Portfolio Value and Links to Previous Monthly Reviews

Feb 29, 2020 value- £75.3K

Mar 31, 2020 value - £62.7K

Apr 30, 2020 value - £79.4K

May 31, 2020 value - £105.8K

June 30, 2020 value - £124.7K

August 31, 2020 value - £145.4K

YTD ~ 122% (down 4% from last month)

Financial contributions to the portfolio this month: ~ £1750

Overview

It has been a volatile month, with big moves in two of my larger positions $LVGO and $AYX. Monthly performance is down from last month due to $AYX (my previous third-largest position) losing a third of its value post ER.

I am ok with this and happy with what is in my portfolio.

Growth rates have slowed down in many software and fintech businesses as a result of COVID19. This is still consistent with long term secular tailwinds in the sector.

The effects of $AYX's decline have been cushioned to a degree by rises in the stock prices of $ROKU and $ESTC.

Stocks go up, stocks go down.

It’s the companies and their execution over the long term that matter.

Portfolio Changes since end July 2020

Sells

$LVGO

I trimmed 10 shares of $LVGO at ~ $134

Buys

$ROKU

Added 10 shares of $ROKU at ~ $149-150

$API

Started a new position of 50 shares in $API at ~ $44

I made a minor trim of $LVGO and rotated the proceeds to $ROKU to continue to build my position. This is probably part mild psychological protest at the merger with $TDOC but more importantly a recognition that I was underweight my intended allocation of $ROKU.

Current Portfolio Allocations (Via Google Sheets)

Stock Reviews

$LVGO

I laid out my expectations for $LVGO last month.

The reported number (for revenue) is likely to be around $90 million

Livongo had an outstanding ER:

Livongo Second Quarter Fiscal 2020 Financial Highlights:

Revenue: Total revenue for the quarter was $91.9 million, up 125% year-over-year, driven by the continued adoption of our Applied Health Signals platform. During the second quarter, the company achieved certain performance milestones and service performance obligations that resulted in approximately $2.5 million of revenue. Excluding that non-recurring revenue, second quarter revenue increased 119% year-over-year.

Gross Margin: GAAP gross margin of 76.6% and non-GAAP gross margin of 77.3%.

Net Loss and Non-GAAP Net Income: GAAP net loss of $1.6 million, and GAAP net loss per share attributable to common stockholders of ($0.02) on a diluted basis; and non-GAAP net income of $12.5 million, and non-GAAP net income per share attributable to common stockholders of $0.11 on a diluted basis.

Adjusted EBITDA: $13.3 million in the second quarter of 2020.

Livongo for Diabetes Members: Over 410,000 as of June 30, 2020, up 113% year-over-year.

Livongo Clients: 1,328 Clients as of June 30, 2020, up 75% year-over-year.

Estimated Value of Agreements (EVA): $108.7 million, up from $74.2 million in the second quarter of 2019, representing 46% growth year-over-year. EVA consists of the estimated value of agreements signed in the quarter with new Clients or expansions entered into with existing Clients.

The blowout ER was overshadowed by the news of the Livongo and Teladoc merger to create the Voltron of Telehealth.

I was initially a bit disappointed by the news.

I actually created a sell limit order at $150 as my initial reaction, but it didn’t hit.

The reason for wanting to sell was that I had previously researched $TDOC back in 2018 and while I thought it was an interesting company, I am naturally less enamoured by “growth via acquisition” strategies and was also previously was turned off the company by historical C-suite shenanigans.

I came round to the idea of holding on to the majority of my $LVGO shares, but it’s a more complex situation than the solo $LVGO story.

$TTD

What I wrote last month:

There are reasons to be cautious short term ($PINS revenue growth of 4%, $FB at 10% YoY), and also reasons for optimism.

The Trade Desk ER was within my range of expectations. At first glance it was not pretty to look at with a -13% YoY drop in revenues; but the acceleration of longer term favourable trends are the real story.

The market response to a lackluster $TTD ER was positive. It’s a testament to Jeff Green’s storytelling ability and the company’s profitability.

