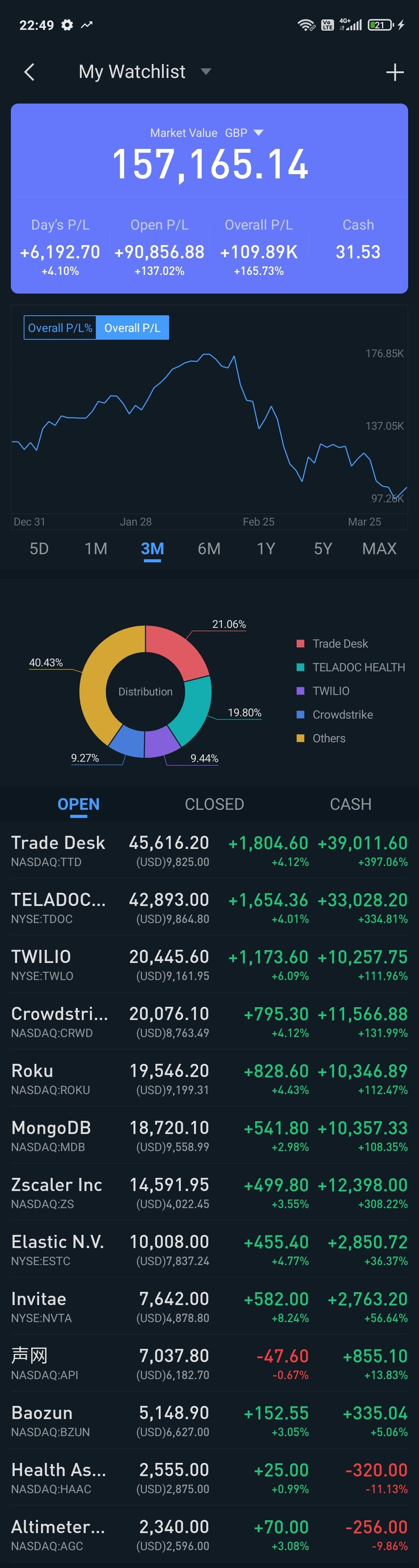

Portfolio Value and Links to Previous Quarterly Reviews

Portfolio Peak ~ £235,000 - Mid Feb

Portfolio max intraday drawdown 29th March ~ £90,000 from peak

YTD -15.7% (includes the effect of closing position in $AYX and withdrawing the capital to pay down loan debt)

That's impressively bad vs the S&P500 or ARKW over the short term. But it is OK over the longer term.

Q1 Overview

In my end of December 2020 review, I stated the ominous phrase

“A -35% correction wouldn't surprise me.”

Ask and you shall receive.

In Q1 2021, my portfolio dropped by more than the entire value of my portfolio in Q1 of 2020.

It has been a significant drawdown. Although I can tolerate it and readily accept that my style of investing guarantees a strong dose of volatility, I won’t pretend that it is easy - it isn’t.

My two largest positions got cleaved in the pullback. But hey, at least I’m not 5x leveraged…

Accepting my concentration as an outcome rather than an input makes it a little easier to tolerate.

It’s easy to state that going to cash mid-February would have been the best move in hindsight. The retrospect-o-scope seems like a powerful instrument but is not very useful in the heat of the moment. That said, it is always worth considering what ex-ante actions might have reduced the impact or probability of the drawdown.

Market frothiness has been a concern.

Acknowledging that a heavy pullback was increasingly in the range of expected probabilities is not the same as knowing when it would happen. Corrections are usually swift and ruthless, and this was no different.

In 2019 I wrote an article on “How i lost £25,000 in 3 months”. The 2021 version was more like “How I lost £25,000 in 3 days”….

Progress of a sort? It’s all a matter of perspective.

