September and Q3 2021 Review

Drawdown pain is back and might get worse, but the loan is gone - I'm ok with that

Portfolio Value and Links to Previous Quarterly Reviews

YTD -6.8% (includes withdrawals, excludes crypto)

End Q2 2021 value £181.6K - loan owed: £4K

End Q1 2021 value £157.1K - loan owed: £9.6K

End Q4 2020 value £181.6K - loan owed: £15.6K

End Q3 2020 value £153.1K - loan owed: £16.6K

End Q2 2020 value £124.7K - loan owed: £27K

End Q1 2020 value £62.7K - loan owed: £28.6K

Dec 31, 2019 value £56.6K - loan owed: £30K

Q3 2021 Overview

We are in the middle of drawdown amongst my stocks…That is never fun.

But the loan is gone!

For much of 2021, my focus was on clearing the outstanding loan. It became a pretty addictive game. The closer I got to the target, the more excited I was by the prospect of paying it off.

Paying it off felt incredible - for about a week.

By the of the month, the euphoria has faded, and I have to confess to feeling a little…..empty?

It reminds me of that underwhelming feeling when you finished a video game as a kid and all you got for your effort was a “thanks for playing!” message followed by the game over screen.

I’m sure I’ll shake it off, but I’ve felt less interested in markets this month since paying off the loan. I don’t think it’s related to the pullback.

On the flip side, it’s a lot easier to stomach a drawdown when you aren’t wondering whether you should have sliced off some gains from a recent uptick to clear your debts.

I don’t have a lot of cash, but it’s good to finally feel that building a cash position is an achievable objective. The ~ £500 that I used to use for monthly loan payments is now going to be added to my brokerage account on a regular basis.

Portfolio Changes since end Aug 2021

Sells

$BZUN - I said that I’d leave it till summer to re-evaluate and the nights are getting longer.

Sold at $24 (-33% on overall position) after an underwhelming ER. Single-digit revenue growth was not enough to keep me interested 4 years down the line. I hate selling stocks when they are weak, but the decision has been on my mind for a while before being sealed by the latest ER. The mental freedom of letting it go means my brain space can be occupied with alternative questions.

As a longer-term idea in a more diversified portfolio, you could consider that Baozun presents possible asymmetry at end of month price of $17. That is probably true. There are understandable near term reasons behind the lagging numbers and sentiment that may fade with a longer time horizon. That might be true, but it's not for me right now.

The opportunity cost was the real damage here. I could have put the money in $SHOP in summer 2017, or $SE in 2018. That said, I doubt that I would have had the discipline to hold them for long term back then…

Buys

Started a tracking position in $SEMR after lockup expiry.

Current Portfolio Allocations

Company Earnings

Results are clickable from Tickers below

TTD

ER Highlights

280.0M in Revenue - growth of 101% (against COVID-19 through comps)

Non-GAAP Net Income $88.2M

Solimar launch - new trading platform

Q3 guidance of over 282M

Stong results and I think $TTD is well-positioned for the open web, but the market cap is still up there. Remember that $TTD grew revs 26% in 2020 while the stock price 3x’d…

MDB

ER Highlights

Q2 Revenue was $198.7M, an increase of 44% year-over-year

Non-GAAP loss from operations was $11.5M vs $10.2M in the year-ago period

MongoDB Atlas Revenue up 83% YoY and 56% of Total Q2 Revenue

200 million cumulative downloads with more than 75 million downloads over the last 12 months

The usual from MDB, down to the lack of profitability. Impressive results from Atlas, which remains the company MVP.

TDOC

TDOC ER highlights

Q2 revenue 109% YoY to $503M

2021 revenue outlook increase to $2,000 - $2,025M.

Total Q2 visits 28% higher than Q2 2020, in the first wave of the pandemic

US paid membership growth of 1%

Adjusted Gross margin 68.1%

The dilutional and profitability impact of the absorption of $LVGO and flat membership growth are factors behind $TDOC poor performance this year, but the underlying business is performing well. It’s a complicated story in an complex sector, and I can see why many have soured on it. The COO has recently left to take a CEO position elsewhere - is that an indication of doubts over the long term potential of Teladoc, or is he simply an exec journeyman on his way to a bigger paycheck? It’ll be interesting to see their analyst day in Q4 to hear more about their long term growth and utilisation aspirations.

The conference call was pretty upbeat - lots of discussion from the exec team about their intentions to increase their revenue per member, and there are interesting international moves that might pay off well over the longer term. I am probably oversized in $TDOC when I compare it to my conviction against alternatives within my portfolio. It’s a good company. But is it outstanding? I only own it due to $LVGO and had I exited a year ago, my shares would be worth about 2x as much.

