Portfolio Value and Links to Previous Monthly Reviews

August 31, 2020 value - £145.4K

Sept 30, 2020 value - £153.1K

YTD ~ 133% (from +122% last month)

Financial contributions to the portfolio this month: ~ £430

Overview

Volatility was the main soundtrack that continued through September.

Fintwit got very excited about the $SNOW IPO and SPACs…

The market is with the Clipse - Snowflake is a fantastic company. It seems to offer a compelling platform with impressive long term tailwinds.

I can’t yet convince myself it will outperform my other ideas over the next few years at the current market cap, but I’m wrong a lot, so make of that what you will.

I know I have a blindspot that has led me to miss out on larger market cap growth businesses - $SHOP and $ZM spring to mind…

$SNOW might be next - but in any case, it’s a new IPO and I woudn’t consider going near till one or two ERs pass.

A great month for $NVTA and $ROKU. My portfolio’s daily fluctuations are currently largely determined by what $LVGO is doing. This is paradoxically helpful: it’s getting easier to tune out the daily swings and focus on the long term.

Portfolio sizing can be a challenge - there is a point for each investor where you might consider trimming an oversized position. I’m minded to simply let my winners run rather than trim $LVGO because it’s doing so well.

Portfolio Changes since end August 2020

Sells

None

Buys

$API

Added another 10 shares of API.

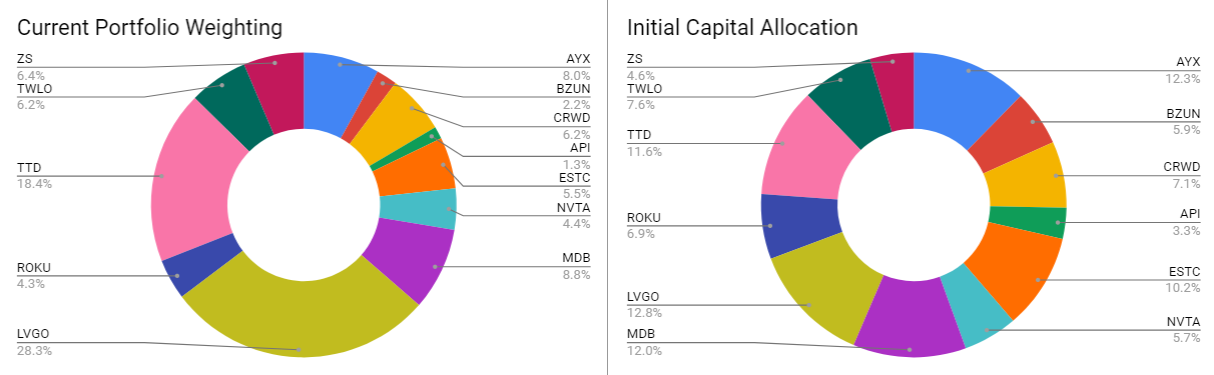

Current Portfolio Allocations via Google Sheets

(Lack of?) Diversification Tree Via Simply Wall Street

Stock Reviews

$LVGO

With all the attention on the $TDOC and $LVGO merger announcement and the volatility that has followed, it’s easy to forget that Livongo stock is up over 80% in the last 3 months. I’m currently reasonably positive about the potential for the merger.

The updated slides released by Teladoc are worth perusing.

I’m naturally a little wary of mergers and acquisitions but can see the bullish arguments. The 400 shares of Livongo that I own convert to ~ 236 shares of TDOC and will pay out cash that will be deployed elSEwhere.

$TTD

You could point out the fact that $TTD had -ve revenue growth in Q2 due to COVID-19 as evidence that the stock price is completely disconnected from reality. It is objectively expensive, and there are more consistent growing B2B enterprise companies you could consider as safer alternatives. But there are long term strategic trends at play.

$MDB

MDB’s Guidance for Q2 was revenue of $127.0 million and a Non-GAAP Loss of $(22.0) million. They delivered a strong beat on both and raised guidance.