Perspective is so much about how you frame things:

I could be beating myself up if I only looked at my portfolio this way:

I had a £90,000 drawdown and didn’t sell at the highs. That is more than I earn in a year and could reduce my mortgage payments, pay for a loft conversion for our home, or a Tesla or Porsche ( not that I want a new car, but you get the point)

I didn’t pay off my full loan outstanding when I had the chance

I lost more than my outstanding loan balance in a single day

Maybe I suck at this and will get “wiped out” as suggested in this f̶r̶i̶e̶n̶d̶l̶y tweet.

Or I could look at it this way

My portfolio is up 3x from the March 2020 lows

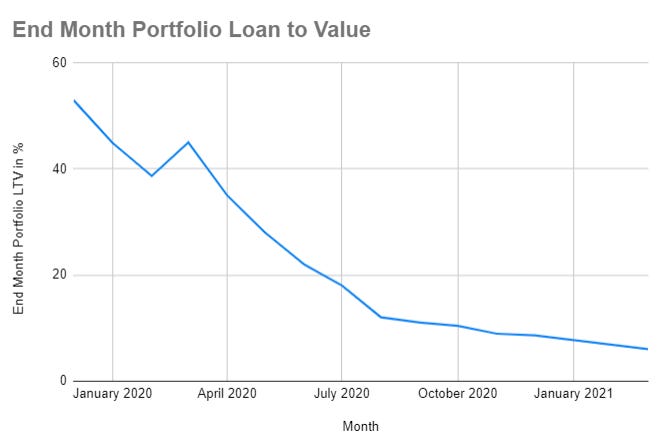

The loan outstanding is now less than 7% of my outstanding portfolio balance down from 45% in March 2020

I’ve accelerated the loan payoffs and am ahead of my originally scheduled payback period

All 6 of the statements above are true - and I’m OK with that. I’ll focus on the latter 3.

Pessimism is self-fulfilling. Optimism is a choice.

Investing is an intensely personal endeavour, so you have to figure out what makes sense for you. Although I didn’t appreciate the implied assumptions or tone of the tweet above, understanding what tradeoffs you are making in your investment strategy is really important.

I don’t make perfect decisions. You have much more control over the process that you do the outcomes in the short term. I’m not really worried about the outstanding loan balance - I could sell my 2 SPAC positions and Baozun and it could be gone if needed.

The bleeding continued into March. Fortunately, I had been mentally prepared for it. Don’t underestimate the value of stress inoculation therapy.

It helped that I was in the process of starting a new job and was too busy to watch the carnage too closely. If your plan is to “do nothing”, I don’t think that staring at the portfolio damage too closely is helpful. If you plan to actively manage your portfolio during drawdowns, then it’s different. I am not free to actively manage my portfolio during the working day, and it might not help if I was.

I try to stay long term focused. Occasionally you have to accept it’s your turn for a beating. Your investment strategy should take your ability to suffer into account.

There is a massive range of what different investors will consider acceptable in a given situation. I first wrote about valuation concerns for my holdings in May 2020, so if I had tried to base decisions purely on valuation concerns, I’d probably end up repeating this cycle elegantly demonstrated in this visual.

.

I had not added much capital to the majority of my existing positions for the last 5 months due to valuation and a shift in my priorities towards getting rid of debt with spare capital.

