Be willing to look stupid but don't do stupid things

You can't be normal and expect abnormal returns

I recently spent far too long on a Reddit forum on financial independence. I had outlined my unconventional approach to investing and shared a few thoughts as to why it was a good fit for my particular situation. I was a little taken aback by the level of vitriol in the responses.

On reflection, I should not have been surprised. Going against a community's worldview will almost always trigger a visceral reaction.

You either have some insane ability and confidence or you're really dumb. You borrowed 40k to invest in individual companies? That's practically gambling.

I'm honestly just so glad to see most people recognise what a bad idea this is.

Or I should say ideas.

Borrowing to invest is a bad idea.

Individual stock picking is a bad idea, unless you happen to be 'the one'.

in some virtual ivory towers somewhere, there are scores of Harvard-level full-time professionals with technology you can only dream of analysing the market to death with decades of success and hard work behind them.

It’s fair to admit that my approach was pretty non-consensus. I’ve previously outlined why it makes sense for me.

For those who fear the armies of smart professional investors, there is a big difference between hard and impossible. It’s not plain sailing for professionals either.

Why would what I’m doing cause such a dramatic response from people who are unaffected by the consequences?

A lot comes down to mindset and culture. British people have a tendency to be pretty conservative in their thinking and aspirations, compared to my experiences of people from many other countries. That probably extends to investing, a minority interest in this country. The historical UK wealth generation formula has largely been property-based. But that model is broken for most of the middle-class, probably for good. It’s time to accept it and move on.

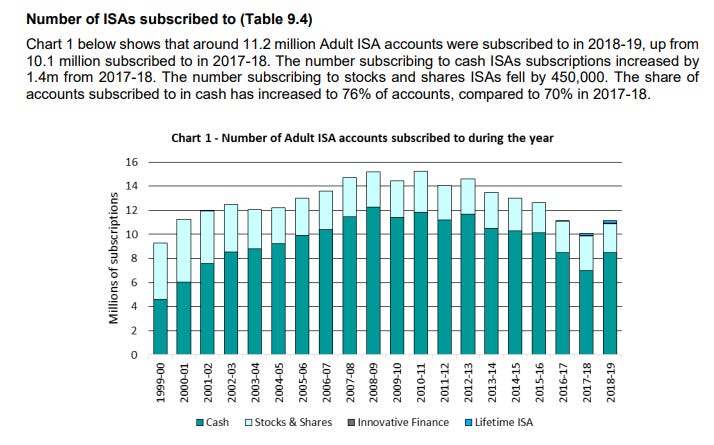

The UK is not a nation of individual investors. In total there are 6.6 million investing accounts, which includes ISA and SIPP figures. Most people taking investing seriously as an individual DIY endeavour with significant amounts of money are likely to be using a SIPP (self investing personal pension - free money due to employer contributions) or an ISA (individual savings account - free of capital gains tax, and £20K max post-tax contributions per year).

There were 1.4 million SIPP (self-invested personal pension) accounts in 2016. Fewer than 3 million people in the UK have a stocks and shares tax-free ISA accounts. The majority of people who have an ISA are hoarding cash.

At a population level, UK retail investors would not be my first choice of people to take inspiration from when it comes to deep investing insights. I guess shouldn’t be surprised that my investing in individual companies was readily criticised.

Before taking any criticism to heart, you need to consider how much weight you should put on the opinion of those who are throwing shade. I listen much more attentively to those who have walked the path I’m trying to follow.

What most critics are really saying is:

you shouldn’t do that because it wouldn’t work for me

I don’t think that I am special. I have an above-average understanding of technology but am not a hardcore technologist. As a failed entrepreneur, I probably also have an above-average risk tolerance, and a greater willingness to accept the risk that things may not work out.

