZS

6.4% Position

I felt the market’s ER response was a bit overcooked, but historically, Zscaler has been an expensive stock to purchase. This does leave it vulnerable to receiving a swift chop like it did last September if ER disappoints. WFH is an obvious tailwind to the story, but I would like to continue to see evidence that sales execution is a thing of the past. We will see.

$CRWD

6.2% position

Crowdstrike turned in a superb ER as I expected. It was overshadowed by the incredible metrics reported by $ZM, but I was very happy with what I read in the ER and the call transcript.

First Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $178.1 million, an 85% increase, compared to $96.1 million in the first quarter of fiscal 2020. Subscription revenue was $162.2 million, an 89% increase, compared to $86.0 million in the first quarter of fiscal 2020.

Annual Recurring Revenue (ARR) increased 88% year-over-year and grew to $686.1 million as of April 30, 2020, of which $85.7 million was net new ARR added in the quarter.

Subscription Gross Margin: GAAP subscription gross margin was 77%, compared to 72% in the first quarter of fiscal 2020. Non-GAAP subscription gross margin was 78%, compared to 73% in the first quarter of fiscal 2020.

Income/Loss from Operations: GAAP loss from operations was $22.6 million, compared to $25.8 million in the first quarter of fiscal 2020. Non-GAAP income from operations was $1.2 million, compared to a loss of $21.9 million in the first quarter of fiscal 2020.

Net Income/Loss: GAAP net loss was $19.2 million, compared to $26.0 million in the first quarter of fiscal 2020. GAAP net loss per share was $0.09, compared to $0.55 in the first quarter of fiscal 2020. Non-GAAP net income was $4.5 million, compared to a loss of $22.1 million in the first quarter of fiscal 2020. Non-GAAP net income per share, was $0.02, compared to a loss of $0.47 in the first quarter of fiscal 2020.

Cash Flow: Net cash generated from operations was $98.6 million, compared to $1.4 million in the first quarter of fiscal 2020. Free cash flow was $87.0 million, compared to negative $16.1 million in the first quarter of fiscal 2020.

Cash and Cash Equivalents increased to $1,005 million as of April 30, 2020.

$ESTC

6% position

Elastic is a company that many growth investors cannot agree on.

ER was a beat on revenue and operating metrics. Non GAAP operating margin is heading in the right direction. The company continues to improve its marketing messaging and I am optimistic about its future. I listened to the ER call which was also upbeat.

Elastic Fourth Quarter Fiscal 2020 Financial Highlights

Total revenue was $123.6 million, an increase of 53% year-over-year, or 57% on a constant currency basis.

SaaS revenue was $29.0 million, an increase of 110% year-over-year, or 120% on a constant currency basis.

Calculated billings was $175.1 million, an increase of 52% year-over-year, or 55% on a constant currency basis.

Deferred revenue was $259.7 million, an increase of 52% year-over-year.

GAAP operating loss was $34.6 million; GAAP operating margin was -28%.

Non-GAAP operating loss was $12.7 million; non-GAAP operating margin was -10%.

GAAP net loss per share was $0.38; non-GAAP net loss per share was $0.12.

Operating cash flow was -$5.9 million with free cash flow of -$6.8 million.

Cash and cash equivalents were $297.1 million as of April 30, 2020.

Full Fiscal 2020 Financial Highlights

Total revenue was $427.6 million, an increase of 57% year-over-year, or 60% on a constant currency basis.

SaaS revenue was $92.3 million, an increase of 101% year-over-year, or 109% on a constant currency basis.

GAAP operating loss was $171.1 million; GAAP operating margin was -40%.

Non-GAAP operating loss was $75.6 million; Non-GAAP operating margin was -18%.

GAAP net loss per share was $2.12; Non-GAAP net loss per share was $0.93.

Operating cash flow was -$30.6 million with free cash flow of -$35.6 million, or -8% free cash flow margin.