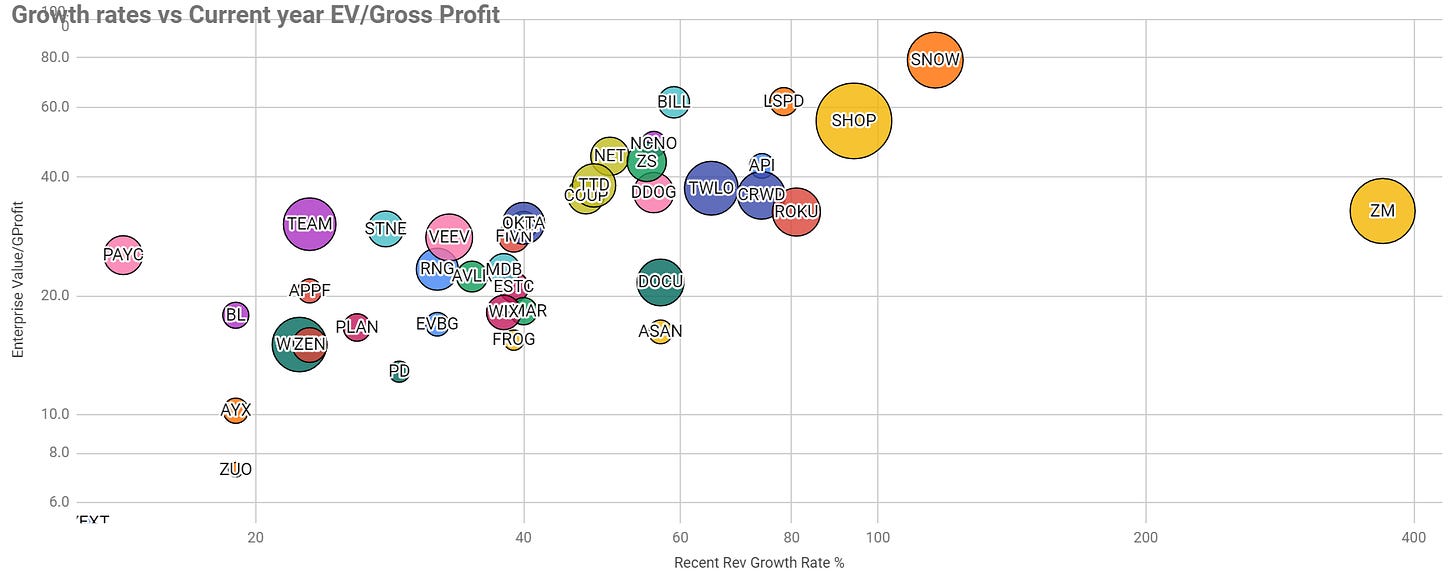

Valuations

Valuations are still pretty high vs historical context, despite the pullback, especially when you take Q3-Q4 of 2019 into consideration.

Relatively depressed valuations in software at the end of 2019 were an understated component of the rampage seen in software company multiple expansion in 2020. I feel that the majority of gains that I got in 2020 were the result of my decision that I made in 2019.

Portfolio Changes since end Feb 2021

Sells

None

Buys

5 shares of $API at $45.5 - close enough to my average price, a small amount of capital, and enough to feel that I “did something” during the pullback. My trigger was simple - the point of maximum regret following the portfolio beating.

2 shares of $ZS at $171 - I had 83 left after selling 7 back in December - and wanted a more satisfying number of shares in my portfolio. 85 is a better number than 83. I know that is ridiculous reasoning, but there it is.