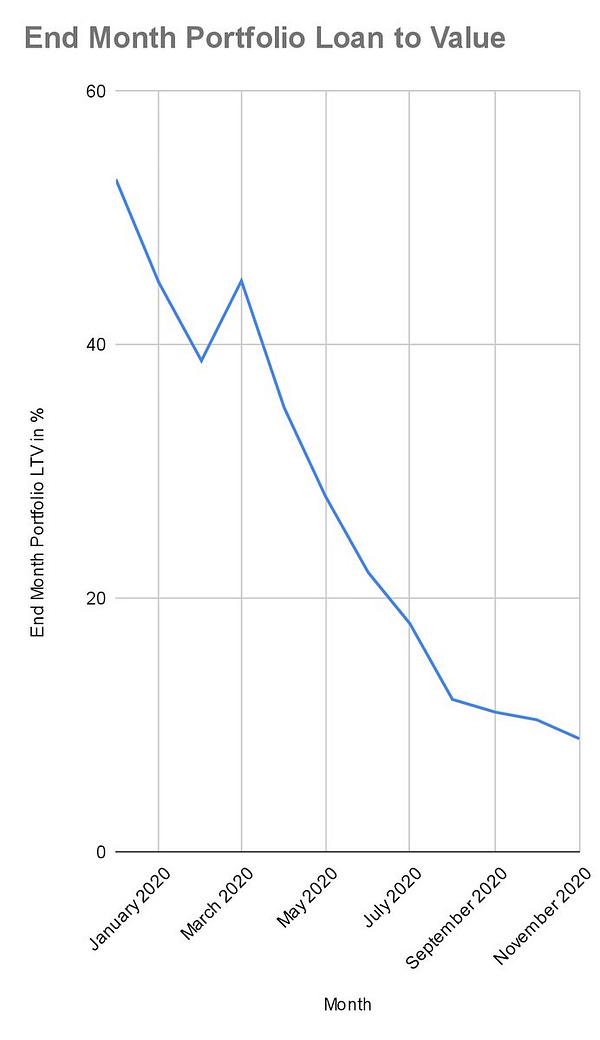

Criticism of the loan is much more understandable, but context is everything. I can see why it might look stupid, but I don’t think that it was stupid. The worst-case was always within my range of acceptable outcomes.

Listening to other people’s opinions too closely would not have led me down this path, which is working out so far and has the potential to change our family’s life for the better.

I wonder if the vitriolic response speaks more to a fear of the risk of being ridiculed, and an unspoken desire to conform. Caring less about what other people think is a key component to unlocking unusual outcomes, but it’s not a very British. As a second-generation immigrant, I feel lucky to have a range of worldviews to draw upon - my parents have always encouraged me to maintain a growth mindset.

A number of people referenced a lack of innovation in UK listed business.

Is there a correlation between the old-school businesses listed on the LSE and the population’s mindset when it comes to bold ideas?

Maybe. I don’t know.

My investing journey is an exploration. I’m willing to try, iterate, improve, learn, share, connect with other people, fail, get back up and figure our how to get better. There are no guaranteed outcomes, but I have no doubt that my life has been improved by starting this journey. I’m optimistic about the long term, even if the short term is messy and unpredictable.

It comes down to simple things. Wage stagnation is real, and the age at which I’ll be able to access my NHS pension is only going to go up. I want my kids to have a great education. I want to pay off our mortgage early and be able to work on my own terms. I don’t care much about money per se, but I do care about freedom. I’m less likely to be able to achieve it without investing.

Could it all blow up? Absolutely. But that scenario isn’t actually all that bad for me, all things considered. What I'm looking for is an abnormal outcome. To get it, I’ve accepted that I have to play a different game.

So what does qualify as stupid decisions in investing? I’m glad you asked…

A lot of sniping from the sidelines comes from those who are afraid to lose or be criticised. Negativity is easy, often sounds smart, and requires less work than optimism. I don’t begrudge that - any risk/reward assessment will depend on where you are in life. At this point I’m comfortable doing things that might look stupid to others.

What I’m doing isn’t stupid to me. It doesn’t mean I think it’s a good idea for anyone else!

I don't think your approach was a terrible idea tbh. The risk/reward added up for your situation in a way it may not have done for others.

I had the fortunate situation of finding a job in financial services in my late twenties, which allowed me to contribute maximum ISA amounts during my thirties.

I've followed a growth investing path for nearly two decades, and over that long period of compounding gains (cagr 27% over 17 years) my salary is dwarfed by my investment returns.

If an investor has the right mindset, approach and discipline, it _could_ make sense to prime the engine by taking a loan to fast track the first few years and get compounding really working.

Great article. Yep I think most have been conditioned to only invest in index funds, but its fear that’s holds people from seeking better opportunities. There is a perception of a big activation barrier to the DIY investing route. For the brave few that persist rewards will come, but I suspect most dabble with share tips and lose. Index funds are safe and simple for people to do and many of heard of scare stories of under performing funds and how hard it is to beat the market thanks to Buffet.

Funnily enough, I did the exact same thing on a couple of FIRE Facebook groups. To suggest anything other than index funds was blasphemy. Returns of greater than 20%, you must be taking massive risk. Nope it’s just volitility nothing to be scared of, only to be surfed!