Guidance on the other hand, was disappointing - with a suggested high end of $540M for the year which would be 26% year on year.

This is odd because in the earning call reference is made to the net expansion rate being above 130%. Multiple analysts picked up in the ER call on this and queried the guidance given.

This is what the company CFO had to say:

Before I move to guidance, I want to briefly discuss our overall framework for fiscal 2021. In the near-term, we believe the trends we experienced in April will continue as our customers continue to prioritize their investments and we help them achieve their business goals with our solutions. We also expect that our SaaS business will continue to grow at a strong pace and faster than our overall business.

Looking ahead, our assumption is that we are going to be operating in a difficult economic environment due to COVID-19 with only a gradual recovery over time, which will likely create headwinds on calculated billings over the next couple of quarters.

In building our fiscal year plan, we examine various scenarios to better assess the impact from affected vertical, segments, and geographies. Some of these have positive effects and some negatives. However, we do generally expect that some customers will scrutinize their spending more carefully given a challenging economic environment and this might cause sales cycles to become longer.

The great thing is that our solutions align well with their business priorities and our competitive advantages are strong and distinct. Therefore, we remain positive on the long-term growth of the business

As I mentioned in my earlier remarks, we did see some impacts related to COVID-19 in some areas, and that was offset by strength to be experienced in other parts of the business.

That's said just given the broader macroeconomic environment that we think will be difficult over the coming quarters, we do generally expect that some customers will likely scrutinize their spending a little bit more carefully in this environment that might cause sales cycle to lengthen a little bit, and it might presents a bit of a headwind calculated billings over the next couple of quarters.

Generally speaking, we expect that the recovery will be gradual and so we believe it's just best to be prudent in our outlook for the rest of the year at this point in time.

and the CEO

We're simply -- first, I'll just start with FY 2021, we're being measured there on how we look forward. This is an unprecedented times. We want to make sure that we're being careful and try to manage it as much as we can without a crystal ball if you will.

When it comes to the long-term, yes, I mentioned in my previous answer, I think our three solutions align extremely well, with changes that are happening due to COVID. Some of them are simply pulling the future more towards the present or the near future when it comes to company -- companies working more virtually, moving more to the cloud.

My take from the above is that they are being conservative. It’s entirely possible that I’m wrong on this.

I fully expect a series of beat and raises from Elastic over the course of the year. I will be disappointed if it does not occur.

There is a contrast with the guidance given by $DDOG (above 50%) or $CRWD (above 70%) who provide competing APM / observability and endpoint protection. I am willing to be patient, but this is a clear demonstration of the value of simple stories and valuation premiums.