My original plan to buy $DOCS with a slice of my $TDOC position has not come to pass due to market cap concerns with Doximity at its current stage - I am perfectly ok with paying a premium for high-quality companies, but I need to be able to formulate a story for how the company can ~ 3x from my purchase levels within an acceptable timeframe, and I’m not there with $DOCS although I like it.

CRWD

A strong ER, with a hint of slowdown, but there isn’t a lot new to say about Crowdstrike from my perspective. One key question is how much bigger can the company really get from here, and how long will that take?

ZS

$ZS seems to have regained its mojo as a consistent 50%+ grower. The valuation is the only thing holding me back from adding at this level, but my contribution on an allocation basis feels underweight vs other companies in my portfolio.

TWLO

Twilio's stock chart isn’t great, but the business is doing just fine. Gross margins remain stubbornly low, but that is partly due to persistent high demand for their SMS based products. Profitability seems further away than I would personally like to see in the guide.

I’m not sure that I fully understand the premium paid for the Syniverse SPAC. I’ll defer to Jeff Lawson’s judgment, but he didn’t give the most convincing justification I’ve ever heard.

ROKU

Despite excellent posted results, there are several legitimate questions about user account and viewing hours at $ROKU as well as competitive threats from $GOOG and $AMZN.

International remains an open question for $ROKU's future although I note they are making some positive moves in Brazil and Germany

Recent moves to leverage their data with Shopify also caught my eye. I like the idea of bringing powerful tools historically only available to large corporations to SMBs - I am a bit of a sucker for new market disruptive innovation.

Here’s a great throwback video from a decade ago - it’s fair to say that $ROKU’s business model and the market forces around CTV has evolved, but the Big Tech competition question has been around for a long time.

$ROKU have a solid foothold on the ecosystem in the US but competitive threats are real and a degree of caution is understandable.