Current Portfolio Allocations

Company Reviews - ER results are clickable from Tickers

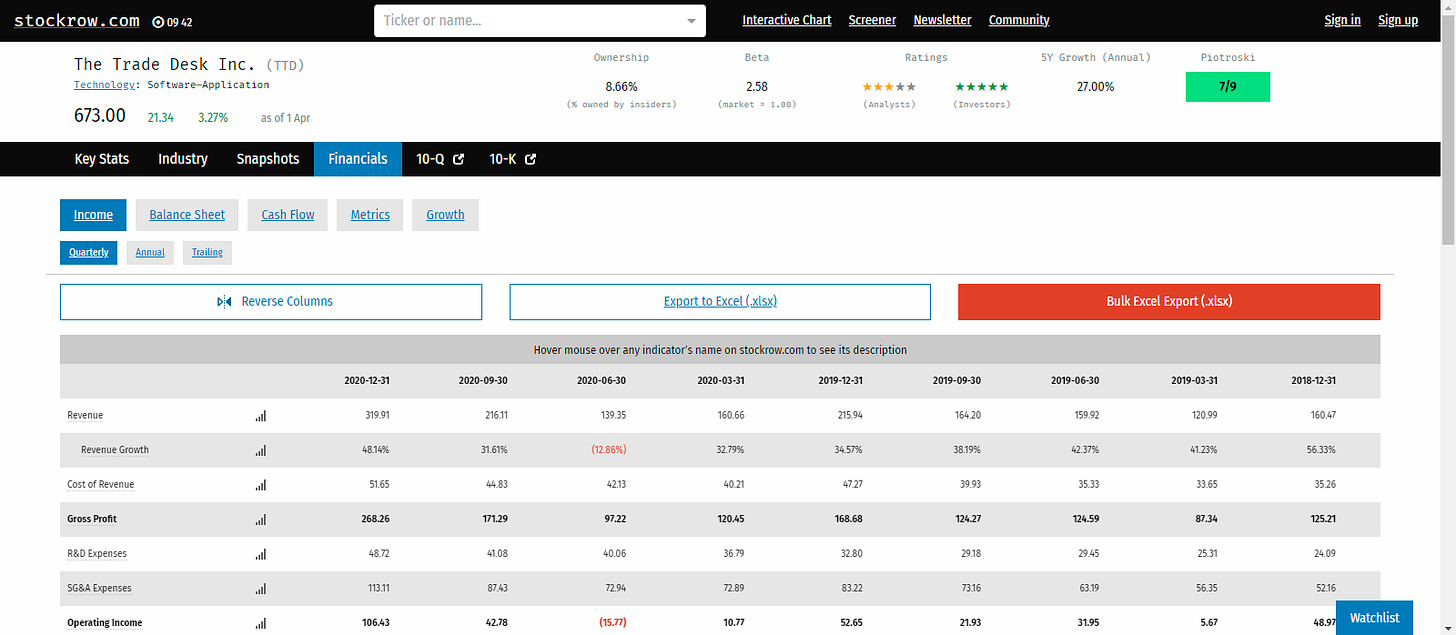

TTD

Back to 45%+ revenue growth in Q4, CTV and China tailwinds in play, and a slightly more reasonable, but still premium valuation.

There were some encouraging sign from the Q4 transcript.

Fourth-quarter spend alone was over $1.6 billion, also a record. CTV spend more than doubled for the year. And once again, despite all the uncertainty of the year, we delivered strong profitability, highlighting the operating leverage we have in our business.

We often benchmark our results against the rule of 40 of other high-growth companies of our size, where the health of a technology company is expressed as the sum of a company's growth rate and EBITDA margin. 40% is healthy. In 2020, we finished at over 60%, all while we are investing in our future as fast as we can. According to eMarketer, total global ad spending declined 4.5% last year. Meanwhile, spend on our platform grew 34%.

We've talked a lot over the last 12 months about how the pandemic accelerated trends that were already under way, but we couldn't have predicted quite how sharp that acceleration would be.

Risks to TTD include the fact that $30B after the pullback remains a steep price to pay for ~$1B in revenues. The profitability profile vs other software companies and exceptional leadership are the reasons I’m comfortable playing the long game.

TDOC

Q1 was a round trip for Teladoc. More investor anxiety due to Amazon entering the space.

Pure telehealth risks being a commodity service and many technology investors scoff at Teladoc for that reason. Healthcare is complicated and messy, organisational behaviour is driven by legacy incentives and regulation, it is a space that is harder to innovate in. It’s certainly simpler to invest in B2B software with secular tailwinds. My belief is that innovation in healthcare is driven by understanding the system more than by pureplay technology. The Livongo merger and whole-person chronic disease health approach makes $TDOC a story that I am happy to watch play out. It’s not one for the impatient. My position here may be oversized though…

As for Amazon, they are to be respected, but…

TWLO

Impressive stuff from Twilio at scale.

Twilio continues to embed itself in the world’s digital communication.

Raising money. And more money.

No complaints here.

CRWD

I have no issue with how Crowdstrike is executing their business.

None at all.

ROKU

Roku’s strong distribution in the US (38% of all smart TVs) is taking them to interesting places. Platform revenue was over 70%, incremental active accounts were up 39%, ARPU is up 24%.

