Portfolio Value and Links to Previous Monthly Reviews

Feb 29, 2020 value- £75.3K

Mar 31, 2020 value - £62.7K

Apr 30, 2020 value - £79.4K

May 31, 2020 value - £105.8K

June 30, 2020 value - £124.7K

July 31, 2020 value - £143.6K (+15% on last month)

YTD ~ 126%

Financial contributions to the portfolio this month: None

Overview

Well, earning season is upon us. We may start to get some insight into whether the Covid-19 multiple inflations for software companies have been warranted or not.

My feeling is that the wins will be distributed unevenly, but I do not have specific insight that gives me an edge in the short term.

A number of investors I admire have sold shares of their high-flyers prior to earnings. Many of those I respect have reduced exposure to or exited high-growth names including Shopify, The Trade Desk, and Alteryx.

I understand these decisions and feel they are completely reasonable. For them. Investing strategy is intensely personal. My strategy remains to aim to do nothing, unless compelled to do something. I try not to force activity when I have no edge.

Each investor must decide on a process that suits them and to stick to it (iteration is of course encouraged), owning the consequences. I have been worried when reading the responses to tweets by investors who transparently mentioned they reducing their positions pre-earnings - there are a significant number of investment lemmings who are clearly just copying their favourite investor’s positions without much thought to strategy…

You cannot borrow conviction for long term investing success. It may work in the short term but will hurt you when volatility hits.

Do. The. Work.

The argument to trim current winners:

valuations are high

surely all positive news is priced in

investors should secure their gains before their stocks are beaten down after earnings.

The argument against: it’s very hard to know exactly how COVID-19 will affect each company on an individual basis. Short term forecasting is a fool’s game.

Here’s an example: Shopify revenue growth accelerated to 97% from 47%.

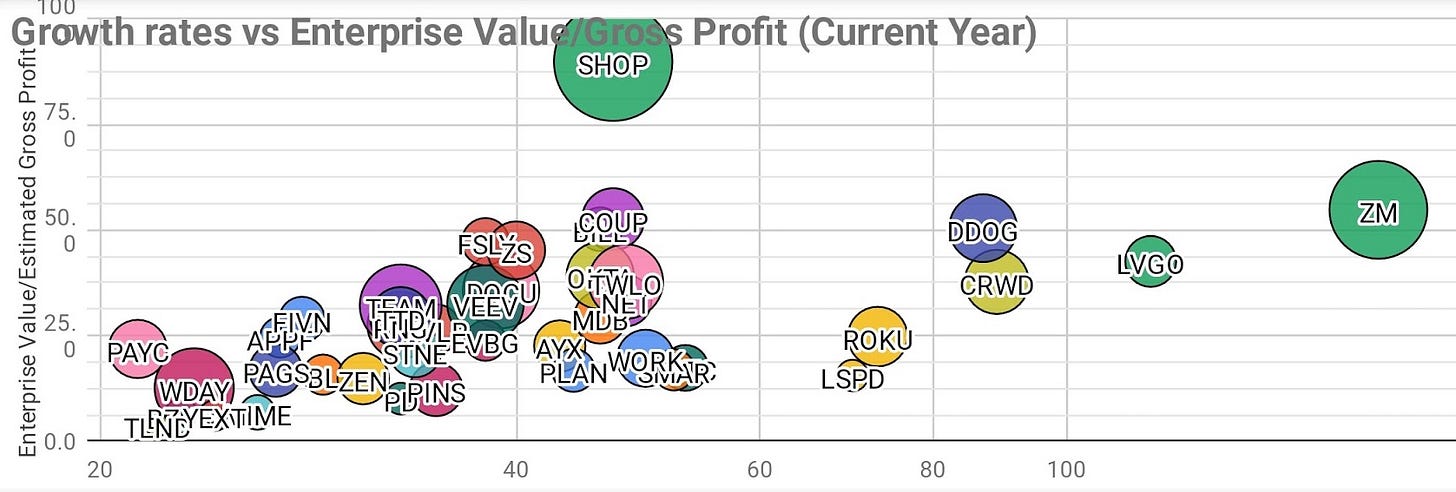

Take a look at these Revenue Growth vs Enterprise value / Gross Profit charts before and after $SHOP reported earnings on July 29,2020.

Before $SHOP Earnings release BMO 29.07.2020

After SHOP Earnings intraday 30.7.2020

Shopify remains richly valued, but it suddenly seems less overvalued than it did a few days ago.

But not every software company has benefited like Shopify, as we are going to discover.

Bring it on. Investing is about the long term.