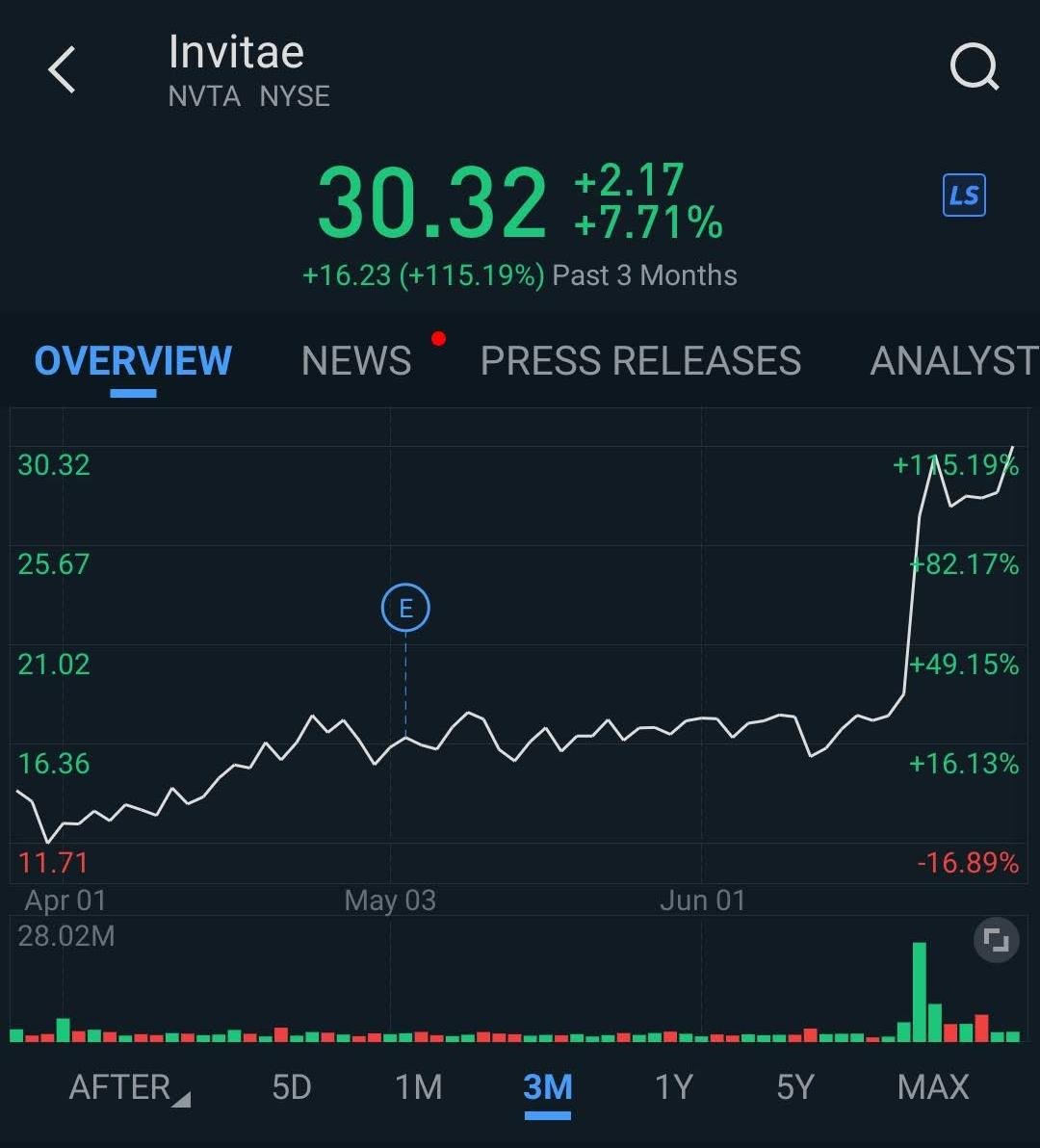

$NVTA

3.9% position

Invitae acquired ArcherDX (who were planning to IPO) in a cash and stock transaction, giving them increased access to cancer genomic and drug development markets.

Press release here.

Terms include 30 million shares of Invitae common stock and $325 million in cash, plus up to an additional 27 million shares of Invitae common stock payable in connection with the achievement of certain milestones, for an overall transaction valued at approximately $1.4 billion

The pitch:

The combined company will be poised to transform care for cancer patients, accelerating adoption of genetics through the most comprehensive suite of products and services available. Integrating germline testing, tumor profiling and liquid biopsy technologies and services in a single platform will enable precision approaches from diagnostic testing to therapy optimization and monitoring, expanding access to best-in-class personalized oncology.

There is a lot of optimism on what the merger means for the future.

Combined, Invitae and ArcherDX are expected to generate $316 million in annual revenue, with a 43% gross margin, 50% to 60% yearly revenue growth, and a net loss of $130 million in 2020.

What that represents is subject to reader interpretation, but in the long term I think $NVTA will be a significantly larger company. Content to hold while the thesis plays out. I’d like to see evidence of cost discipline as they grow. I don’t plan to add to my position unless I see that.

Archer DX financials

$BZUN

3.5% position

Baozun reported a solid Q1 ER that beat expectations. The company has come off its lows for the year but has been an unremarkable portfolio performer for the last 2 years. It is a holding with a number of risks.