TTD vs shorts

CEO Jeff Green

As advertisers commit more of their budgets to digital, especially as they shift more of their TV dollars to CTV, they want to know that they can reach the right audiences, that they can measure and compare performance, and that they can support the right content for them. The move toward a more contemporary approach to identity will be key in building that trust for advertisers.

Let me close by just reiterating the consistency of these themes among advertisers. If, like me, during COVID, you’ve been sucked into the world of online webinars and events, you’ll have heard many of the same themes.

But I’m excited by it. Advertisers are more tuned in to the power of data-driven advertising than ever before. They understand the role it can play in helping them be agile in the midst of today’s uncertainty. They understand it can help them gain market share. And as they embrace it across their advertising channels, they are demanding more of our industry.

Investing is about the long term, and the thesis remains intact for $TTD.

$MDB

MDB’s Guidance for Q2 is revenue of $127.0 million and a Non-GAAP Loss of $(22.0) million.

We will see on 2nd September.

MDB is still 1.4x the valuation of $ESTC despite only being a quarter ahead in metrics.

$AYX

I said last month that

The short term may get ugly

And indeed it did as COVID19 headwinds made their impact clear and Alteryx’s revenue growth rate fell to previously unheard of levels.

The market seemed surprised by this and the stock fell below the 200DMA. Valuation does matter if you had any doubts.

Alteryx Second Quarter 2020 Financial Highlights

Revenue: Revenue for the second quarter of 2020 was $96.2 million, an increase of 17%, compared to revenue of $82.0 million in the second quarter of 2019.

Gross Profit: GAAP gross profit for the second quarter of 2020 was $86.6 million, or a GAAP gross margin of 90%, compared to GAAP gross profit of $72.7 million, or a GAAP gross margin of 89%, in the second quarter of 2019. Non-GAAP gross profit for the second quarter of 2020 was $88.0 million, or a non-GAAP gross margin of 91%, compared to non-GAAP gross profit of $74.3 million, or a non-GAAP gross margin of 91%, in the second quarter of 2019.

Income (Loss) from Operations: GAAP loss from operations for the second quarter of 2020 was $(17.8) million, compared to GAAP loss from operations of $(8.3) million for the second quarter of 2019. Non-GAAP loss from operations for the second quarter of 2020 was $(0.1) million, compared to non-GAAP income from operations of $0.8 million for the second quarter of 2019.

Net Income (Loss): GAAP net loss attributable to common stockholders for the second quarter of 2020 was $(35.3) million, compared to GAAP net loss of $(3.2) million for the second quarter of 2019. GAAP net loss per diluted share for the second quarter of 2020 was $(0.53), based on 66.0 million GAAP weighted-average diluted shares outstanding, compared to GAAP net loss per diluted share of $(0.05), based on 62.6 million GAAP weighted-average diluted shares outstanding for the second quarter of 2019.

Non-GAAP net income and non-GAAP net income per diluted share for the second quarter of 2020 were $1.7 million and $0.02, respectively, compared to non-GAAP net income of $0.9 million and non-GAAP net income per diluted share of $0.01 for the second quarter of 2019. Non-GAAP net income per diluted share for the second quarter of 2020 was based on 69.6 million non-GAAP weighted-average diluted shares outstanding, compared to 68.5 million non-GAAP weighted-average diluted shares outstanding for the second quarter of 2019.Balance Sheet and Cash Flow: As of June 30, 2020, we had cash, cash equivalents, and short-term and long-term investments of $974.4 million, compared to $974.9 million as of December 31, 2019. Cash provided by operating activities for the first six months of 2020 was $6.6 million, compared to cash provided by operating activities of $6.7 million for the first six months of 2019.

Some investors immediately sell companies on slightly negative earnings reports. That is not my style. The headwinds were telegraphed and should not surprise. The effects are more exaggerated to due the complex revenue recognition of ASC606.

The long term thesis remains intact, and I continue as a happy part-owner of the company. It’s not a great feeling to see $7000 in value taken off a holding, but the short term is not my focus - I’m more interested in how the company might look in 2025.

$TWLO

A solid ER at scale - I finally feel I can say that phrase honestly now that the $SEND acquisition has been lapped.