Portfolio Changes since end June 2020

Sells

$AYX

I trimmed 6 shares of AYX at $179

$CRWD

Sold 5 shares of $CRWD at $117

Buy

Added 5 shares of $ROKU at $159

These changes are fairly minor. I’d thought long and hard about paying down some outstanding debt a little earlier than scheduled, but I also want to allow my long term high growth ideas to continue compounding. The 6 shares of $AYX that I sold effectively “took me back” to my fully sized allocation of $10,380 from an oversized position just under $11,000.

$ROKU is still undervalued in my opinion: I felt comfortable increasing my allocation.

There is nothing specific to $CRWD that caused me to trim 5 shares. Between $CRWD and $ZS my cybersecurity capital allocation is still full at $9,960.

I have considered small trims to $ESTC and $MDB, but have held off doing so for now. My plan is to largely try to avoid fiddling with my portfolio and to let the compounding work for me over the long term.

Current Portfolio Allocations (Via Google Sheets)

Stock Reviews

$LVGO

Livongo is dominating my portfolio and is up over 50% in the last month. The company released a preview to Q2 earnings on the 7th of July, greatly exceeding quarterly guidance - this is a familiar pattern to the previous beat and raise preannouncement for Q1.

Livongo now expects revenue for the second quarter of 2020 to be in the range of $86 million to $87 million, up from prior guidance of $73 million to $75 million.

The reported number is likely to be around $90 million, imho and the balance sheet will be boosted by their June 2020 capital raise.

The TAM for LVGO may be smaller than assumed, as not all patients with T2 diabetes are likely to engage with their product, but for now, I see a company exceeding all expectations and I have no reason adjust my position which is now up approx 4.5x from my initial buy point.

I’ve felt $LVGO was undervalued for much of the year - that is no longer the case. It is odd to expect a company that is a leader in an important emerging market, growing revenues over 100% a year with gross margins in the 70s, secular tailwinds, and excellent management to remain under or even normally valued.

I have learned from my mistakes of selling winners like Shopify, The Trade Desk, Square, and AppFolio too early. The company is richly valued, but its current market cap is still below $13B - it is not a large company. The ride is likely to be volatile and I am willing to accept the 30% haircut that may occur at some stage. I have sell criteria for my long term investments, but Livongo does not meet any of them.

Why trim the roses and water the weeds?

$TTD

The Trade Desk has had a quiet month in terms of stock performance.

The company has sealed a non-exclusive deal with Channel 4 in the UK as one of several demand-side platforms to offer access to Channel 4 inventory programmatically, giving brands access to audiences across connected TVs and other screens.

“As advertisers recognize the data-driven potential of CTV advertising to maximise ad relevance and improve the viewer experience, this partnership with Channel 4 represents a further boost in their ability to execute. Broadening access to Channel 4’s inventory for brands across the open internet means better targeting for brands and greater revenue for broadcasters,” said Patrick Morrell, director of partnerships EMEA at The Trade Desk.

The company has made a series of HR changes during July, hiring executives from Oracle Data Cloud, Quantcast, and internally.

It’s hard to know what the COVID impact has been on $TTD’s Q2 revenues. Dhaval has some of the best insights on the industry, and you should be following him. There are reasons to be cautious short term ($PINS revenue growth of 4%, $FB at 10% YoY), and also reasons for optimism. We are both long term orientated, so that’s where the focus remains.

$AYX

Not much new to say on Alteryx, so I’ll leave it to the company executives from the Q1 Earnings call.

On the strategic need for Alteryx

We also continue to have meaningful conversations with executives at global organizations who see COVID-19 accelerating their digital transformation initiatives. The need for a data-driven culture has never been greater. We are confident the Alteryx platform can help organizations unify the data analytic processes and people to see success in digital transformation.

On hiring:

As a result of COVID-19 and the resulting macroeconomic deterioration, we immediately took a number of actions in response including pausing hiring in the near-term until we better understand customer-buying behavior, although we will move forward with any outstanding offers and hiring will continue for critical roles and functions. We have also curtailed nonessential spending and are focusing our investments on those areas that we believe are most important to continue to drive the business through this recovery.

On the future:

Better outcomes happen when you combine the imagination of humans, the power of data, and the speed of modern compute. Every day, Alteryx is amplifying human intelligence and enterprises around the world, which in turn is delivering better results for our customers. For these reasons, we believe that our business is well-positioned with the uncertainties we face. Leveraging our own platform, we will continue to monitor business conditions closely. And we'll continue to adjust our operating plans as the economic effects of the coronavirus unfolds to come out of this crisis stronger than ever before.