Second Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $138.3 million in the second quarter fiscal 2021, an increase of 39% year-over-year. Subscription revenue was $132.5 million, an increase of 41% year-over-year, and services revenue was $5.8 million, an increase of 11% year-over-year.

Gross Profit: Gross profit was $96.0 million in the second quarter fiscal 2021, representing a 69% gross margin, compared to 70% in the year-ago period. Non-GAAP gross profit was $99.7 million, representing a 72% non-GAAP gross margin.

Loss from Operations: Loss from operations was $49.8 million in the second quarter fiscal 2021, compared to $37.7 million in the year-ago period. Non-GAAP loss from operations was $10.2 million, compared to $14.8 million in the year-ago period.

Net Loss: Net loss was $64.5 million, or $1.10 per share, based on 58.4 million weighted-average shares outstanding in the second quarter fiscal 2021. This compares to $37.3 million, or $0.67 per share, based on 55.6 million weighted-average shares outstanding, in the year-ago period. Non-GAAP net loss was $12.7 million or $0.22 per share. This compares to $14.7 million or $0.26 per share in the year-ago period.

Cash Flow: As of July 31, 2020, MongoDB had $975.4 million in cash, cash equivalents, short-term investments and restricted cash. During the three months ended July 31, 2020, MongoDB used $10.0 million of cash from operations, $3.8 million in capital expenditures and $1.1 million in principal repayments of finance leases, leading to negative free cash flow of $15.0 million, compared to negative free cash flow of $13.8 million in the year-ago period.

Growth has slow a little for MongoDB, but in context, I feel that this the ER was solid.

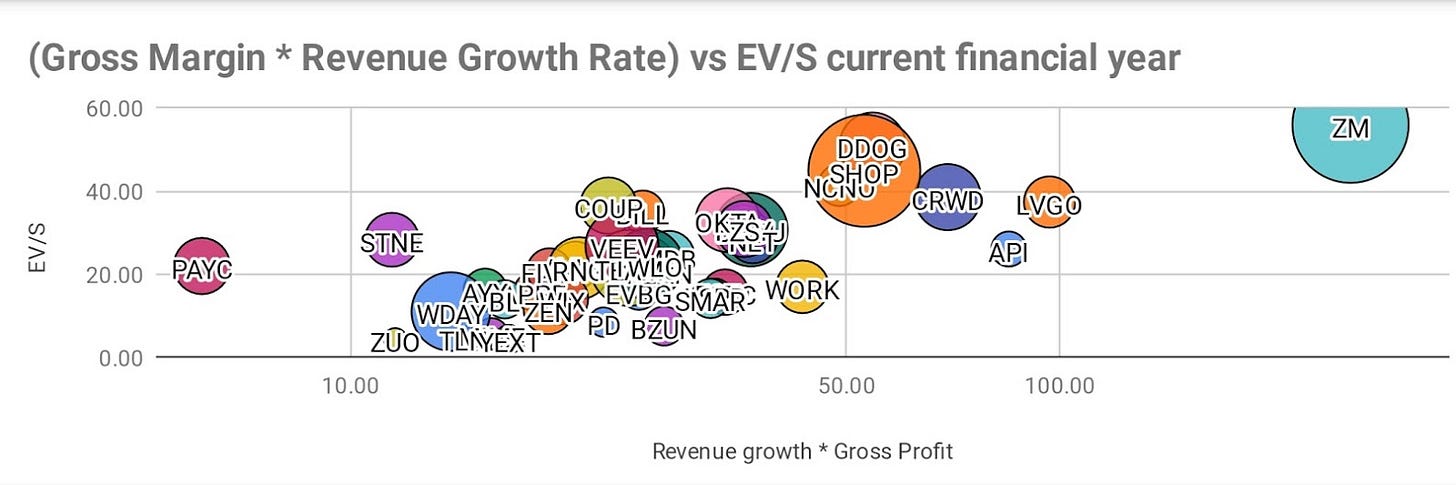

Is the valuation stretched?

