Overview

So, May was worse than April.

If you get into a boxing ring, you have to accept that you are likely to get punched in the face more than once.

The question is, can your chin take it?

I felt it. It hurt, but I’m still here…

It turns out that March wasn’t rock bottom after all. Portfolio concentration works in both directions - when your largest positions $TTD and $TDOC get the crap kicked out of them, this is what your portfolio value might look like…

(Image via Portseido - hat tip to the Irish Born Investor for putting it on my radar)

The range of volatility that can be tolerated while still sleeping well is unique to each individual. I don’t say that to dismiss my portfolio's underperformance, but I really am ok with the concept of being “wrong” in the short term but optimistic about my chances over the longer term.

I believe there is a good chance that companies in my portfolio will be larger in 3-5 years time, but I can't make short term calls with high accuracy, so I don't try too hard to do it.

Just gotta stick to the process and remember to breathe…

Focusing on process over outcome. Only one of those is under your control.

My best predictor of a near term top is still speaking to my wife about the portfolio.

It works almost every time…

Having said that, over the long term there are occasional counterpoint days too. Can’t appreciate one without the other.

The market overshoots to the upside and to the downside over the short term. This matters less the further out I focus my time horizon, provided the companies can keep executing above expectations. That doesn’t mean the prices don’t get silly from time to time. $TTD grew revenue by 26% in 2020, and the stock price went from $264 to $818 in the same year. IMHO some of the drop was warranted, even when you take into consideration changes in the advertising landscape driven by the pandemic.

I’m not an investing professional. I am not able, and would not want to look at markets all day. I have to craft an approach that works for my life. I can accept a $20K+ swing in the value of a position if I believe in the long term of a company.

YMMV - it’s not the right approach for everyone. You could make a very reasonable case for holding a core position LT and trading around it.

I would hope that any newer investors who haven’t taken the time to clearly define their investing process have used the 2021 growth stock flush to reassess their strategy and tolerance.

It’s so important to play your own game. I share my thoughts and some of my process, but I am just a guy on the interweb. I know my financial situation and what I am able to tolerate - it’s highly unlikely that what I do would be an ideal match for anyone else. I am still a work in progress.

Portfolio Changes

Buys

None

Sells

None

Current Portfolio Allocations via Google Sheets

No changes this month. Looking at my allocations and conviction has me considering whether I might trim some $TDOC and add to $ZS, but there is no rush. There are a couple of companies I’d like to add, but it’ll probably have to wait…

Deleveraging - A Philosophy Change

I have made it a goal to pay off all of my outstanding investing loans by the end of 2021. It means I probably won't have much new capital available for new ideas over the rest of the year.

There are a number of reasons for this change:

I have achieved what I initially wanted to achieve with the £40K loan - get to a 6 figure portfolio, so that the effect of compounding is more meaningful

I have decided to reduce my hours at work to 80% of full-time hours so that I can spend a regular day a week looking after my primary and nursery age kids. This will cancel out the net financial benefit of a recent work promotion, but I'm OK with that as I get something that feels priceless in return - being present.

We still owe £342K on our mortgage, so there is much to do, but my priorities go beyond just running down the numbers on debt. Financial independence remains the goal, but living a full life along the way is vital to me.

I believe I will eventually pay off the mortgage ahead of schedule but it's a longer-term goal. I think I can achieve the vast majority of what I want to achieve at work at 80%. NHS salaries plateau out at my level for roughly the next 5 years in any case.The work pattern change is a reversible decision, so there is no need to overthink it.

I started investing because I wanted to make life better for my family, but our finances are only one component of that puzzle. Two other “obvious” priorities for me are spending more time with my family and getting into better shape. I want to be able to dunk on / get dunked on by my son in 10 years time.

My portfolio and watchlist is volatile. Having a cash balance to strategically deploy during aggressive pullbacks would be very desirable, but is hard to do when servicing loans at the same time.

We are exploring working outside of the UK if international options open up in the next few years. Debt would be another deterrent to realising this.

My kids have better 2021 returns, and a crypto confession

The main assets that have had a good showing in 2021 have been the ones not in my long term stock portfolio.

My children's Junior ISA account positions in $TRMR.L (but coming to the NASDAQ) is small allocations but up > 100% YTD. It’s their only position, so their 2021 returns destroy mine.