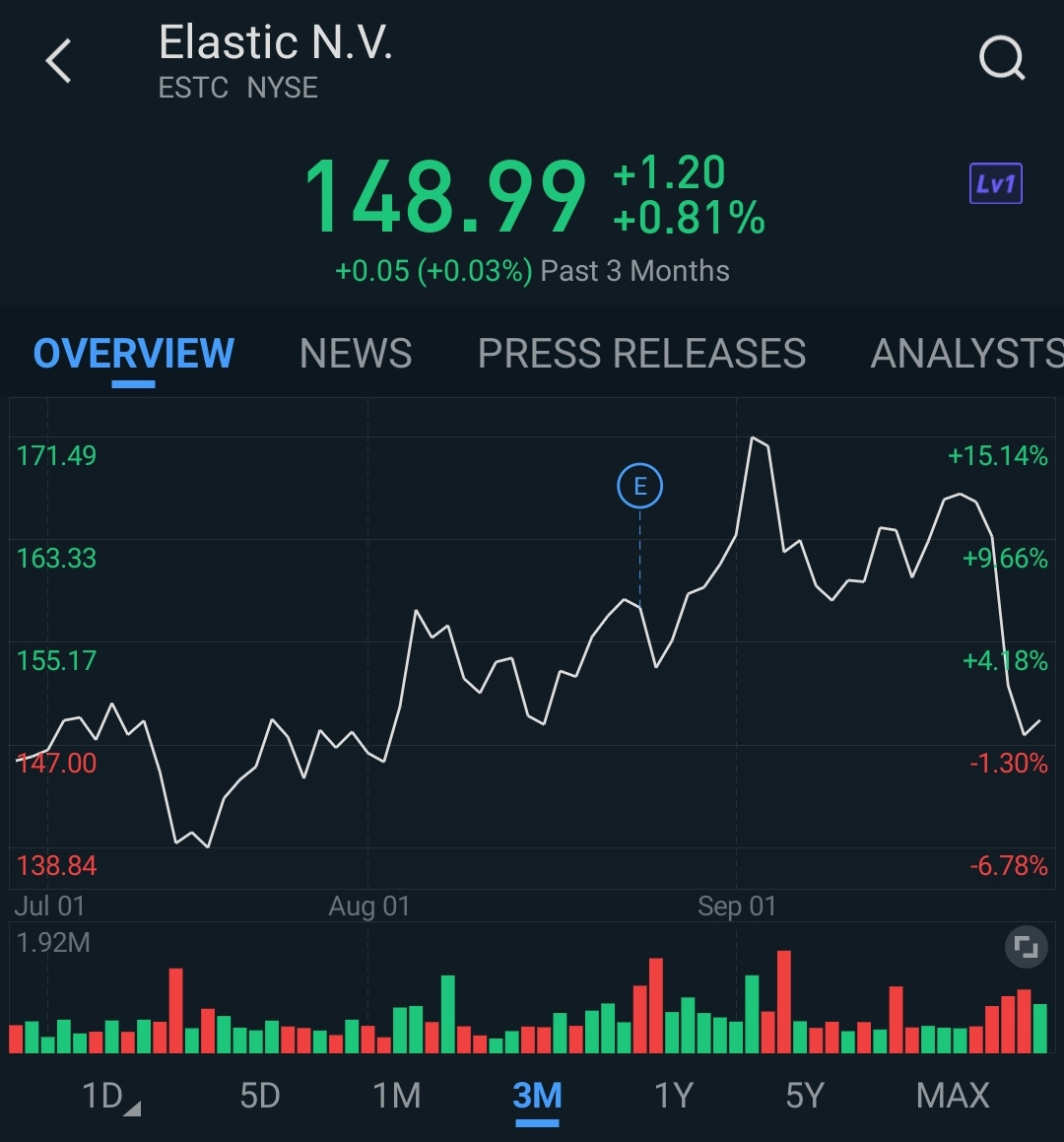

ESTC

$ESTC gets little respect vs $MDB. Perhaps another example of the effects of a more complex story.

Is it ever going to start to jam?

NVTA

There wasn’t much surprise in the ER. The big news was the Citizen acquisition.

The long term platform vision is appealing, but Invitae continues to feel like a venture capital investment. Whether Sean George and his team can execute on the integration of their frequent acquisitions while growing volumes, reducing costs and improving profitability metrics to something more sustainable is the key question. Let’s see how the new CFO does.

API

Another ugly quarter for Agora’s price action. Increasing concerns about China ADRs in general, tough comps, China’s regulation within $API’s key verticals (educational and video game markets), new potential competition from $TWLO and $NET, and it’s perhaps no surprise.

ER contained some positive trends, with the number of active customers up 65% YoY. But perspective on overall growth probably depends on how accurate you believe their interpretation of the C-19 impact to be.

I’ve been giving Agora the benefit of doubt while I’ve been focused elsewhere - it’s at an enterprise value today where I could see an upside even with the potential dark clouds. But the questions are 1) whether there are better places for the money from a portfolio CAGR perspective, and 2) whether $API deserves to have had more money allocated to it than $ZS as an example.

SEMR

The best introduction to SEMRush that I have come across comes courtesy of Mr Dubra. SEMRush passes my primary screen and I'm looking forward to learning more.

I’ve realised that I tend to buy too early, so I’ve taken a tiny tracking position while I continue learning about the company, and will look to add when I get hammered on my buy on a % basis. Levels of interest for adding are circa $22-22.5 and $19.5-20 for now. A stink bid in the high teens is not out of the question…

On my portfolio’s performance

It’s has been another choppy quarter for most of my holdings, with outperformance by $ZS, $MDB and weakness in most other holdings as well as in many watchlist companies.

After the run-up in 2020, a consolidation phase is perhaps no bad thing.

In my slightly obsessive focus on paying off my loan, I have barely made any changes to my portfolio. I haven’t owned any of this year’s big winners $UPST (scarred by my immature forays into China fintech exposure in 2017-18), $GLBE / $DLO (too soon post IPO), $LSPD or $ASAN (couldn’t see the strong competitive position).

I was early to $LSPD but didn’t hold on to it, swapping it for $CRWD and $ROKU back in May 2020. I’m fine with that decision based on what I knew at the time, but the retrospect-o-scope has a knack for making you feel bad.

A bias towards inaction is a deliberate part of my strategy. I know that underperformance for periods is a normal part of the journey. I do occasionally wonder whether I ought to be faster to cut or reduce companies that disappoint or present higher levels of uncertainty. I won't be a frenetic chaser of momentum either, but these behaviours exist on a spectrum.

I’ve also wondered about opening a trading account at IBKR to consider more international markets. There is only so much time in the week, and I’m keen to optimise my return on time spent investing.

I have a few things to consider as I revise my investor policy statement for 2022…For now, I’ll take the loan payoff as the win, even if my overall returns have been less than impressive in 2021.

More pain in October? Who knows, but the last few years have certainly seemed that way. If my memory serves me well, the last week of October has historically been a good time to think of adding…

Have a great month!

Watchlist

$APPS, $AMPL, $CFLT, $BLND, $CLPT, $OLO, $TOST, $DCBO, $NRDY, $EPSIL.AT

Congrats on paying off the loan, even if it's had a temporary, negative knock-on effect. I've been enjoying your posts for a while - I think you write so well. Also good to have more UK investors writing amidst the US substack/twitter noise!

Nice to have a new post from you :) Enjoyed reading this, thanks man.