They announced a strategic alliance with Neilsen which strengthens their position in the advertising ecosystem.

My question with Roku is whether they can replicate their US success internationally. I don’t know yet.

MDB

The usual fare from Mongo. I’m assuming that the apparent disinterest in operating leverage means that MDB’s leadership team think that the company has a lot more growing to do.

Tailwinds from Tencent, a deeper integration of the Realm acquisition and expansion with Google Cloud are all suggesting that execution and the runway remain strong.

ZS

Was ZS saved by COVID, or is the strong execution down to Dali after stumbling in 2019?

Maybe it’s both. We might never know, but the company is back on track and organisational security will continue to be a strong focus this decade. The partnership with Crowdstrike is deepening, so they have good taste.

ESTC

Better growth and operating profit, and the same licensing moves as Mongo, but continues to trade a discount and was not spared in the correction, There is a premium paid for simplicity.

API

Agora in Mid Feb

Agora at the end of March

It would have been sensible to have sold Agora at $10B on a sub $200M revenue run rate - the hype was related to Clubhouse and Cathie Wood fascination rather than business fundamentals, which are good, but not yet stellar. It is a Chinese ADR, has impressive and well-funded capable competitors, and a declining growth rate.

On the flip side, they are making some solid attempts to build out an ecosystem of developers using their technology.

NVTA

Nothing new at Invitae.

Fulgent is laughing at me - I turned it down because I was less comfortable with the $200M market cap at the time…It’s now $3B.

BZUN

What can I say about $BZUN? ER was OK, not great. It fell back past the breakout on the technicals. Maybe it was a fallout of Bill Hwang's margin call…I don't know. Patience is wearing thin, but I said I'd give it till summer.

HAAC

No definitive agreement, and trading close to NAV.

AGC

No definitive agreement yet, but rumours about Grab are interesting.

Price action suggests that I overpaid in my initial enthusiasm for Altimeter, but the overall impact on my portfolio results is limited due to the small relative scale of both HAAC and AGC.

The Loan

Loan balance outstanding: ~ £9.6K

Loan to portfolio value (LTV) rate: 6.1%, down from 8.6% end Q4 2020.

Pondering Space….

Ignoring ARKX, I’ve started some casual due diligence into space-based companies as an investment area. Admittedly, this might be because they trigger fond childhood memories as a kid in the 1980s. The best cartoons always had a space theme and a badass intro…

I know it’s not the original Robotech intro (and I know it’s Macross really) but the updated animation is awesome and keeps the spirit of the original.

SilverHawks never got to the same popularity as the ThunderCats, but was equally epic

“No guts no glory, no pain no gain”… does that apply to investing?

Companies that seem worth a deeper look include these SPACs $NSH $SFTW and $SRAC - what else?

Final Thoughts

I’m not convinced that we are out of the woods simply due to a nice day to close Q1 - but it’s good to see a little green to end the month.

Stakes go up as the size of a portfolio increases, but principles and solid process win over the long term. I’ve learned not to let taxes sway my decision making if there seems to be an opportunity to exit a lower conviction idea once it has appreciated over 2.5x from the purchase price in 6 months. I don’t think that means I’ll suddenly become an active trader. It simply reflects the reality of lower conviction ideas when a) the risk-reward is no longer appealing, or b) until conviction builds due to the performance of the underlying business.

I remain a long term buy and hold investor for my higher conviction ideas that I believe will be significantly bigger businesses over the next 3-5 years. Volatility is the admission price for the game, but the game is worth playing if you can stay long term focused.

Have an enjoyable April - I’m looking forward to catching up with extended family now that some of the UK restrictions are being lifted.

Thanks for the write up, very enjoyable read.

If you haven' already found it, I would recommend reading Septum Capital's analysis of $SRAC (https://septum.substack.com/p/analysis-of-momentus-space-srac), I found it very useful.

Always appreciate your thoughts !!