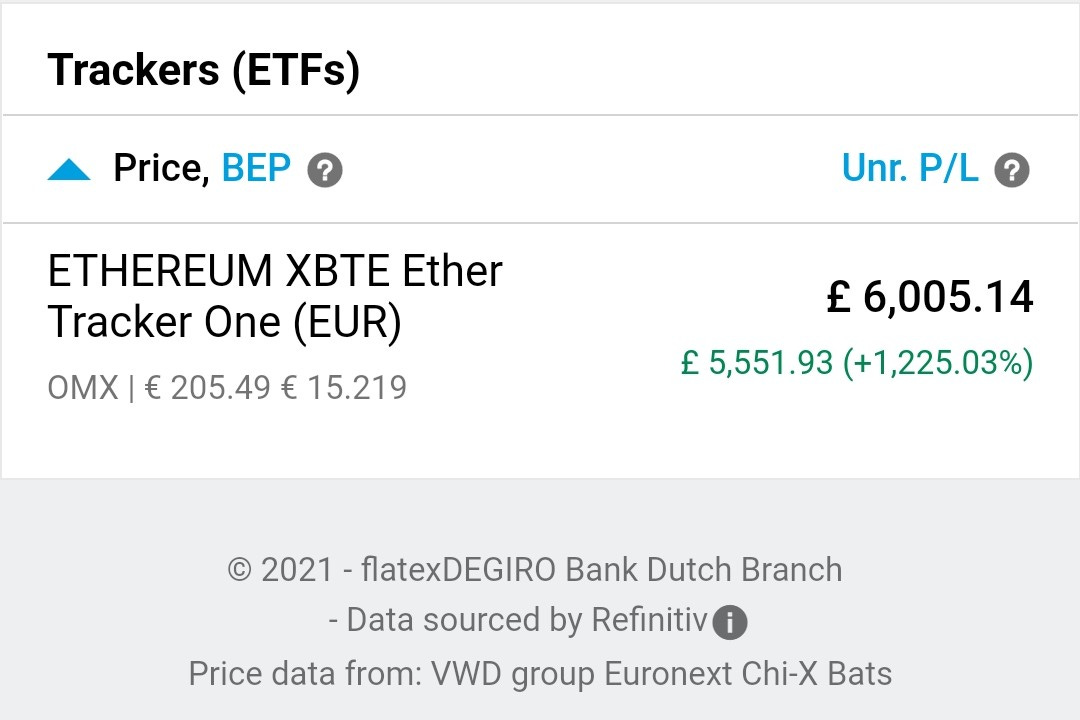

I have a small confession to make. I made a ~ £500 synthetic foray into Ethereum via the XBTE Ether ETN on the NASDAQ OMX in Stockholm just over a year ago. It has appreciated significantly even after I trimmed it back to pay down some debt and a sharp crypto pullback in May.

I am not a crypto asset expert but thought that there was enough potential asymmetry present in April 2020 for a speculative bet that I was willing to ignore for a year. I never wrote about it on here because it’s not really an investment in the same way I think about stocks.

I try to avoid talking about things I don't know enough about. Crypto is still on that list.

The fact that it has given good returns so far doesn’t make me smart and still hasn’t given me firm conviction in Ethereum. It’s not a company, it’s extremely volatile and I haven’t yet fully formed a framework for thinking about it. But perhaps I don’t need to - I could simply accept that it’s speculation, and avoid getting overly cerebral about it. It might not work out at all, and that is ok.

I do find Ethereum interesting - but the risk/reward back in April 2020 was much more attractive to my simple brain. I’m a little wary of parabolic moves over short timeframes and there have been a lot of recent parabolas in the world of crypto. There is a lot of hyped-up crud in crypto land that is NGMI, and the volatility makes my stock portfolio look like the S&P500…

I can’t help but get “dot.com mania“ vibes about the majority of cryptoassets. At the same time, I can accept that if DeFi takes off for regular people, there is a high probability that Ethereum would have an important role to play in it. I’ve capped my risk at an acceptable level and will try to largely refrain from talking much about it. I don’t have any strong opinion on its price action. I don’t include it in my portfolio returns, and that won’t change.

To be clear, this was money that I was/am willing to lose in order to learn more, and I was able to hold it in my brokerage account without any of the complications associated with wallets. Call me lazy. One added benefit is that it stops me from wasting my weekends and nights observing price action that I am unlikely to act on…The real value of my holding as I type this weekend is probably closer to -12% of what is listed above.

Interestingly, I wouldn’t be able to purchase the ETN anymore via my broker if I wanted to. I can only sell it, so I’ve kinda become a faux-HODLr as a result of the UK FCA.

Twitter

I have been spending less time on Twitter this month. I just haven’t enjoyed the negative vibes in my timeline, especially the stuff that got extremely personal about individuals.

We are all adults, and it’s healthy to disagree but I have to say that I don't enjoy seeing waves of people gang up on anyone else. That stuff should have been left behind at secondary/high school.

I’ve really enjoyed reconnecting with friends and family in the last month. As I type this at the end of a sunny evening, it finally feels like summer might finally be on its way…

Enjoy the long weekend!

PS

I’ve been invited to speak on Investing from Scratch on Twitter Spaces by Investquotes and am really to get the chance to hear directly from TSOH and StockNovice. I’m definitely the least experienced investor of the speakers and feel lucky to get the chance to do this.

Please come and join us on June 2nd on Twitter if you get the chance! If you have any questions on the due diligence process that you would like to see covered please feel free to ping me via Twitter or email hello@mytwitterid dot com, and I'll try to get it included.

Watchlist

$GHVI, $VYGR.CA, $GLBE, $NCNO, $APPS, $AVLR, $TWST, $KSPI.L, Doximity

Good to see your getting into crypto especially ETH. A lot of developers are using this for blockchain applications. Just hold on for dear life for the next 5-10 years and I think your be handsomely rewarded. My TTD got hit as well, there risks there but if the company can pull it off, we’ll see all time highs soon I hope. Thanks for your enjoyable post.

Always have to "do you" and stick to your priorities! Great post.