Yes.

Mongo remains in the “do nothing” pile.

$AYX

If I was trying to optimise my portfolio for the next quarter, I would probably drop $AYX. But that is not the game that I am playing: short term performance edge is not my strongest hand.

The sales impact due to COVID-19 and short term business survival needs is evidence that analytics may not be seen as mission-critical for a proportion of businesses.

While there may be an opportunity cost involved in holding a position while the business is in transition, I don’t currently feel compelled to sell out of $AYX completely. I have considered trimming the position to reflect the fact it is not my highest confidence position in the near term. My investing timeframe skews towards the longer term.

Pondering.

$ZS

Zscaler reported a solid ER with strong billings, like the $ZS of 2018/ early 2019. Growth is good, but not stellar in the mould of $CRWD, and valuation remains elevated - although the unusual timing of the $ZS annual year has mollified current year EV/S.

Fourth Quarter Fiscal 2020 Financial Highlights

Revenue: $125.9 million, an increase of 46% year-over-year.

Income (loss) from operations: GAAP loss from operations was $44.9 million, or 36% of total revenue, compared to $7.9 million, or 9% of total revenue, in the fourth quarter of fiscal 2019. Non-GAAP income from operations was $7.8 million, or 6% of total revenue, compared to $7.9 million, or 9% of total revenue, in the fourth quarter of fiscal 2019.

Net income (loss): GAAP net loss was $49.5 million, compared to $5.3 million in the fourth quarter of fiscal 2019. Non-GAAP net income was $7.4 million, compared to $9.1 million in the fourth quarter of fiscal 2019.

Net income (loss) per share: GAAP net loss per share was $0.38, compared to $0.04 in the fourth quarter of fiscal 2019. Non-GAAP net income per share was $0.05, compared to $0.07 in the fourth quarter of fiscal 2019.

Cash flow: Cash provided by operations was $31.6 million, or 25% of revenue, compared to $17.8 million, or 21% of revenue, in the fourth quarter of fiscal 2019. Free cash flow was $10.9 million, or 9% of revenue, compared to $7.6 million, or 9% of revenue, in the fourth quarter of fiscal 2019.

Deferred revenue: $369.8 million as of July 31, 2020, an increase of 47% year-over-year.

Cash, cash equivalents and short-term investments: $1,370.6 million as of July 31, 2020, an increase of $1,005.9 million from July 31, 2019. In June 2020, we issued convertible senior notes for an aggregate principal amount of 1,150.0 million and net cash proceeds of $985.3 million.

$CRWD

Second Quarter Fiscal 2021 Financial Highlights

Revenue: Total revenue was $199.0 million, an 84% increase, compared to $108.1 million in the second quarter of fiscal 2020. Subscription revenue was $184.3 million, an 89% increase, compared to $97.6 million in the second quarter of fiscal 2020.

Annual Recurring Revenue (ARR) increased 87% year-over-year and grew to $790.6 million as of July 31, 2020, of which $104.5 million was net new ARR added in the quarter.

Subscription Gross Margin: GAAP subscription gross margin was 76%, compared to 74% in the second quarter of fiscal 2020. Non-GAAP subscription gross margin was 78%, compared to 76% in the second quarter of fiscal 2020.

Income/Loss from Operations: GAAP loss from operations was $30.0 million, compared to $50.6 million in the second quarter of fiscal 2020. Non-GAAP income from operations was $7.8 million, compared to a loss of $20.6 million in the second quarter of fiscal 2020.

Net Income/Loss: GAAP net loss was $29.9 million, compared to $51.9 million in the second quarter of fiscal 2020. GAAP net loss per share, basic and diluted, was $0.14, compared to $0.40 in the second quarter of fiscal 2020. Non-GAAP net income was $7.9 million, compared to a loss of $23.1 million in the second quarter of fiscal 2020. Non-GAAP net income per share, diluted, was $0.03, compared to a loss of $0.18 in the second quarter of fiscal 2020.