Twilio Second Quarter 2020 Financial Highlights

Total revenue of $400.8 million for the second quarter of 2020, up 46% year-over-year.

GAAP loss from operations of $102.6 million for the second quarter of 2020, compared to $93.7 million for the second quarter of 2019.

Non-GAAP income from operations of $9.5 million for the second quarter of 2020, compared to $1.5 million for the second quarter of 2019.

GAAP net loss per share attributable to common stockholders of $0.71 for the second quarter of 2020, based on 141.6 million weighted average shares outstanding, compared to a net loss per share of $0.72 for the second quarter of 2019.

Non-GAAP diluted net income per share attributable to common stockholders of $0.09 based on 153.7 million non-GAAP weighted average shares outstanding, compared to net income per share of $0.03 for the second quarter of 2019.

If you want to read an outstanding breakdown of $TWLO’s Q2, look no further than Software Stack Investing.

$ZS

Zscaler reports Sept 9.

Learning more about edge networks has me wondering if my $ZS position should acknowledge the competitive bottoms up threat of $NET or the generalised edge network value proposition of $FSLY.

$ESTC

Elastic finally broke beyond last year’s highs. Some investors have been frustrated by the last year’s price action. To my mind, it’s a reflection of perceptions about CAP, but also a reflection that entry price is important. If you paid $90 last summer or $50 earlier this year, you’ll likely have different perspectives on Elastic’s price action over the last 12 months.

ER was good, with improving op margin, and maintained >130% net dollar retention rates. I get the sense from ER they are playing the long game, which is exactly what I want to see.

CEO Shay Bannon

We've done that now, aligning with our other solutions, which also have a free proprietary self-managed distribution tier via our basic subscription.

This speeds our go-to-market motion by offering a compelling feature set that's accessible to anyone, and drives broader adoption by dramatically lowering the barrier to entry. Customers can also upgrade to our paid offering, where they benefit from high value enterprise grade features such as single sign on and granular document level security controls.

This is not as exciting a position as $DDOG or $CRWD, but I’m optimistic about the long term for the company.

Elastic First Quarter Fiscal 2021 Financial Highlights

Total revenue was $128.9 million, an increase of 44% year-over-year, or 45% on a constant currency basis.

SaaS revenue was $32.6 million, an increase of 86% year-over-year, or 86% on a constant currency basis.

Calculated billings was $130.0 million, an increase of 45% year-over-year, or 47% on a constant currency basis.

Deferred revenue was $277.5 million, an increase of 63% year-over-year.

GAAP operating loss was $29.5 million; GAAP operating margin was -22.9%.

Non-GAAP operating loss was $4.3 million; non-GAAP operating margin was -3.3%.

GAAP net loss per share was $0.23; non-GAAP earnings per share was $0.06(1).

Operating cash flow was $22.0 million with free cash flow of $21.6 million.

Cash and cash equivalents were $350.4 million as of July 31, 2020.

Elastic is consistently launching new product updates, and the secular trends they are aligned with are accelerating in the long term.

$CRWD

Looking forward to the ER on Sept 2nd.

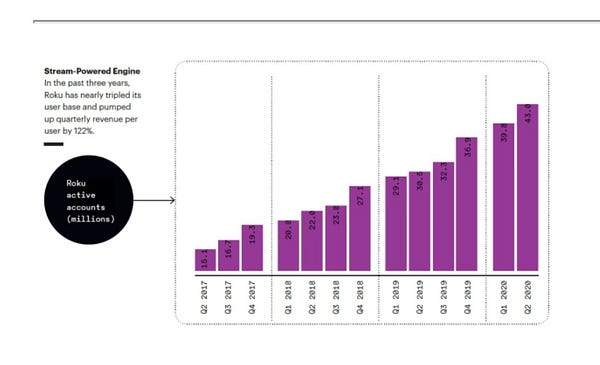

$ROKU

I’ve been buying more ROKU in August after the downtrend breakout in July.

ER was great although declining platform gross margins are worthing monitoring over a longer time frame.

I was more impressed with the $ROKU platform revenue growth than the market’s post ER response, particularly in the context of other advertising companies like $TTD, $FB, and $PINS.