On Covid19 impact:

The current macroeconomic environment is clearly in a state of turmoil, and we expect it will continue to negatively impact our business. Given the evolving situation with COVID-19 and the increased uncertainty it has created for businesses across the globe, at the present time, we cannot reasonably predict the impact on our full-year 2020 financial results.

Coming into Q1, the momentum that we saw in 2019 continued and we got off to a solid start to the year. However, in March, we saw activity levels slow considerably. This was particularly evident with opportunities with new customers and expansion opportunities that were not attached to a renewal.

On Q2 guidance:

For Q2 2020, we expect GAAP revenue in the range of $91 million to $95 million representing year-over-year growth of approximately 10% to 15%. We expect our non-GAAP operating loss to be in the range of $9 million to $13 million and non-GAAP net loss per share basic and diluted of negative $0.12 to $0.18.

Investors need to decide how believable they find the management of Alteryx. The short term may get ugly, but in the long term, I’m a happy part-owner of the company.

$MDB

MDB hired a new seasoned CTO at the end of June, but there is otherwise not much new to say about the company, other than the usual arguments about valuation.

Guidance for Q2 is revenue of $127.0 million and a Non-GAAP Loss of $(22.0) million.

$TWLO

A strong month for Twilio. They released a really interesting study on the acceleration of digital communication strategy in mid-July. It’s worth a review and is certainly indicative of acceleration of revenue growth.

The acquisition of $SEND has now been lapped, so there is no further scope for easily misinterpreted information about growth at scale!

$BAND results are encouraging for the CPaaS sector in general, and I am also looking forward to learning more about new Chinese IPO $API’s performance in these COVID times.

$ZS

Zscaler is back to being expensive for the revenue run rate. We will see if the coronavirus tailwinds mean that it is justified and whether they have overcome the sales execution issues that caused a nosedive last summer.

They raised a $1B convertible note round at the end of June and have been acquiring companies this year.

$ESTC

Elastic has been pretty static this month. They have gained FedRAMP authorisation status which should make it easier for them to sell to the US government. The jury is out on the COVID impact on $ESTC vs $DDOG and $CRWD. An investment in Elastic is only for the patient.

$CRWD

Fast-growing, COVID tailwinds, improving profitability metrics. What’s not to like?

$NVTA

Likely to have a poor ER due to COVID impact in my opinion. The integration of ArcherDX and future growth trends are my main focus for now.

$BZUN

Perhaps the most frustrating company I own shares of. The high-level thesis still seems intact, but I am aware of the opportunity cost while Baozun shares have done nothing for 2.5 years. I don’t believe that I am smarter than any other investor, but I can be more patient. Let’s see.

$ROKU

Last month I pointed out that $ROKU looked like it was due a breakout or breakdown.

The breakout has come to pass. Technicals are not predictive but useful for scenario planning. It still seems undervalued to me but looks like it needs a good ER for increased confidence by the market in the short term.

Podcasts Episodes I’ve Been Listening To

The Loan

Loan balance outstanding: ~ £26.5K

Loan to portfolio value (LTV) rate: 18%, down from 22% last month

Summary

I’m heading into earnings season with my eyes open. My investing approach accepts a significant amount of volatility. I am sticking to my process of trying to optimise for the long term, accepting the short term consequences. Many people have suggested I would be wise to take my profits and sit out the rest of the year - that is a perfectly reasonable thing to do.

I’ve come to the conclusion that many investing arguments occur because investors fail to realise that they have different approaches, risk tolerances, time horizons, and goals. None of this is financial advice: you should do what lets you sleep at night. I’m well aware that any company I own could receive a -30% haircut in the near term. We can review the consequences of my decisions at the end of August!

Thank you to all my readers here and to anyone who is kind enough to follow me on Twitter.

I was amazed to discover readers from countries as widespread as

Denmark, Scotland, Germany, USA, Canada, Ireland, Malaysia, Israel, England, Philippines, Mexico, Switzerland, Bahrain, The Netherlands, Sweden, Singapore, Spain, Bermuda, India, Brazil, Russia, Chile, Austria, Venezuela, Argentina, and Uganda.

I really appreciate you taking the time to read my writing - thanks to every one of you.

Feel free to send any questions, comments or suggestions to hello@adventuresinfi.com, or via Twitter.

Have a great month!

Watchlist

$SE, $API, $LSPD.CA, $DND.CA

PS It stings to sells winners early. SHOP was my first "big" buy with 100 shares under $100. I sold so early. HAD NO IDEA!

NICELY done!! Kicking myself for selling my LVGO position TOO early at 60. With the pandemic, I expected a correction along the way. There was only one day when it dipped to 48 and got bought up. How many LVGO shares do you have?