Cash Flow: Net cash generated from operations was $55.0 million, compared to negative $6.2 million in the second quarter of fiscal 2020. Free cash flow was $32.4 million, compared to negative $29.2 million in the second quarter of fiscal 2020.

Cash and Cash Equivalents increased to $1,065 million as of July 31, 2020.

The WFH driven demand for endpoint secutrity is a powerful tailwind for a company that was already performing admirably. It’s incredible to think that traded at an enterprise value of $4B during the March lows just 6 months ago.

$TWLO

A down month for $TWLO but a positive quarter.

Let's see what comes out of the annual Signal Conference

There are some worries about $MSFT’s new Azure offerings which have some product overlap with Twilio’s suite, but I believe it a) functions as validation of the market and value proposition and b) Twlio is the leader in the space and is more focused on delighting developers.

I have been trying to think of good examples of large company destroying a more agile software business leader by entering its market. Let me know if you come up with some good examples.

$AMZN didn’t kill $SHOP

$PYPL didn’t TKO $SQ

$FB didn’t bulldoze $MTCH

$AMZN didn’t crush $ESTC or $MDB with competing products

Don’t @ me about $MSFT and $WORK (yet) - I think that one is still too early to call.

$ESTC

Flat on the month and up about 18% on the quarter. The ElasticON conference and an Analyst Meeting are scheduled for mid-October.

$NVTA

If you had told me in Sept 2019 that $NVTA would outperform $ESTC, I would have been skeptical.

$NVTA has returned a 6x from March lows around $7.5. My personal holding at an average of around $24 has seen a -69% loss swing to a return of 69% in the span of 6 months.

The business is in recovery mode after the slump in volumes of Q2. It will be important to watch the revenue growth trend and cost of testing fall over the next decade.

The issues of cash burn, dilution, and the fact that genetics is outside of my area of special expertise are the reason that I have no intention to add to my position here, despite the good performance of the stock. My framework for investing in Invitae was a bet with asymmetrical upside on the ~ £3750 investment if it works out and no risk of ruin if it does not.