Roku Q2 2020 Highlights

Platform revenue increased 46% YoY to $244.8 million;

Gross profit was up 29% YoY to $146.8 million;

Roku added 3.2 million incremental active accounts in Q2 2020 to reach 43 million;

Streaming hours* increased by 2.3 billion hours over last quarter to 14.6 billion;

Average Revenue Per User (ARPU) of $24.92 (trailing 12-month basis), up 18% YoY;

The Roku Channel reached U.S. households with an estimated 43 million people.

The guidance was a little cautious vs that of $TTD. Not a big deal in my opinion.

$NVTA

Last month I said: Likely to have a poor ER due to COVID impact in my opinion.

A picture is worth a thousand words.

Invitae Second Quarter 2020 Financial Results

Accessioned more than 120,000 samples in the second quarter of 2020 compared to 111,000 samples in the second quarter of 2019. Billable volume exceeded 113,000 in the second quarter of 2020

Generated revenue of $46.2 million in the second quarter of 2020 compared to $53.5 million in revenue in the second quarter of 2019

Reported average cost per sample of $358 in the second quarter of 2020 compared to $252 average cost per sample in the second quarter of 2019. Non-GAAP average cost per sample was $318 in the second quarter of 2020

Achieved gross profit of $3.2 million in the second quarter of 2020 compared to $25.5 million of gross profit in the second quarter of 2019. Non-GAAP gross profit was $8.0 million in the second quarter of 2020

Total operating expense, excluding cost of revenue, for the second quarter of 2020 was $145.3 million. Non-GAAP operating expense was $105.7 million in the second quarter of 2020.

Net loss for the second quarter of 2020 was $166.4 million, or $1.29 net loss per share, compared to a net loss of $48.7 million in the second quarter of 2019, or $0.54 net loss per share. Non-GAAP net loss was $99.2 million, or $0.77 non-GAAP net loss per share, in the second quarter of 2020.

No surprises, but some promises of improved cost control going forwards.

From the CFO at ER

Shelly Guyer

As Sean mentioned, we were hit early in the quarter by the full impact of COVID. But as the quarter progressed, we saw monthly improvements in our most important metrics. We took actions early in the quarter in response to the crisis, not to yield immediate second quarter savings, but with the objective of managing our burn throughout the remainder of the year and into next. These moves were designed to ensure that we kept foremost in our minds, our long-term strategy to provide access to testing across numerous platforms.

Our intent was and is to exit the year with a rapidly growing business that is positioned as an even stronger competitor in this growing genetics market. To that end, during the quarter, we continued our acquisitions closing on two deals and announcing the ArcherDX deal.

Thesis intact, so doing nothing - it’s a long term story here.

$BZUN

Baozun turned in a decent ER and sold off, presumably on guidance. So it goes.

Once they have lapped the effect of losing Huawei’s low margin revenue, guidance comparisons will be more useful.

I was pleased to see the improvement in higher-margin “services” (they really should rename that part of the business), non-distribution GMV, brand partners and operating margin.

Baozun Second Quarter 2020 Financial Highlights

Total net revenues were RMB2,152.1 million (US$304.6 million), an increase of 26.3% year-over-year. Services revenue was RMB1,224.3 million (US$173.3 million), an increase of 43.2% year-over-year.

Income from operations was RMB160.6 million (US$22.7 million), an increase of 87.2% year-over-year. Operating margin was 7.5%, compared with 5.0% in the same quarter of last year.

Non-GAAP income from operations was RMB187.1 million (US$26.5 million), an increase of 81.4% year-over-year. Non-GAAP operating margin was 8.7%, compared with 6.1% in the same quarter of last year.

Net income attributable to ordinary shareholders of Baozun Inc. was RMB119.8 million (US$17.0 million), an increase of 78.6% year-over-year.

Non-GAAP net income attributable to ordinary shareholders of Baozun Inc was RMB146.0 million (US$20.7 million), an increase of 73.4% year-over-year.