I continue to hold because the long term thesis is intact, but have capped my capital allocation to acknowledge the risks. Chinese companies have understandably been out of favour given the political climate and transparency issues, including the outright fraud by $LK. It would be silly to pretend fraud is solely a problem with Chinese companies - but I do think that in general, corporate governance and oversight is less clear.

First Quarter 2020 Financial Highlights

Total net revenues were RMB1,523.6 million (US$1215.2 million), an increase of 18.4% year-over-year. Services revenue was RMB822.5 million (US$116.2 million), an increase of 22.9% year-over-year.

Income from operations was RMB12.8 million (US$1.8 million), as compared with RMB45.8 million in the same quarter of last year. Operating margin was 0.8%, compared with 3.6% in the same quarter of last year.

Non-GAAP income from operations was RMB36.8 million (US$5.2 million), as compared with RMB64.7 million in the same quarter of last year. Non-GAAP operating margin was 2.4%, compared with 5.0% in the same quarter of last year.

Net income attributable to ordinary shareholders of Baozun Inc. was RMB2.2 million (US$0.3 million), as compared with RMB34.0 million in the same quarter of last year.

Non-GAAP net income attributable to ordinary shareholders of Baozun Inc.3 was RMB26.0 million (US$3.7 million), as compared with RMB52.6 million in the same quarter of last year.

Basic and diluted net income attributable to ordinary shareholders of Baozun Inc. per American Depository Share (“ADS4”) were RMB0.04 (US$0.01) and RMB0.04 (US$0.01), respectively, compared with RMB0.59 and RMB0.57, respectively, in the same quarter of last year.

Basic and diluted non-GAAP net income attributable to ordinary shareholders of Baozun Inc. per ADS5 were RMB0.44 (US$0.06) and RMB0.44 (US$0.06), respectively, compared with RMB0.91 and RMB0.89, respectively, in the same quarter of last year.

First Quarter 2020 Operational Highlights

Total Gross Merchandise Volume (“GMV”)6 was RMB9,209.8 million, an increase of 17.6% year-over-year.

Distribution GMV7 was RMB782.9 million, an increase of 10.4% year-over-year.

Non-distribution GMV8 was RMB8,426.9 million, an increase of 18.3% year-over-year.

Number of brand partners increased to 239 as of March 31, 2020, from 200 as of March 31, 2019.

Number of GMV brand partners increased to 228 as of March 31, 2020, from 192 as of March 31, 2019.

$ROKU

2.3% position

Somewhat underloved at present, ROKU remains volatile and in a downtrend below the 200DMA at present. I added 5 shares at 131 when it looked like it might break the downtrend line of resistance.

It failed to breakout, but I’m planning to take advantage of its volatility by adding in increments.

The chart gives the impression that resolution in either direction should take place by the end of July/early August - let’s see how it plays out.

Adding near the support line seems like a sensible strategy as I continue to add slowly.

Stocks I’ve been watching

$SE, $MELI, $API (new IPO), #PRSM (Blue Prism) - my international companies of interest

$TXG, $FSLY

Podcasts Episodes I’ve Been Listening To

Tweetstorm: Introduction

Tweetstorm: Reflections on My First 1000 Days of Investing

The Loan

Loan balance outstanding: ~ £27K

Loan to portfolio value (LTV) rate: 22%, down from 28% last month

Summary

Reading through my previous posts in March, I commented that whilst acknowledging valuation risk and bubbly behaviour in my posts, I did not take any definitive actions to mitigate the risk I recognised.

Am I guilty of making the same mistake twice in the same year?

Possibly.

But intelligent stock picking for the long term seems like a better plan than trying to time an exit and re-entry in the shorter term. I don’t need the money in the short term, and I am resisting the urge to fiddle.

The only real consideration is paying down some of the outstanding debt…

Stay well.