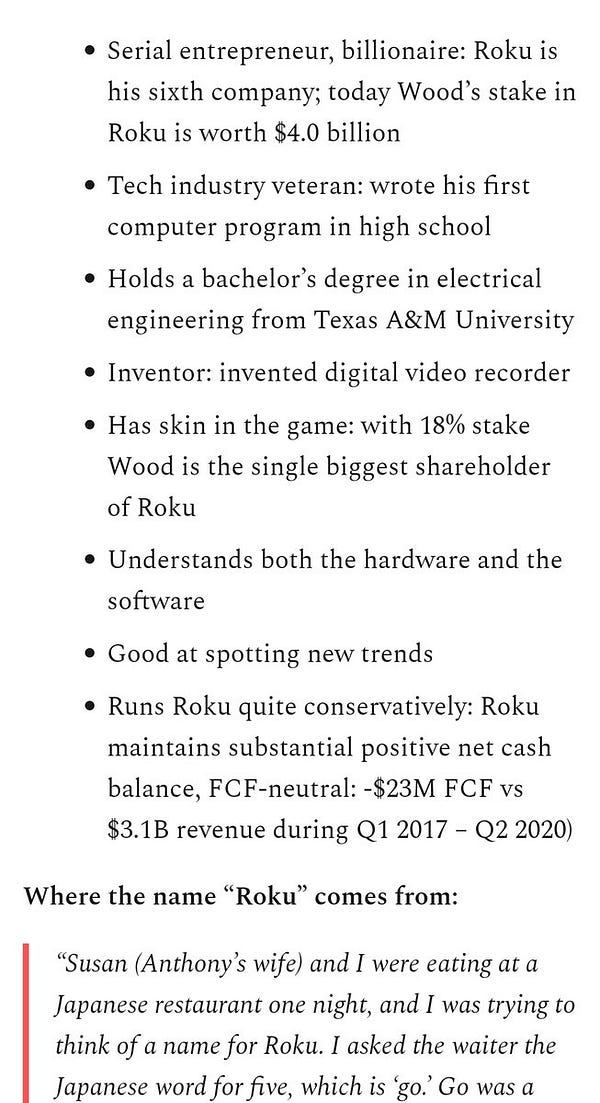

$ROKU

Up 10% in September and over 50% for Q3. $ROKU and NBC finally came to an agreement about Peacock, which acted as a positive catalyst for the stock price. $ROKU is strengthening it’s position as a key distribution channel for AVOD and SVOD. The increasing value of the ROKU home page will likely strengthen the company’s bargaining power over time and improve opportunities for the $ROKU platform.

For a great thread on $ROKU - Take a look at this breakdown by Secret Capital.

I also learned more about the Anthony Wood, the $ROKU CEO.

$BZUN

Meh.

The Hong Kong IPO was unremarkable and there was a large dumping of $BZUN stock on US markets on Tues 29th Sept, with over $135M worth of shares being traded, vs the usual ~$40M.

Does that represent Q3 portfolio rebalancing of underperformers, or something else?

The HK IPO prospectus was interesting because although it showed the company was still the leader in brand e-commerce, it was a much less impressive suggestion of market share than what the company historically promoted.

How long do you let underperformers drag before you take them outside and put them them out of their misery? I want to be patient here because the thesis still seems intact, but am toying with the idea of switching funds here to a new position in $SE.

Currently suppressing my inner voice…

$BZUN has underperformed, but it is still within the long term channel. If it breaks to the upside, it might move aggressively, but I have no idea when that might happen. If it was to break to the downside, I’d probably drop it.

$API

Shares haven’t done much, but it’s a new IPO and there are good reasons not to get too excited too early and to build a position slowly. $API is under all simple moving averages as of Sept 30.

I added another 10 shares this month. It’s possible they may get some interest in mid October after their RTE event.

On the other side, it's entirely possible that $API falls to a EV in the $2B - $3B range. The risk/reward to me would be pretty interesting to me at that level.

Podcast Episodes I’ve Been Listening To

The Loan

Loan balance outstanding: ~ £16.6K

Loan to portfolio value (LTV) rate: 11%, down from 12% last month

Paying off part of the loan last month made me happy.

I’m pleased that I managed to pay off the M&S part of the loan with profits from swing trading 100 extra shares in $LVGO that I picked up in the 20s in Feb-March. I sold these in August before we went on holiday, and snuck in under the taxable threshold so there’s no paperwork hassle either. I try not to mess with my long term portfolio.

Cashing in on my swing trade got the debt down in a practical way and psychologically helped me to feel I had cashed in a bit on what has been a ridiculous 6 months.

I don’t make many short term trades or write about them for various reasons, but that’s where the money came from. An asymmetrical bet that paid off handsomely and the source of some holiday spending.

My main position of $LVGO shares I referred to in my long term portfolio review are held separately in my ii.co.uk long term tax free ISA account.

Final Thoughts

Stretched valuations and a great run YTD leave me largely in cruise control mode now, and possibly for the rest of the year in terms of portfolio moves. I don’t feel compelled by much at the moment, and my focus will probably shift towards debt payoffs.

As we get towards the end of the year, it might be reasonable to start looking at company valuations on a 2021 revenue EV/S ratio. With low interest rates, and stimulus likely the new normal for the medium term, I’m not going to try to predict what happens next. I don’t know what will happen in markets around US election

time, so am largely planning to sit tight.

Have a good October!

Watchlist: $SE, $PTON, $FSLY, $AMWL, $GDRX, $U, $FROG, $LSPD, $ASAN