Basic and diluted net income attributable to ordinary shareholders of Baozun Inc. per American Depository Share (“ADS”) were RMB2.04 (US$0.29) and RMB2.00 (US$0.28), respectively, compared with RMB1.16 and RMB1.13, respectively, for the same period of 2019.

Basic and diluted non-GAAP net income attributable to ordinary shareholders of Baozun Inc. per ADS5 were RMB2.48 (US$0.35) and RMB2.43 (US$0.34), respectively, compared with RMB1.45 and RMB1.41, respectively, for the same period of 2019.

Baozun Second Quarter 2020 Operational Highlights

Total Gross Merchandise Volume (“GMV”) was RMB12,757.8 million, an increase of 31.2% year-over-year.

Distribution GMV was RMB1,037.6 million, an increase of 9.1% year-over-year.

Non-distribution GMV was RMB11,720.2 million, an increase of 33.6% year-over-year.

Number of brand partners increased to 250 as of June 30, 2020, from 212 as of June 30, 2019.

Number of GMV brand partners increased to 241 as of June 30, 2020, from 202 as of June 30, 2019.

On the technicals, it appears like a long term breakout from sustained suppression will lead to violent movement upwards. But I can’t say when that will happen.

Could the secondary listing be a positive catalyst? Or will it take another couple of ERs? I don’t know.

$API

A new position. For a great introduction, please read Richard’s breakdown and also some other useful breakdowns on Pocket Change and this article on Medium.

My hesitation for this position:

New IPO - 2 months listed and therefore limited price stability or insight into long term growth profile

Chinese VIE/ADR status

Valuation - This was more of a challenge to me as I felt given the ADR/VIE status it should not trade at US company multiples.

On the flip side, the company had a -45% correction from the post IPO pop and turned in an impressive ER. They are displaying leadership in the important emerging video plaftorm market, and the CEO seems like a high quality founder.

My process for managing recognised risks was to buy approx 1/3 portion of my intended eventual position. I will cap my capital allocation size to Agora lower than my usual full position size. The EV could fall to below $2B and remain within my volatility tolerance and give an opportunity to add at a cheaper price. Conversely, it could rise from my purchase price over the next few months, giving me the confidence to add up if the thesis is intact and the investment derisked in some way.

I’m not in a rush with Agora. The small allocation is unlikely to dramatically affect my portfolio performance in the short term. Having it my portfolio does make me more likely to act if an attractive opportunity manifests down the line.

Podcast Episodes I’ve Been Listening To

The Loan

Loan balance outstanding: ~ £17K

Loan to portfolio value (LTV) rate: 12%, down from 18% last month

I’m not a complete degenerate when it comes to risk. My portfolio has exceeded all expectations this year, and I’m well aware that software valuations are high. That being said, I want to stick to my long term strategy and trying to keep time in the market as it’s much easier to optimise for the long term than the short term.

I tried to think through what actions I might wish I had taken in the event of a -30% portfolio correction and I decided that reducing the amount of investment-related loan outstanding was the single most useful thing I could do.

I used the proceeds from my shorter-term / swing trading account (I don’t write about this) to pay off the M&S Bank component of my loan which had around £9K outstanding.

The screenshot is from my Clearscore profile and is slightly out of date.

I did this just before we went away on holiday to Croatia. My wife was pleased, so it has several non-financial advantages too! Going to take the snowball approach to clearing our debt.

Final Thoughts

One of the great things about being on holiday was the benefit of unplugging from the firehose of noise and data. We are constantly bombarded with minute to minute updates about stock prices, tweets, and social media updates, and I really appreciated the chance to unplug and connect with my wife and kids.

I was a little alarmed at how often I felt the urge to reach for my phone. I deleted my portfolio tracker app and restricted my use of Twitter for the duration of time we were away. It was one of the best things I could have done, and I’ve realised that I didn’t really miss much of importance. I’m trying to be more intentional about my time going forwards. Chadwick Boseman’s passing at 43 is a stark reminder of the fragility of life. Take care of yourself and invest the time with your loved ones.

Have a great month.

Watchlist: ¥BASE.4477, $FLGT, $SE, $FSLY, $NET, $PD, $MELI, $STNE, $PAGS, $YEXT, $NNOX